S&P 500 News and Analysis

- Two-week winning streak threatened by potential US government shutdown

- Is the trend of softer US data upon us? US CPI , retail sales next

- IG client sentiment provides a mixed bias due to inconsistent daily and weekly positioning

Two-Week Winning Streak Threatened by Potential US Government Shutdown

In just his first few weeks on the Job, new House Speaker Mike Johnson has a battle on his hands as he attempts to get another crucial funding bill over the line before Friday’s deadline. It feels like just the other day the US government was doing this same dance and yet here we are again – validating the general view held from ratings agencies that the US exhibits political polarization and lacks the political will to deal with expanding US debt.

On Friday Moody’s shifted its outlook for US debt from ‘stable’ to ‘negative’, and unlike the other two agencies, maintains US debt at AAA status. The downgrade did little to impact US yields, dollar or the S&P 500 .

The potential Government shutdown is unlikely to be resolved until the last minute, if past exercises are anything to go by, with the potential to weigh down market sentiment this week.

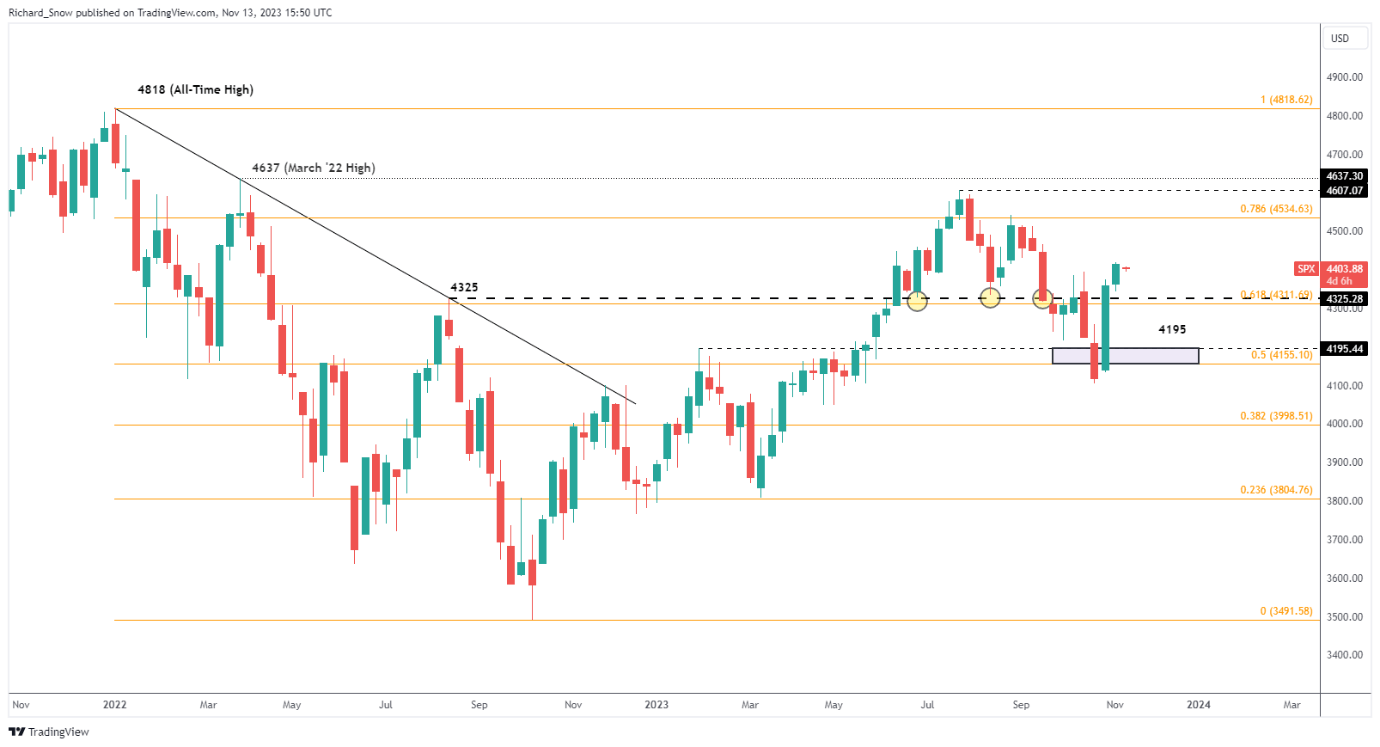

Source: TradingView, prepared by Richard Snow

Is the Trend of Softer US Data Upon US? US CPI, Retail Sales Next

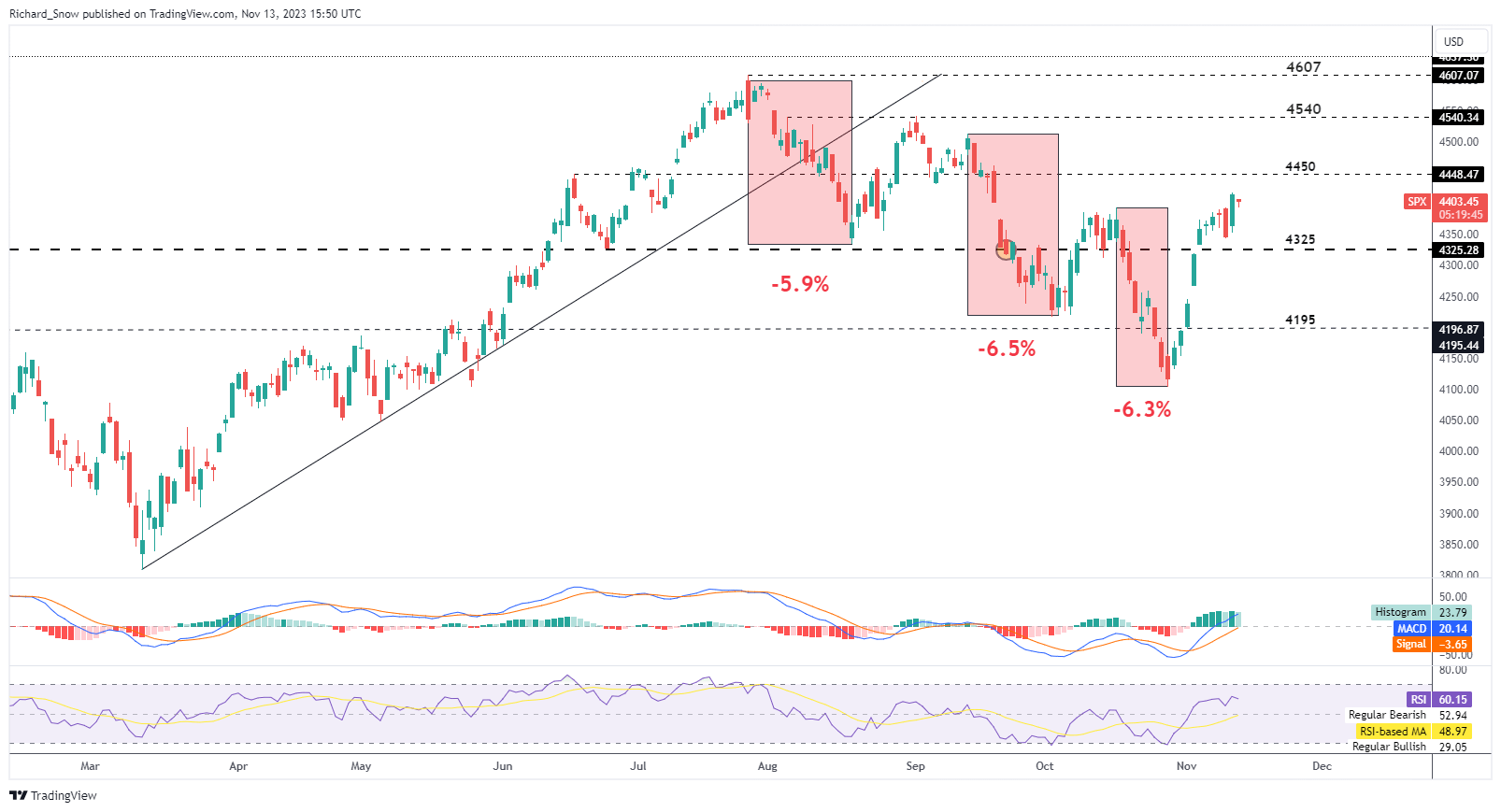

US stocks (mainly mega-caps) have surged after a spate of softer US data beginning with a softer NFP print and a tick higher in the unemployment rate. Other sentiment-based indicators like US PMI data has also disappointed in the recent print while the University of Michigan consumer sentiment also missed the mark of Friday.

While US CPI is the headliner this week, it would be prudent to keep a watchful eye on US retail sales, given the sizeable contribution of domestic consumption to Q3’s positive surprise. Markets will be looking for confirmation of softer US data and a disappointing print could embolden US equity bulls, at least momentarily as the potential Government shutdown is only likely to be resolved late on Friday.

Source: TradingView, prepared by Richard Snow

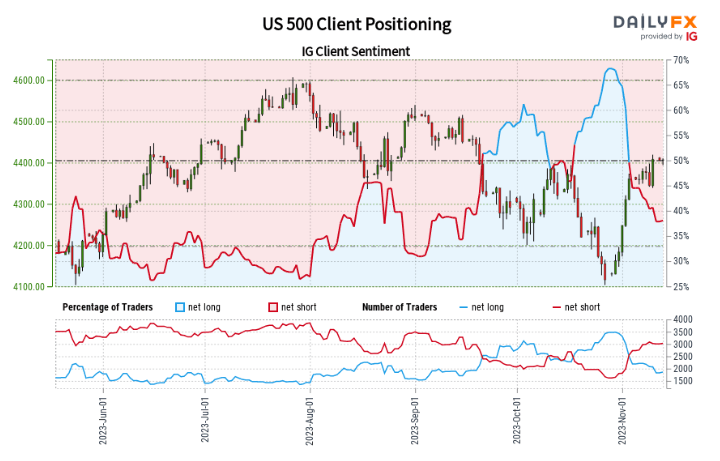

IG Client Sentiment Offers Few Clues Ahead of CPI Data

Source: IG, DailyFX, prepared by Richard Snow

US 500 : with the ratio of traders short to long at 1.41 to 1.

, and the fact traders are net-short suggests US 500 prices may continue to rise.

The combination of current sentiment and recent changes gives us a further mixed US 500 trading bias.