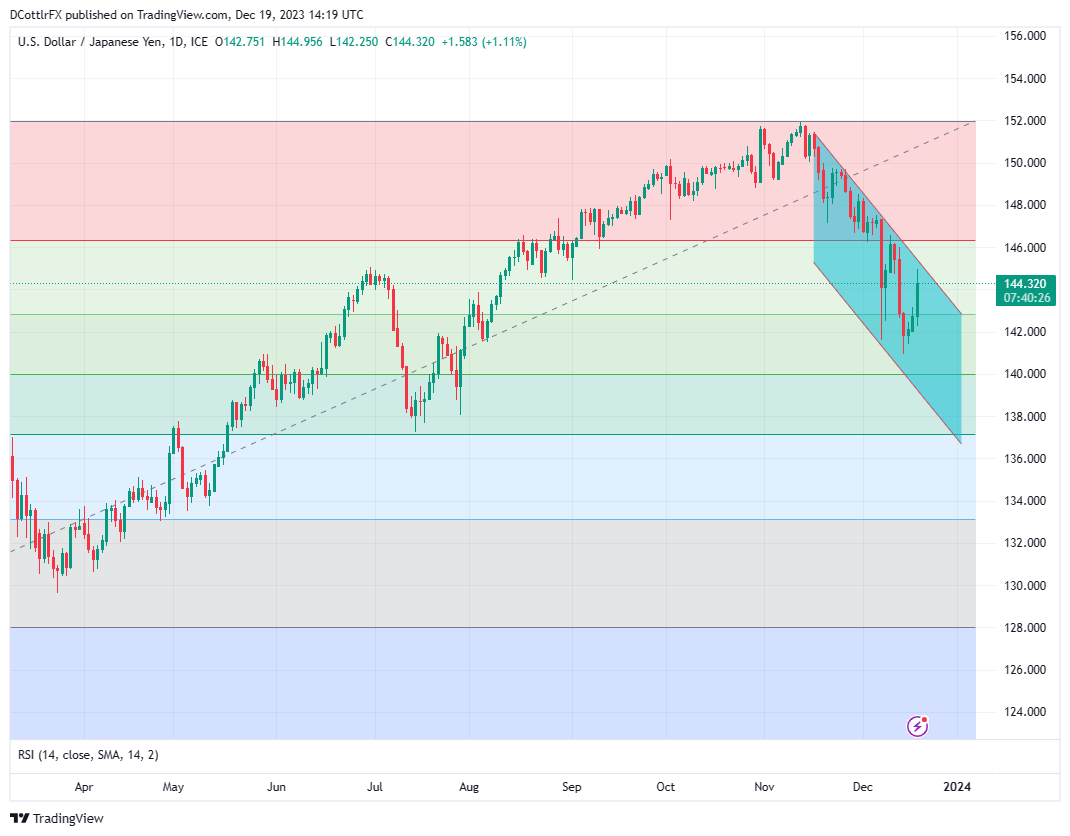

USD/JPY Needs to Retake Resistance at 147.48

The preceding quarter saw USD/JPY power up to highs not previously seen since mid-1990, thanks largely to those fundamental, interest-rate differentials. In that context the retreat since has been very modest, but it still means the pair is set to end this three-month period fairly close to where it started ( USD /JPY was at 145.80 at the start of September).

The big question as we head into 2024 is the extent to which the current Dollar downtrend endures. The pair looks to have solid support ahead of the fourth Fibonacci retracement of the rise to November’s highs from the lows of January 2023. That comes in at 137.66 and the Dollar has bounced twice before a test of that in the past six months. Still, Dollar bulls will probably need to retake the territory lost in December’s sharp falls if they’re going to convince. That will mean retaking resistance at 147.48.

Source: TradingView, Prepared by David Cottle

EUR/JPY May Take its Clues From EUR/USD

The EUR/JPY chart looks broadly similar to USD/JPYs, but it must be unlikely that both will continue in lockstep should the Fed start to cut interest rates while the European Central Bank keeps them on hold. The Euro has bounced back into a wide trading band that broadly defined trade between late August and early November between 157 and 159.77.

As the new year gets under way it will probably be instructive to watch the direction of any new break of this range for near-term directional cues. EUR/USD remains in its own uptrend, in place since early October, and the EUR /JPY cross may well take its cues from this, at least in the early months of 2024.

Source: TradingView, Prepared by David Cottle