AUD/USD ANALYSIS & TALKING POINTS

- Weaker US dollar propping up AUD after Friday’s NFP .

- RBA expected to hike rates by 25bps tomorrow.

- AUD/USD holding above key 0.65 support handle.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

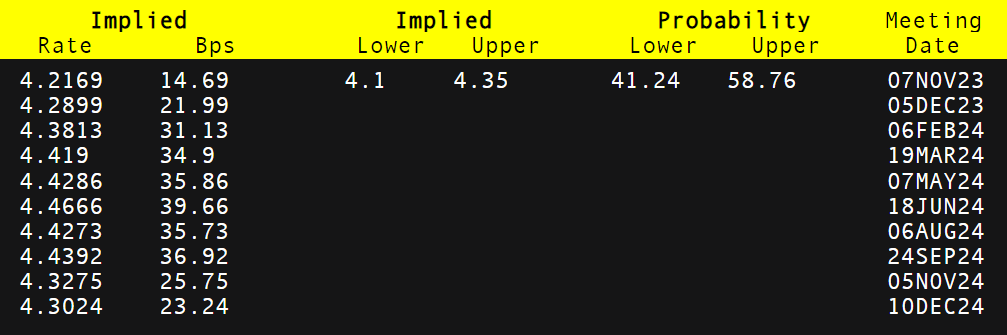

The Australian dollar has held onto last week’s gains after the US Non-Farm Payroll (NFP) report missed estimates causing a dip in US Treasury yields. Implied Fed funds futures show a dovish repricing of interest rate expectations to roughly of cumulative rate cuts by December 2024 vs just a few weeks ago. This may an overreaction as one data print does not make a trend and further confirmation will be required in the coming months.

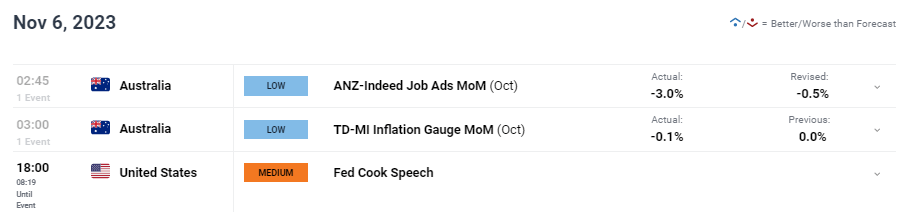

Earlier this morning (see economic calendar below), Australian job ads and inflation gauge figures slumped and could point to turnaround in the economy as tight monetary policy take ahold. Although low impact data, this could have an impact on tomorrow’s Reserve Bank of Australia’s (RBA) rate decision that currently has money markets pricing in a chance of a rate hike (refer to table below).

Consensus is for a rate hike after persistent high inflation plagues the economy but with global recessionary fears gaining traction, will this deter central bank officials from hiking again? After keeping rates on hold ( ) from June this year, a jump could see the AUD back up around the level.

AUD/ USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

RBA INTEREST RATE PROBABILITIES

Source: Refinitiv

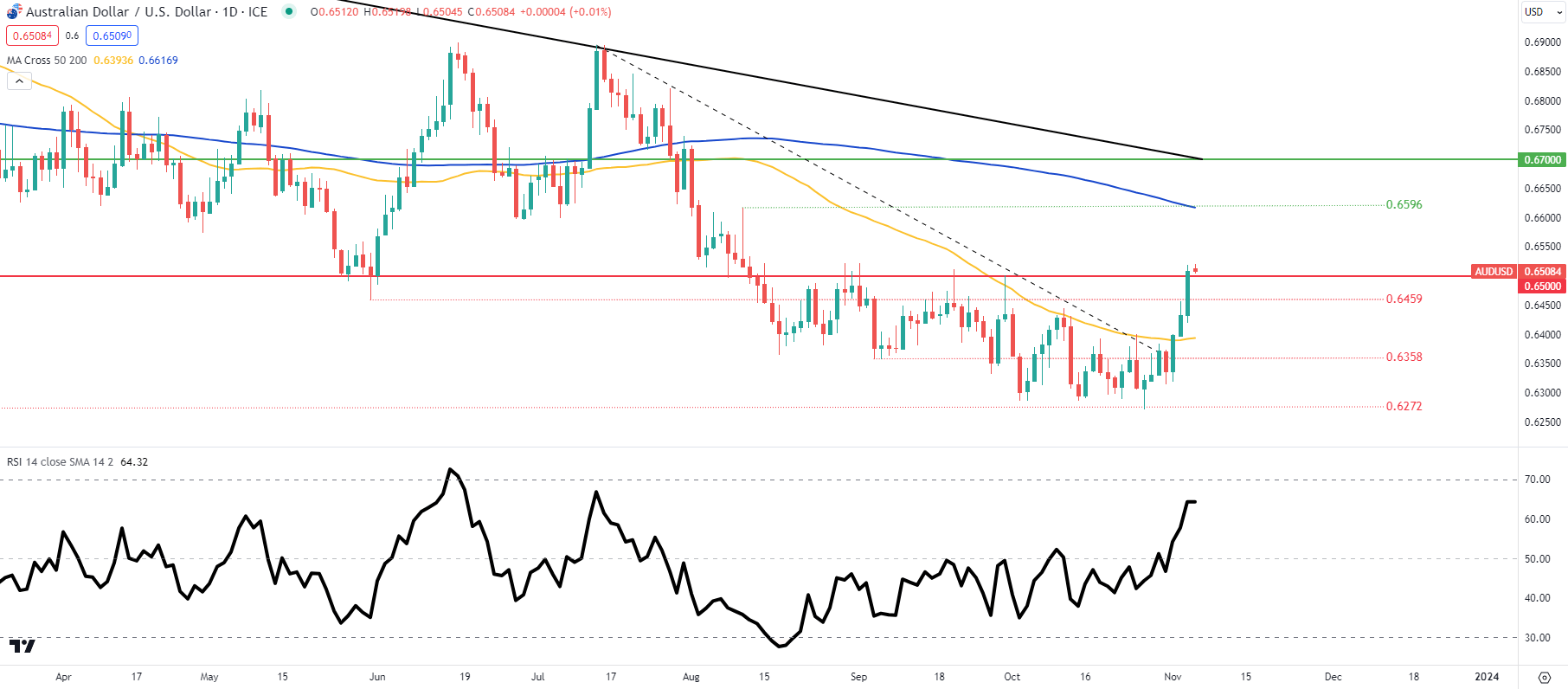

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily AUD/USD price action above is slowly approaching the overbought zone as measured by the Relative Strength Index (RSI) but has more room to appreciate. As mentioned above, short-term directional bias will be determined by the RBA tomorrow. A rate pause could see the pair slip back below once more and a hike could bring into consideration the 200-day moving average (blue)/ resistance zone respectively.

- 0.6596/200-day MA

- 0.6500

- 0.6459

- 50-day moving average (yellow)

IG CLIENT SENTIMENT DATA: BULLISH (AUD/USD)

IGCS shows retail traders are currently net on AUD/USD , with of traders currently holding long positions.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course