Pound Sterling (GBP/USD) Analysis

- UK retail sales rose an impressive 3.4% to overcome December’s 3.3% decline

- GBP/USD unphased by the report after a busy week, filled with data

- Fed speakers, US PPI and the University of Michigan consumer sentiment report up next

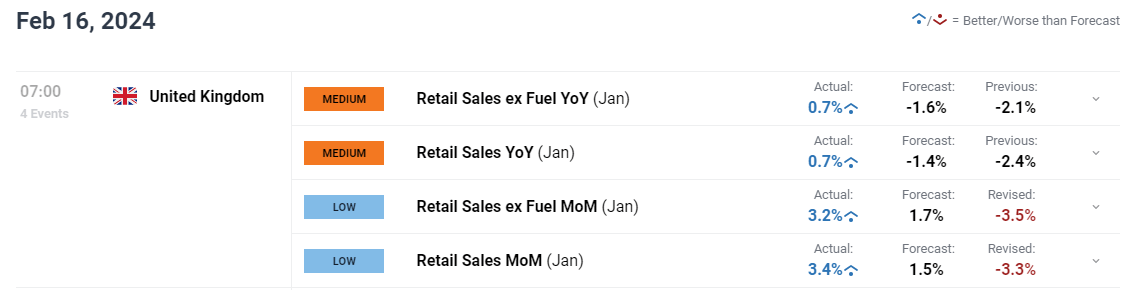

UK retail sales rose an impressive 3.4% in January, recovering December’s surprising drop of 3.3%. The dismal December print was chalked up to Christmas gifts being bought during the Black Friday discounts in November and partially due to plans to spend less in light of the cost of living, according to nearly half of surveyed respondents.

The positive news comes just one day after the UK confirmed its economy had dipped into recession in the final quarter of 2023. Also this week, inflation was unchanged and the labour market proved resilient, just a few stats that will likely see Bank of England officials towing the line when it comes to rate cut expectations.

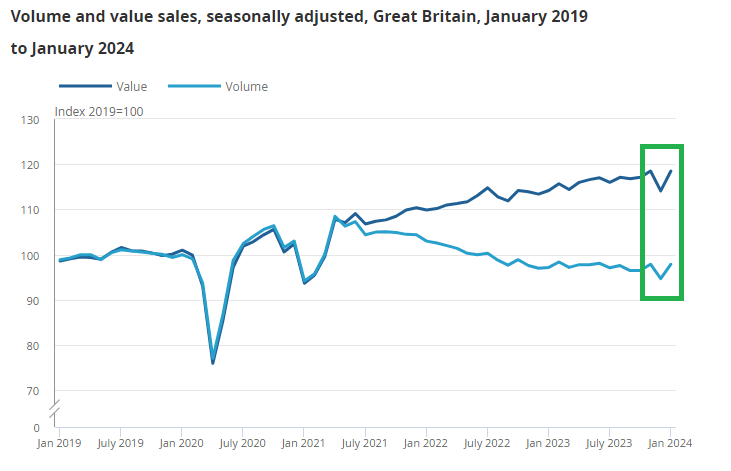

Consumers landed up paying more for less as the ‘value’ statistic, which captures the price aspect of sold items, rose faster (3.9%) than the volume component (3.4%).

Source: ONS, prepared by Richard Snow

GBP/USD Immediate Reaction

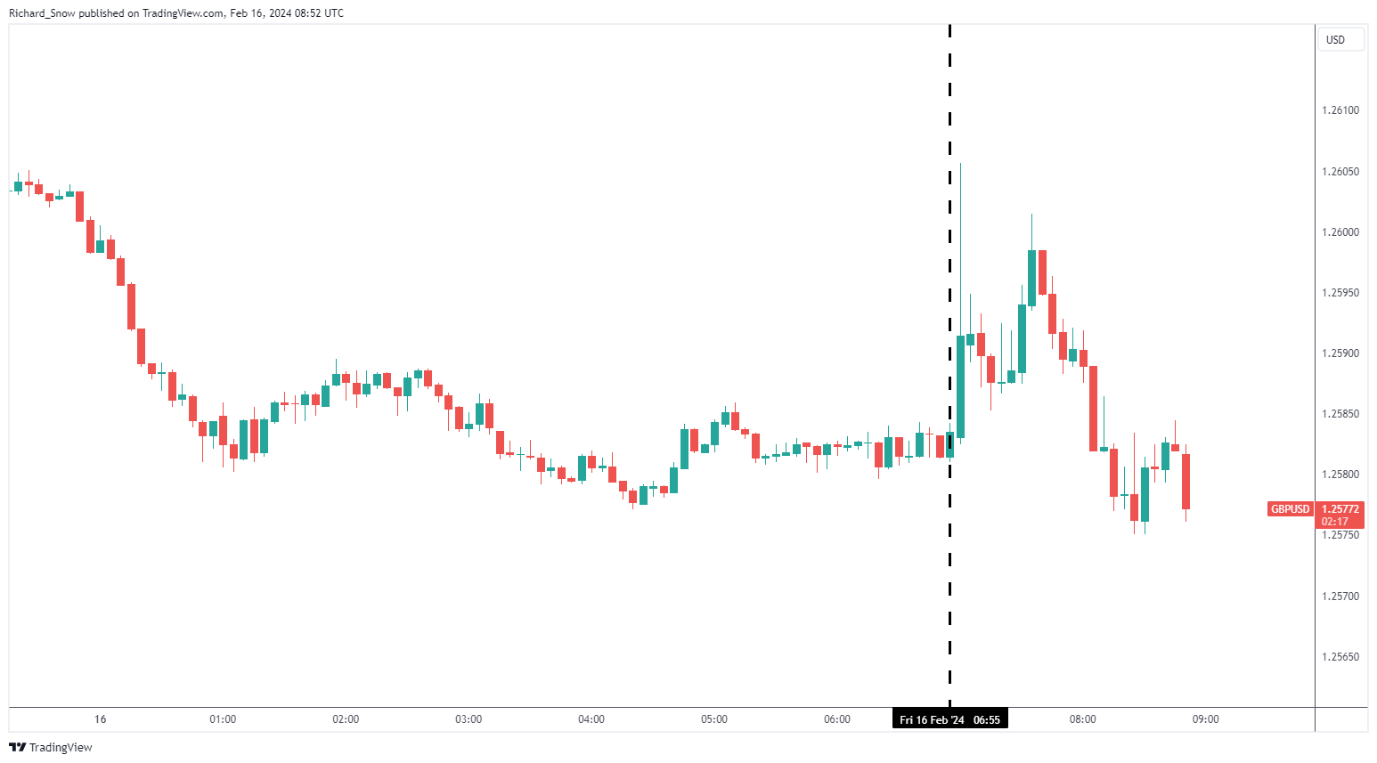

The pound reacted favourably to the data but ultimately declined back towards levels witnessed ahead of the release. The pound is on track for a softer week against the dollar as the pair attempts to break below the broad trading range.

Source: TradingView, prepared by Richard Snow

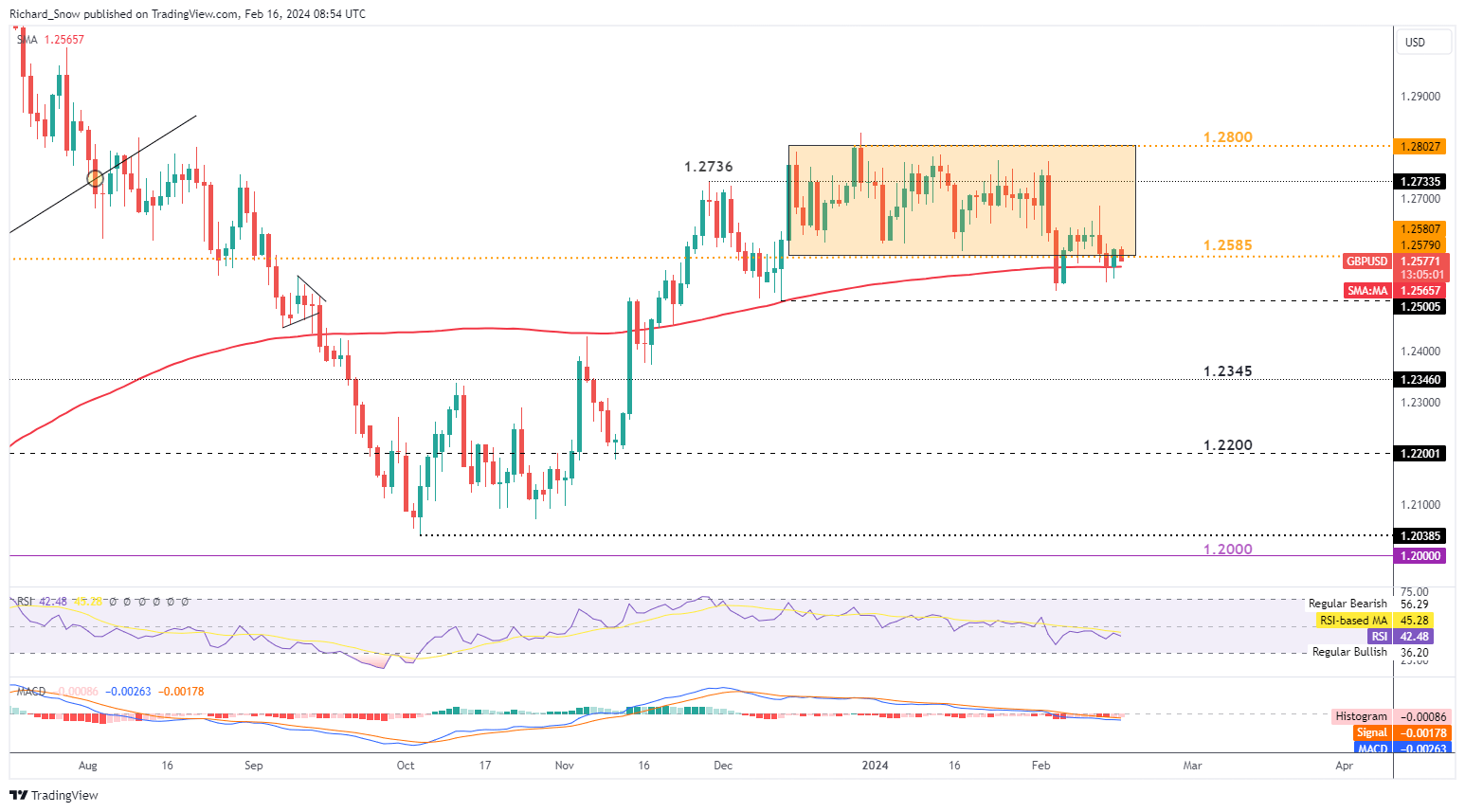

The daily chart reveals the two recent attempts to break out of the trading range with the first attempt falling short due to a lack of momentum and sufficient support around the 200-day simple moving average.

The underside of the horizontal trading range has also been effective in previously containing bears but may now provide resistance as prices reveal a tendency towards the downside – evidenced by increasing downward momentum showed by the MACD indicator. Later today US PPI data is due alongside comments from prominent Fed members, Michael Barr and Mary Daly, finished off with the University of Michigan consumer sentiment preliminary report for February. Keep an eye on inflation expectations in the report as broader sentiment continues to improve at a decent pace.

Source: TradingView, prepared by Richard Snow