Japanese Yen Latest – USD/JPY

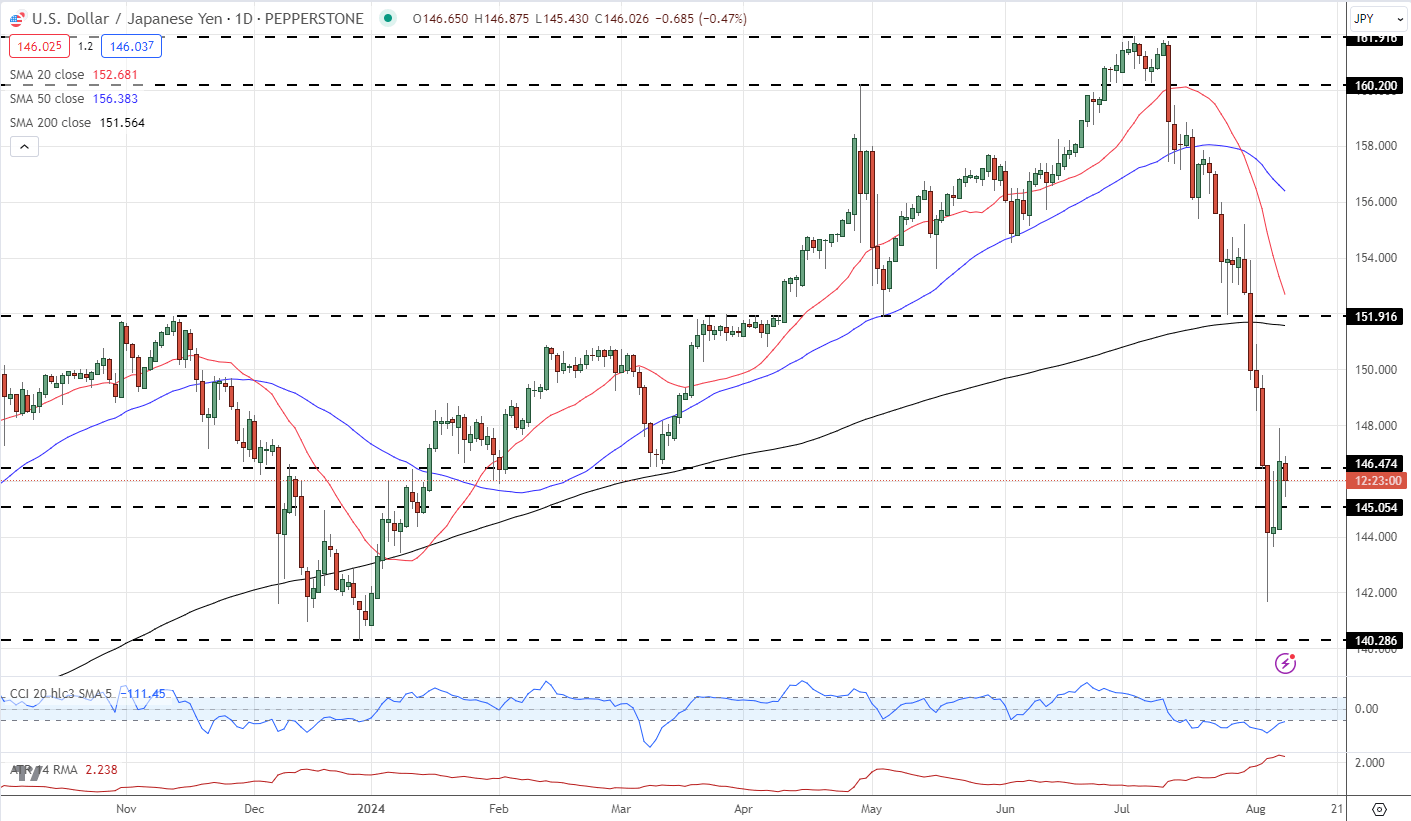

- USD/JPY trading on either side of 146.00

- Inflation has shown steady progress towards target.

The ‘likelihood of achieving the inflation target has increased further’ and further upward pressure is expected, according to the latest Bank of Japan Summary of Opinions.

‘Assuming that the price stability target will be achieved in the second half of fiscal 2025, the Bank should raise the policy interest rate to the level of the neutral interest rate toward that time. As the level of the neutral rate seems to be at least around 1 percent, in order to avoid rapid hikes in the policy interest rate, the Bank needs to raise the policy interest rate in a timely and gradual manner, while paying attention to how the economy and prices respond.’

USD / JPY continues to be buffeted by external factors, including the unwinding of the Japanese yen carry trade. While the Bank of Japan had taken a hawkish stance, signaling higher rates in the months ahead, the market has recently reined back its rate hike expectations over the last couple of days.

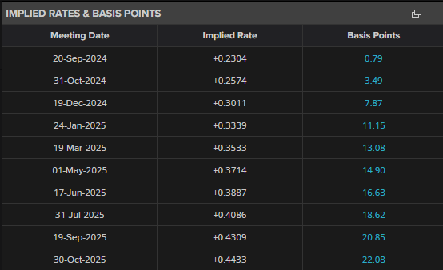

Implied rates are now seen gradually moving higher, with the policy rate forecast to be around 50 basis points in one year's time. This shift in market expectations, away from more aggressive BoJ tightening, helped stabilize the USD/JPY pair after it had plummeted to touch 142 on Monday.

However, on Tuesday, Bank of Japan Deputy Governor Shinichi Uchida walked back some of the more hawkish comments made by Governor Ueda, helping to stabilize the market.

USD/JPY outlook remains uncertain, as the interplay between the Bank of Japan's policy path and growing expectations of a 50-basis point cut by the Federal Reserve continue to exert influence on the exchange rate.

With little significant US or Japanese economic data expected this week, the USD/JPY pair may remain vulnerable to further official commentary and rhetoric from central bank policymakers. Statements from the BoJ and FOMC could drive further volatility in the pair as market participants try to gauge the future policy directions of both institutions.

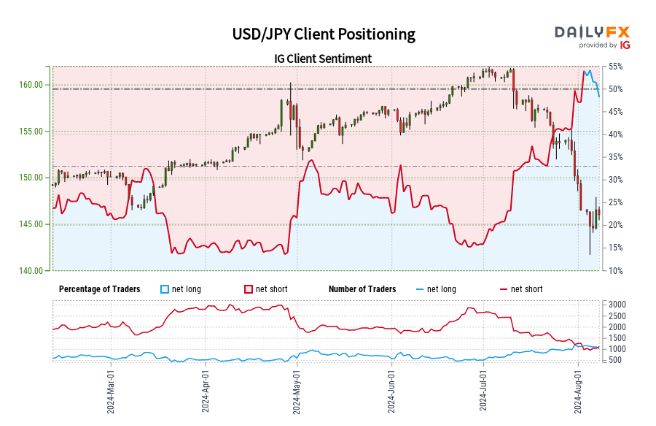

Retail trader data shows 48.62% of traders are net-long with the ratio of traders short to long at 1.06 to 1.The number of traders net-long is 6.90% higher than yesterday and 9.45% lower from last week, while the number of traders net-short is 6.20% higher than yesterday and 13.17% lower from last week. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse lower despite the fact traders remain net-short.