POUND STERLING ANALYSIS & TALKING POINTS

- Dovish Fed narrative holds strong in support of sterling.

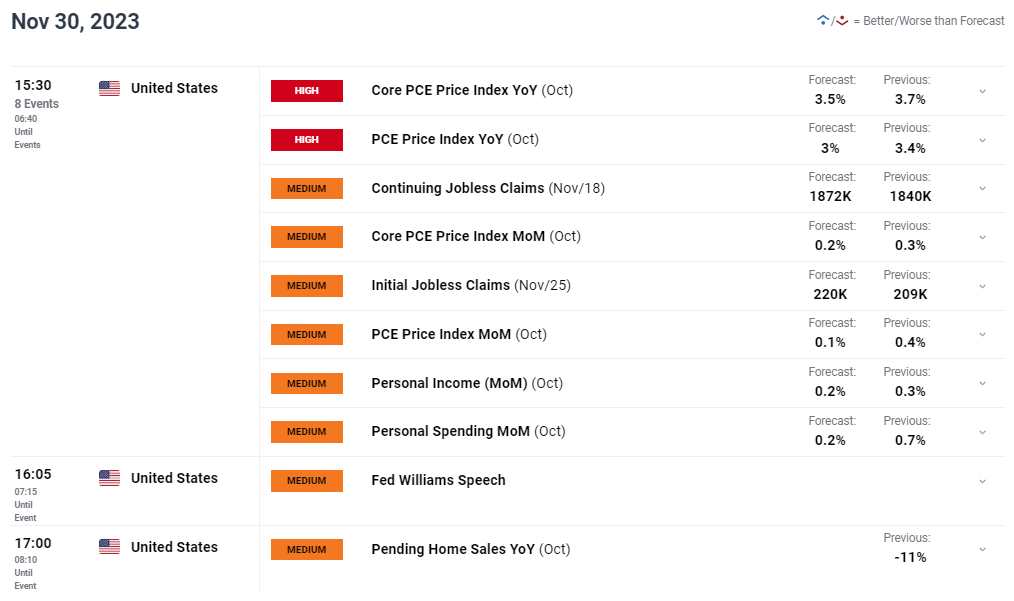

- US core PCE price index under the spotlight later today.

- GBP/USD uncertain at overbought levels.

GBPUSD FUNDAMENTAL BACKDROP

The British pound has been heavily influenced but the US dollar of recent with investors becoming less hawkish on the Federal Reserve ’s interest rate path. Recent weaker US economic data has prompted such an outlook alongside some dovish Fed commentary. During yesterday’s US trading session, the 2nd estimate on US GDP surprised to the upside but the market remained firm on it’s bearish USD viewpoint after the Fed Beige book revealed slowing economic growth and softening prices that will likely extend through to 2024. Some mixed Fed speak did not really move the needle but is worth mentioning – see statements below:

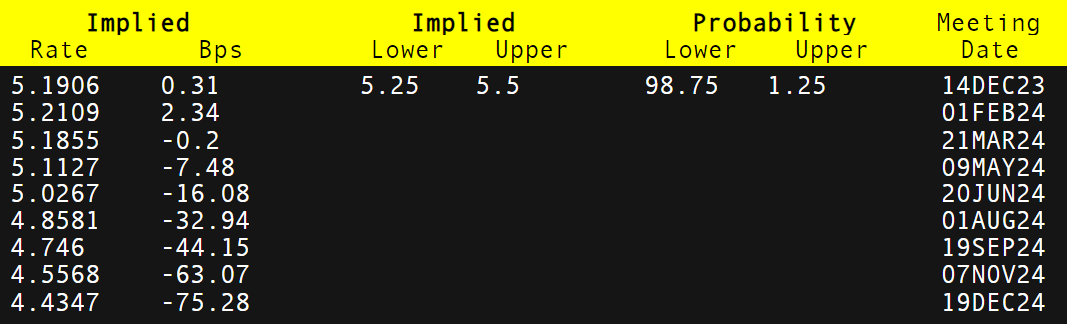

Money markets have since priced in 115bps of cumulative rate cuts by the Fed by December 2024. The focal point for the week has always been the upcoming core PCE price index (see economic calendar below) which is the Fed’s preferred measure of inflation . Should actual data fall in line with forecasts, the pound may well find additional support. Jobless claims will also be scrutinized to see whether or not recent labor market weakness continues or was just a blip in what has been a robust part of the US economy.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

From a UK perspective, the Bank of England (BoE) Governor Andrew Bailey spoke yesterday reinforcing the need to bring inflation down to by “whatever measures” although markets did not take heed as the US holds a solid lead. BoE pricing shows of rate cuts by December 2024 but will likely change as UK economic data starts filtering in from next week onwards.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

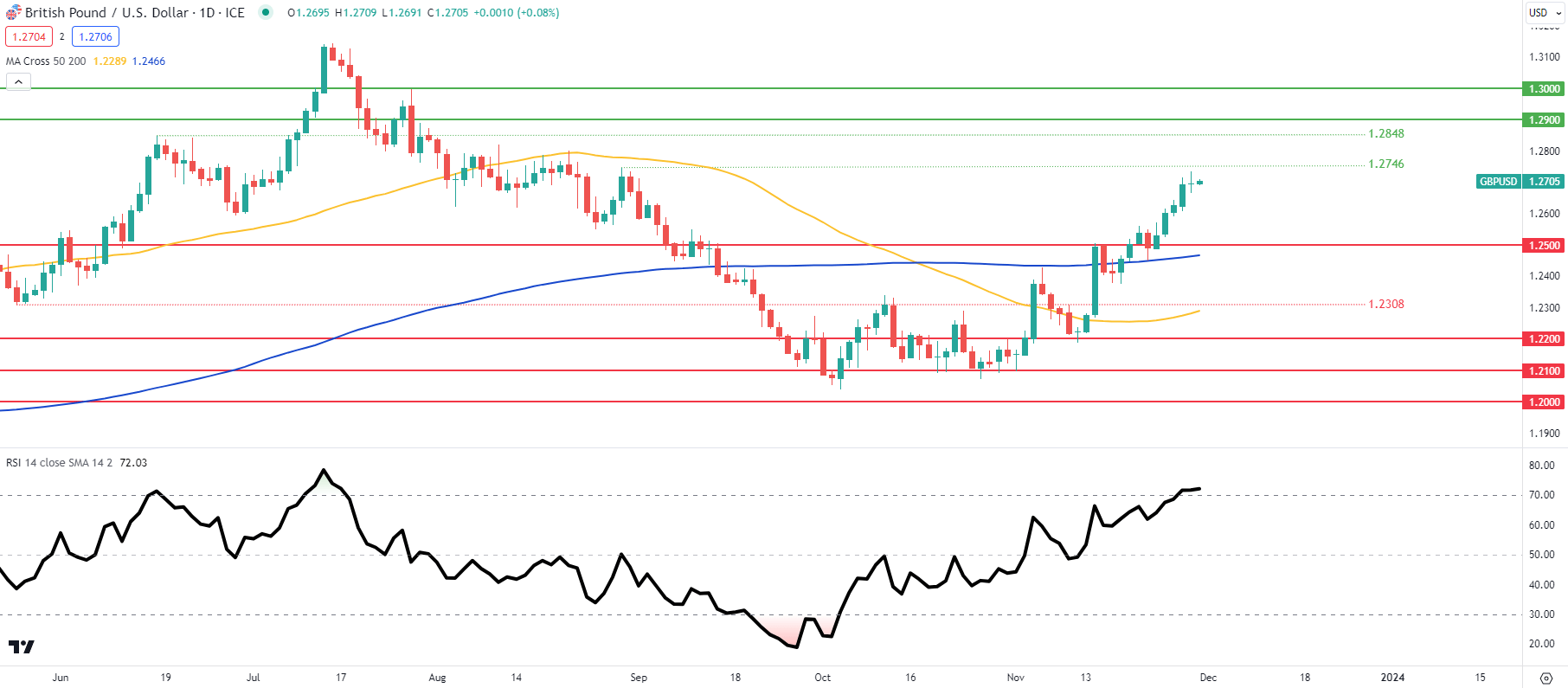

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas , IG

Daily GBP/USD price action trades in overbought territory on the Relative Strength Index (RSI) ,as yesterdays doji close underlines hesitancy ahead of today’s core PCE price index report. That being said, there is still room for the pair to push higher as the 200-week moving average sits around the resistance handle. We could say some form of consolidation at current levels before a bullish continuation up towards that 200-week MA. As mentioned above, US data is critical to short-term directional bias on cable.

- 1.2900

- 1.2848

- 1.2746

- 1.2500

- 200-day MA

- 1.2308

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net on GBP/USD with of traders holding long positions (as of this writing).

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course