EUR/USD Forecast - Prices, Charts, and Analysis

- FOMC minutes give little away, leaving the US dollar rudderless.

- UK Autumn Statement may give Sterling a boost.

The Federal Reserve is very unlikely to cut interest rates anytime soon and may hike them if inflation remains uncomfortably high. The minutes showed that monetary policy will remain restrictive until inflation towards goal (2%) but that FOMC members believe that the central bank can ‘proceed carefully’ when making any decisions. Overall the minutes were fairly balanced and left the US dollar with little to work on. The latest CME FedFund probabilities show the first 25 basis point US rate cut in May next year with a total of 100 basis points expected to be shaved off US borrowing costs next year.

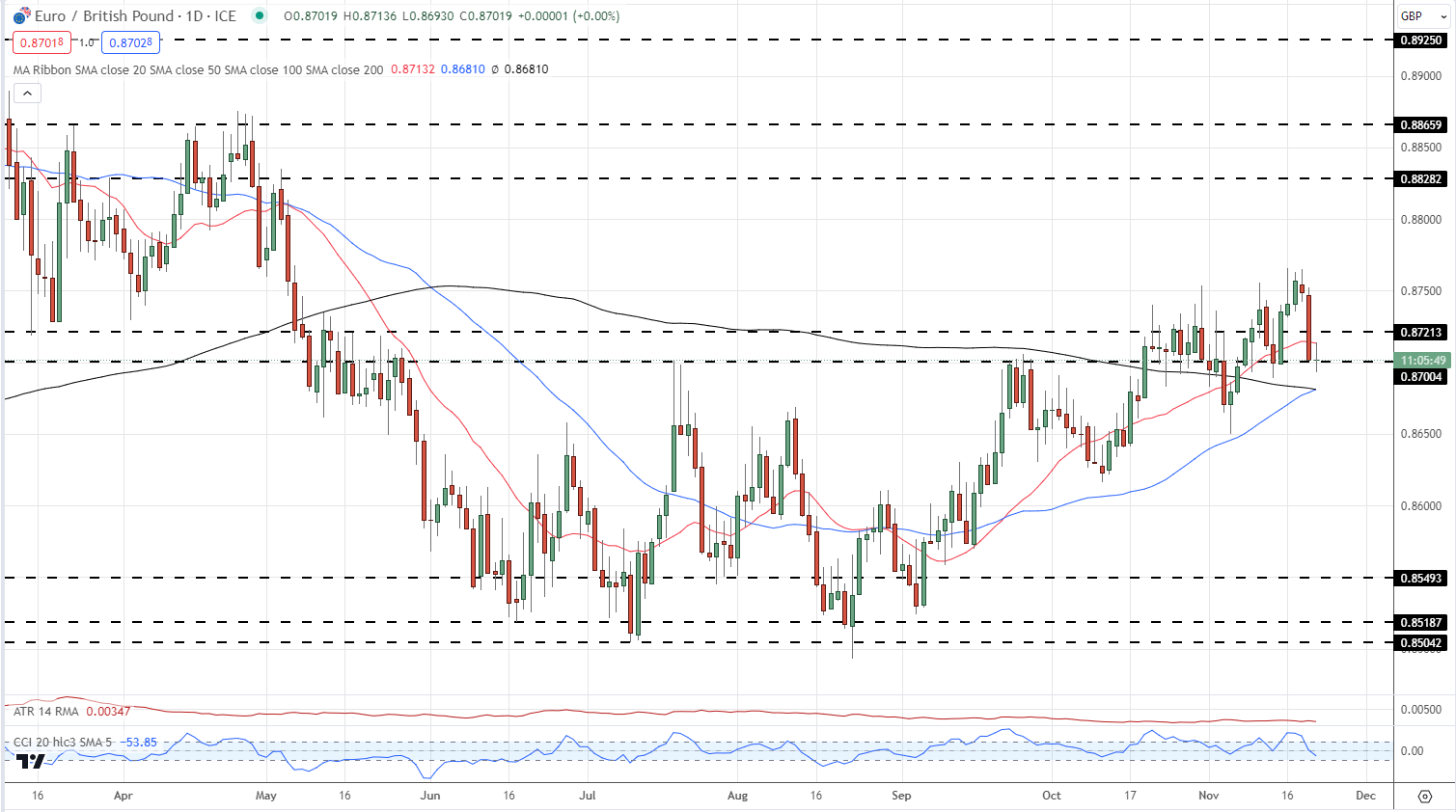

EUR / USD is trading on either side of 1.0900 after having hit a multi-month peak around 1.0965 on Tuesday. The chart set-up remains positive with support provided by all three simple moving averages, especially the recent break of the 200-dsma. Near-term support is seen in the 1.0865 to 1.0885 area ahead of the 200-dsma at 1.0807.

EUR/USD Daily Price Chart

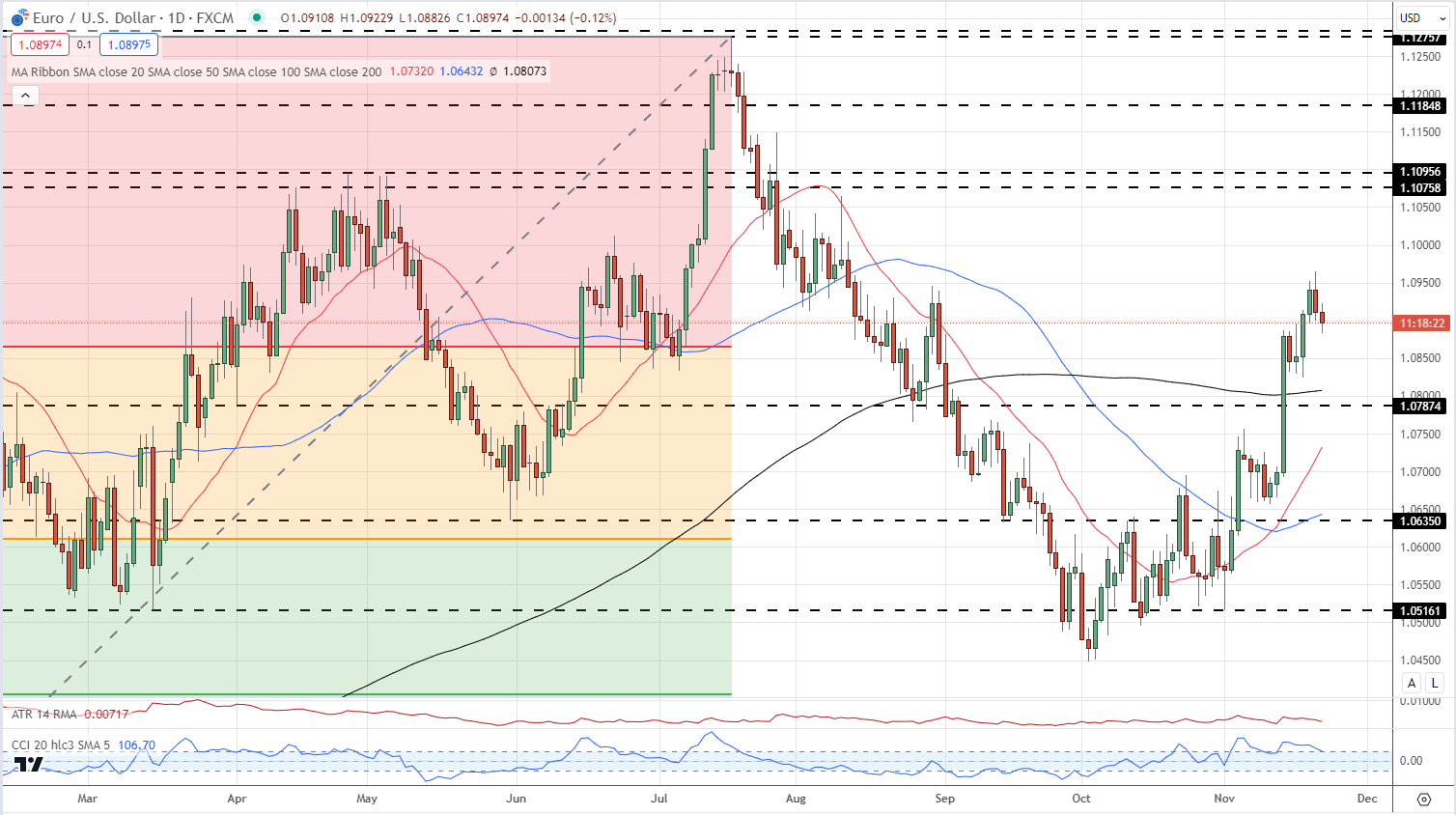

EUR/GBP gave back all its recent gains in one move yesterday and currently rests on an old level of resistance turned support. The move, a combination of a stronger Sterling complex and a marginally weaker Euro backdrop has seen the pair trade below the 20-dsma and head towards the 50- and 200-dsmas. The 50- and 200-dma are looking to produce a golden cross, as early as today, and this may support the pair. The overall pattern of higher lows and higher highs should see EUR/ GBP turn higher soon.

EUR/GBP Daily Chart