EUR/USD Forecast - Prices, Charts, and Analysis

- US dollar pushes higher as 2024 trade gets underway.

- EUR/USD downside should be limited.

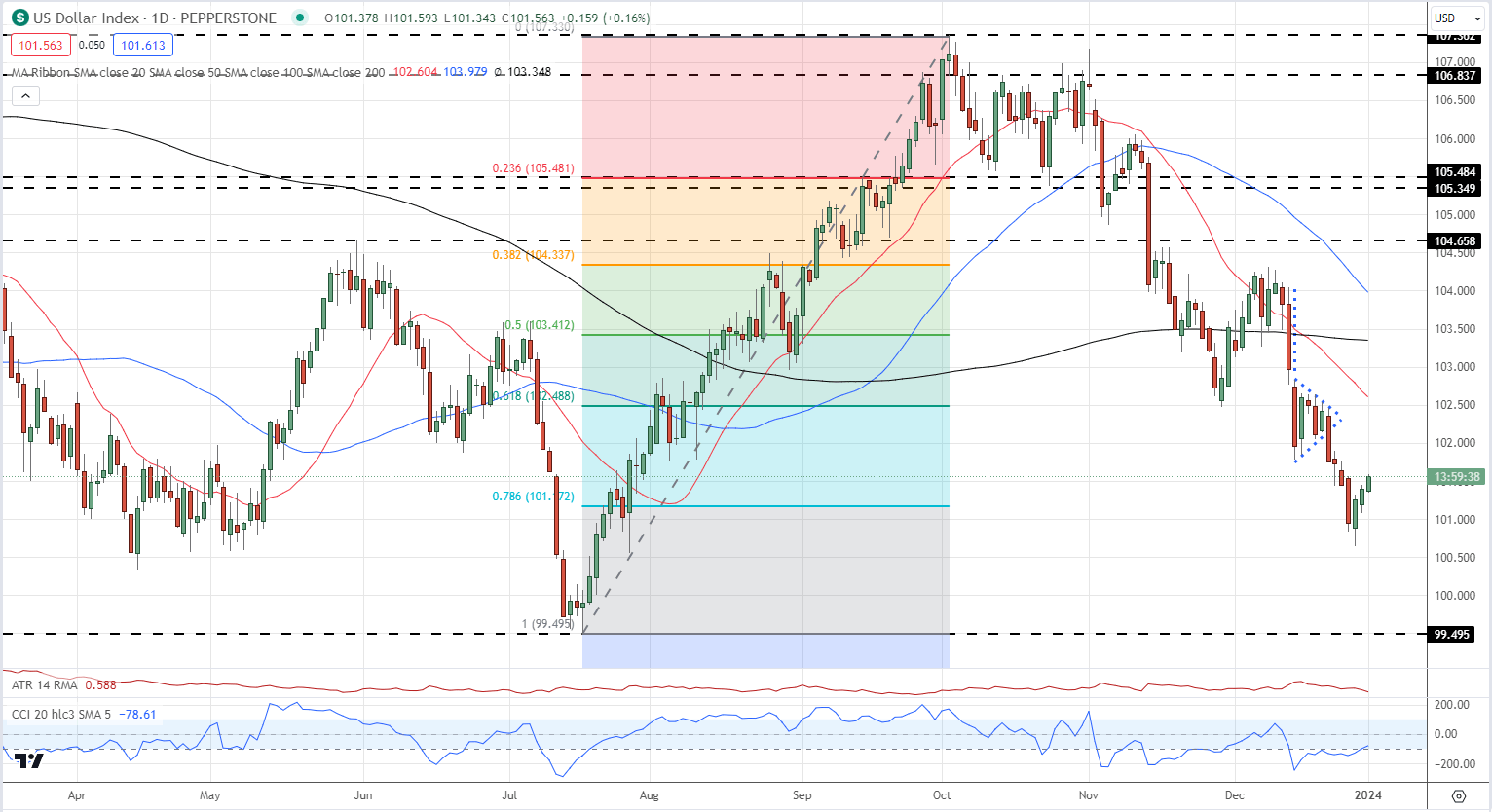

US Treasury yields are bouncing off their recent multi-month lows giving the US dollar a small bid as 2024 trade starts. The push higher in UST yields however looks unconvincing and is likely a function of year-end position squaring and low volume trade conditions. The US dollar index chart (DXY) remains negative with the mid-December bearish pennant pattern and downward-sloping simple moving averages all adding to the bearish, longer-term view.

US Dollar Index Daily Chart with Bearish Pennant Breakout

The economic calendar is relatively quiet today with just a handful of final PMI readings to keep an eye on. The main action of the week will be driven by various US labor releases, culminating in the latest US NFP report on Friday.

For all market-moving events and data releases, see the real-time

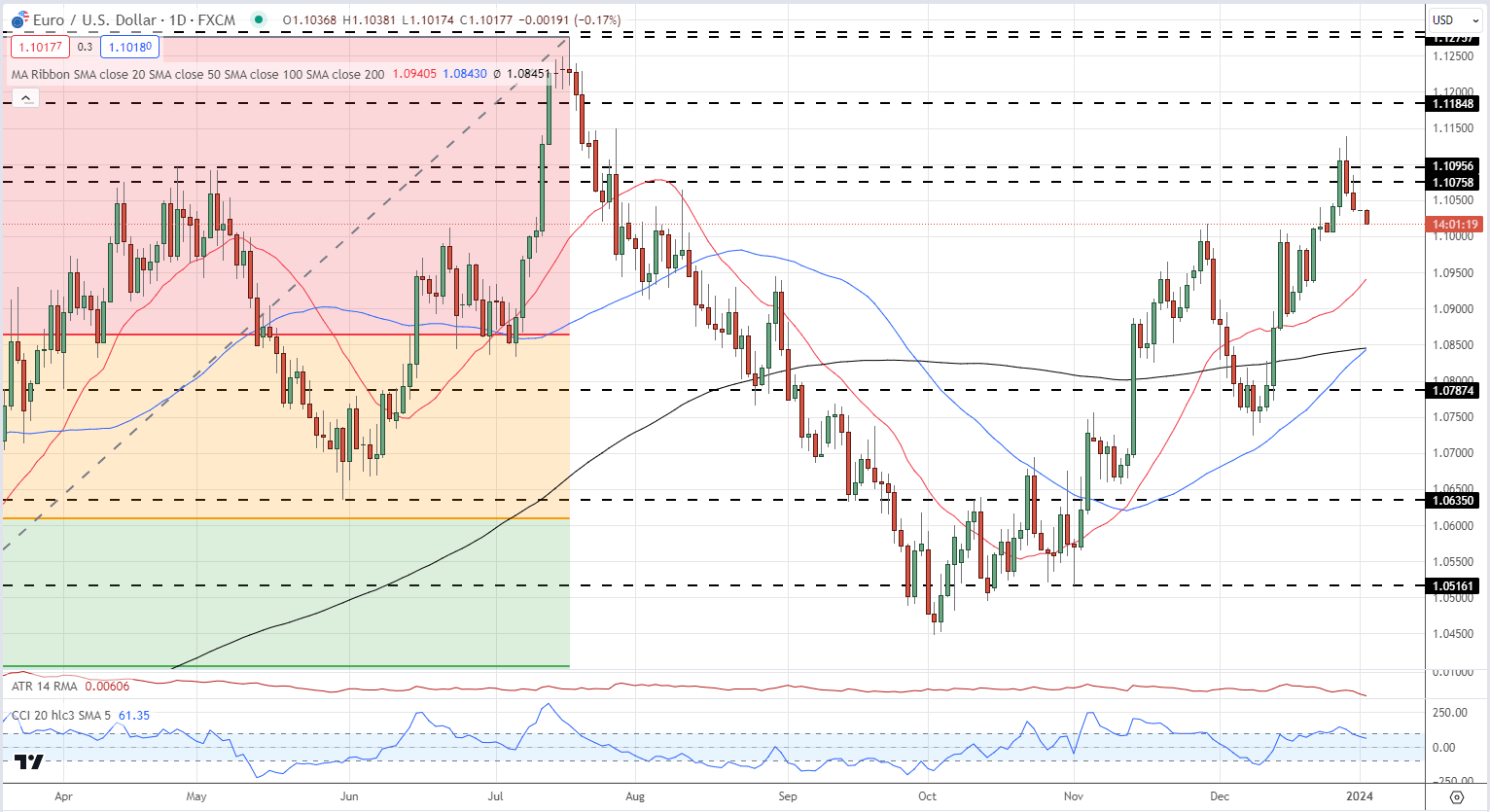

EUR/ USD touched a multi-month high of 1.1139 at the end of December before fading lower. For now the 1.1076 to 1.1096 zone will act as resistance and may prove difficult to clear convincingly ahead of the US NFP release. The daily chart remains positive though with a golden cross being formed as the 50-day sma trades through the 200-dsma.

EUR/USD Daily Chart

IG retail trader data shows 36.30% of traders are net-long with the ratio of traders short to long at 1.76 to 1.The number of traders net-long is 3.99% higher than yesterday and 0.69% higher than last week, while the number of traders net-short is 1.53% higher than yesterday and 4.59% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.