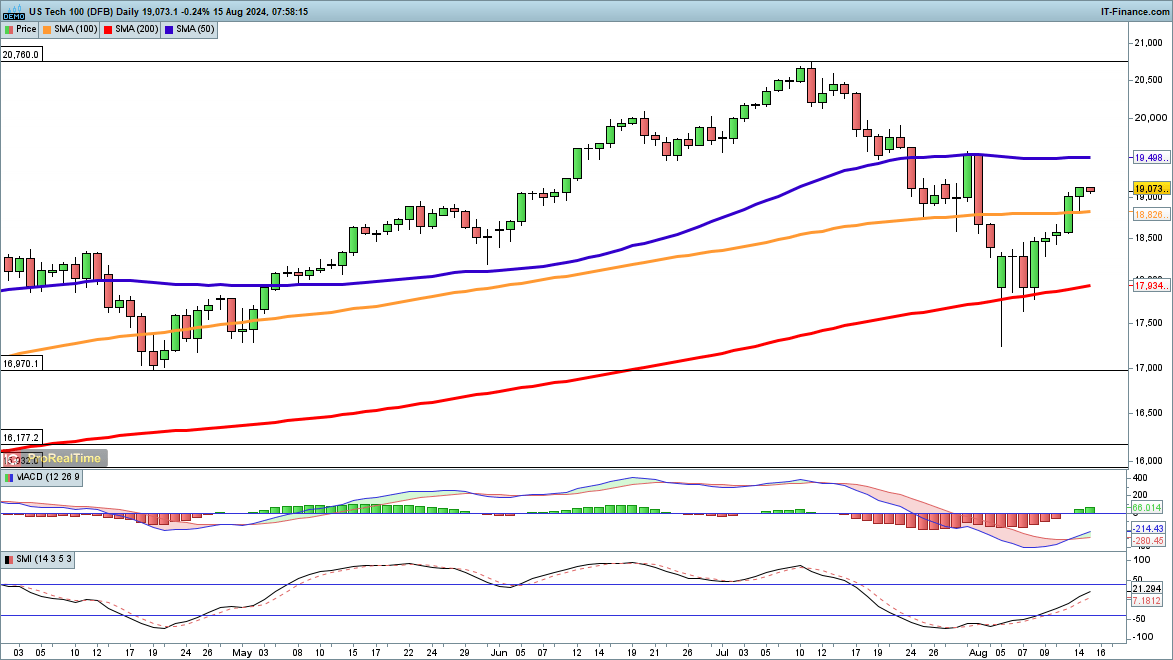

Nasdaq 100 still moving higher

The index has enjoyed an impressive run over the past week, bouncing off the 200-day simple moving average (SMA).Further gains now target the 19,500 highs from 31 July and 1 August and the 50-day SMA. Beyond this lies the 20,000 level.

So far there has been no indication of a reversal, though a drop below 18,800 might signal that some near-term weakness is at hand, potentially targeting the 200-day SMA once more, as well as the lows of August around 17,500.

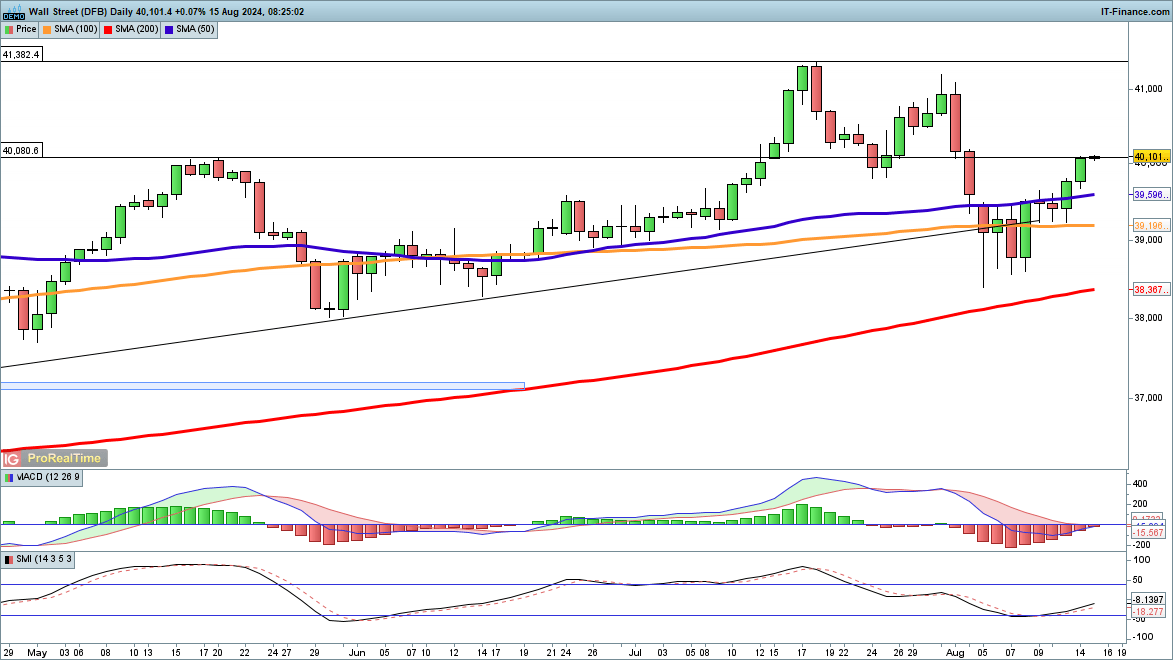

Dow is back above 40,000

The rebound goes on for this index too, having recouped the 40,000 level, and in early trading, it is testing the 40,080 highs from May.

Additional gains would now take the price on to 41,000 and then 41,382, the latter being the record high. Sellers will need a reversal back below 39,000 to indicate a new test of the early August low around 38,500.

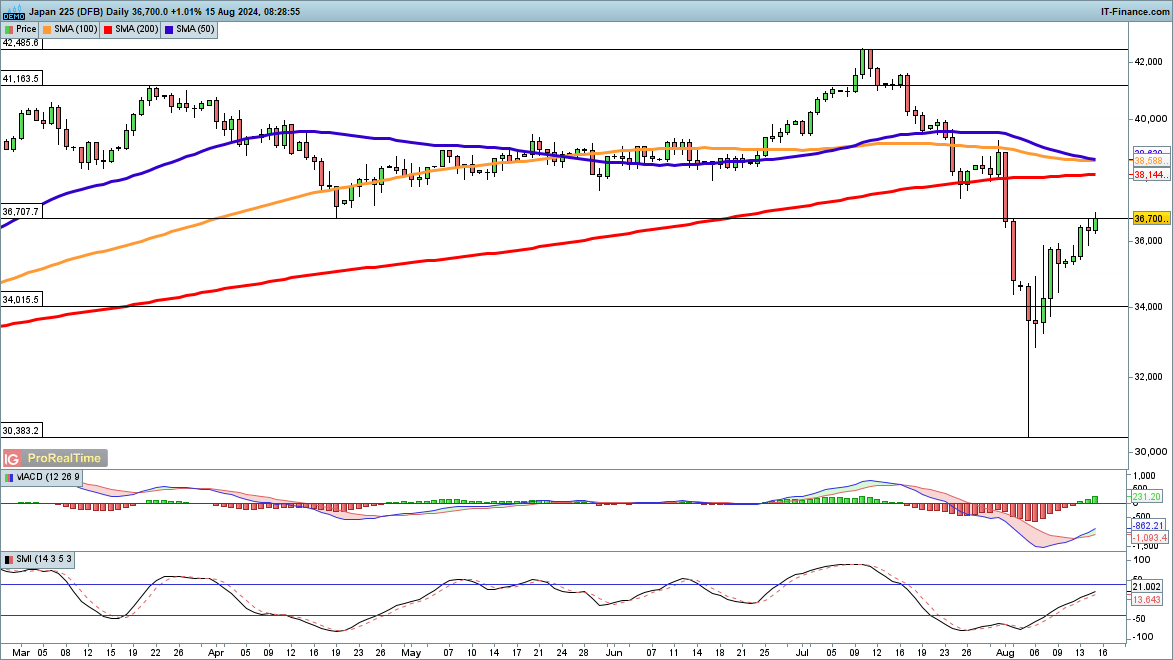

Nikkei 225 pushes higher

Having recouped all its losses from the open on 5 August, the index has now recovered the losses from Friday 2 August. This remarkable bounce shows no sign of stopping at present.

Further gains will target the 200-day SMA at 38,144, once it has closed above the 36,707 level, the low from mid-April.