Market Week Ahead: ECB, China, Inflation , US Earnings, Tech Stocks

- ECB will guide towards a September rate cut .

- China Plenum starts on Monday.

- Inflation reports from the UK, Euro Area, and Japan.

- US banks continue to report earnings along with Netflix and TSM.

- US tech stocks coming under pressure.

For all market-moving economic data and events, see the FB Finance Institute

A busy week ahead, full of key data, events, and Q3 US earnings, all with market-moving potential.

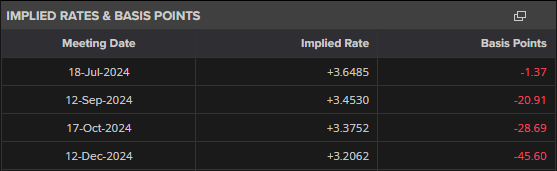

The ECB is expected to leave interest rates unchanged at Thursday’s meeting but will likely give the market further guidance that interest rates will come down again at the September 12 meeting. Financial markets are currently pricing in an additional 45 basis points of interest rate cuts in 2024.

EUR/USD Nears a Fresh Four-Month High

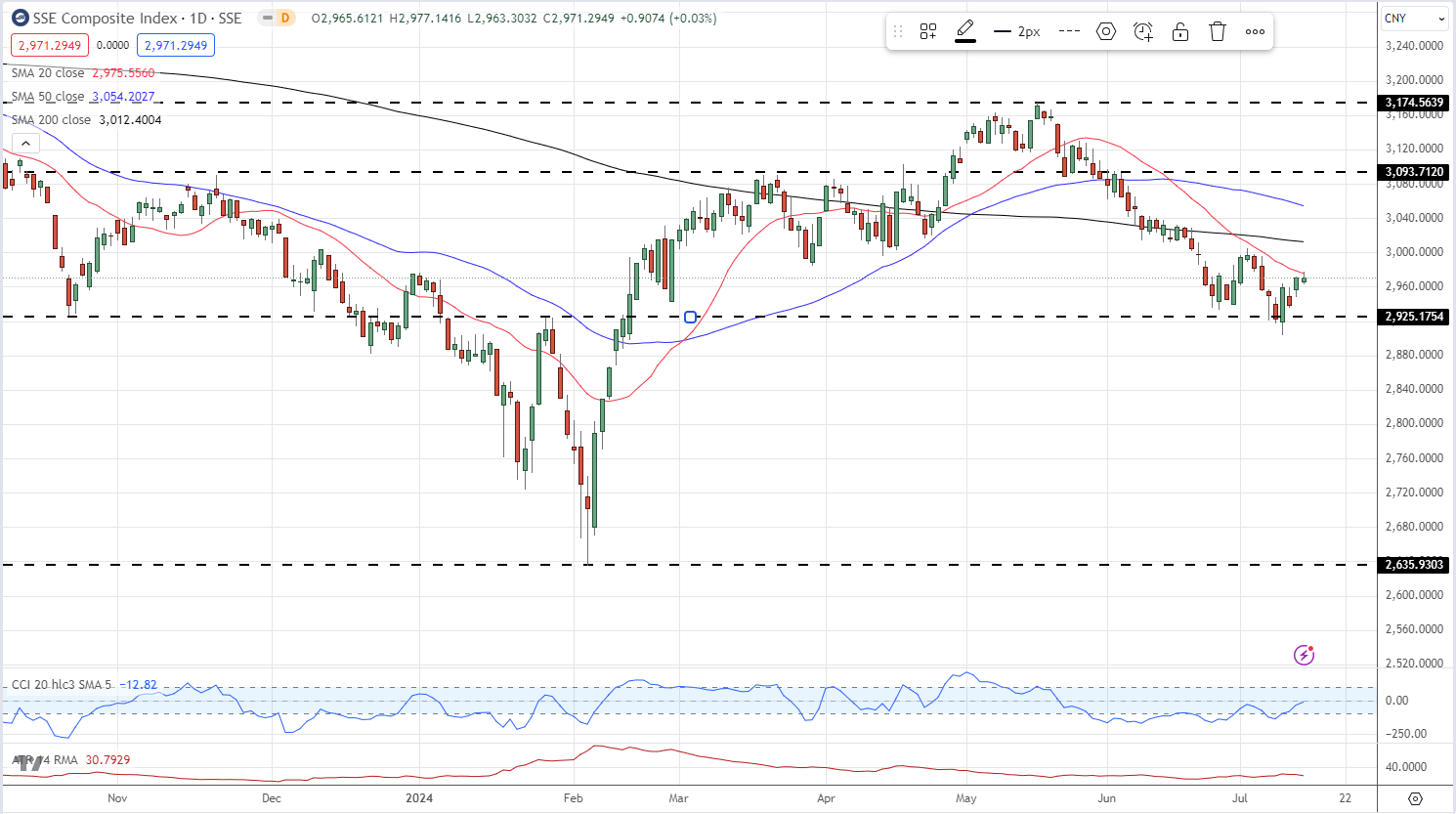

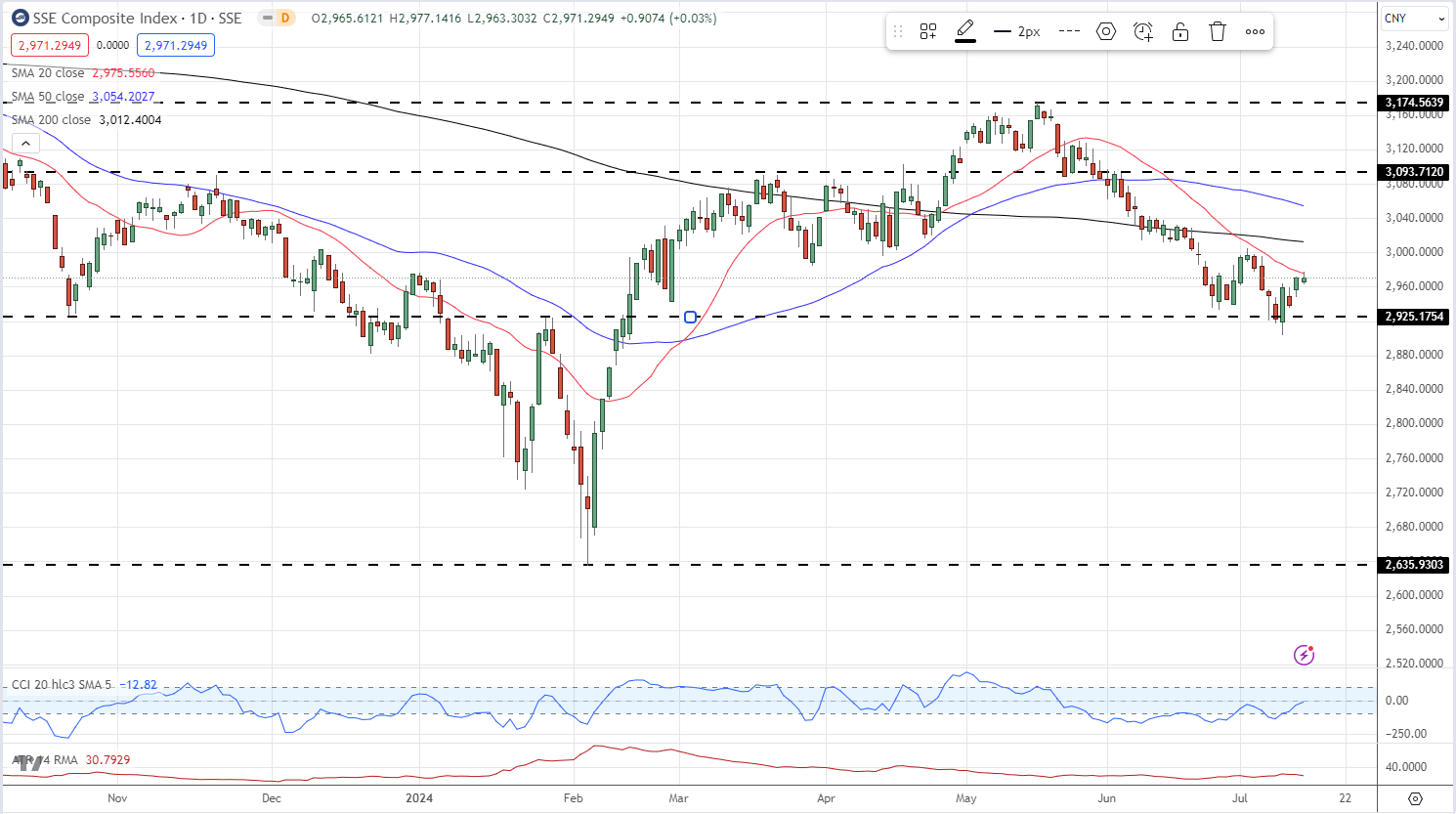

The Third China Plenum starts on Monday 15th, a full meeting of the Central Committee, one of the most powerful decision-making bodies in China's political structure. Plenums are used to discuss and decide on major policies, laws, and personnel changes. The meeting often sets the direction for significant reforms or initiatives and can impact China's economic, political, and social policies. Decisions made here can have a long-term effect on China’s financial markets.

SSE Composite Index Remains Under Pressure

Inflation reports from Canada, the UK, the Euro Area, and Japan dominate the economic calendar next week, along with China Q2 GDP , UK employment data, and German and Euro Area ZEW sentiment readings. These economic releases are spread across the week and will add volatility to a range of FX-pairs.

US earnings season continues apace with notable releases from financial heavyweights BlackRock, Goldman Sachs, Bank of America, and Morgan Stanley. In addition, Netflix, a member of the Magnificent Seven, and chip giant Taiwan Semiconductor Manufacturing will also open their books.

See the DailyFX Earnings Calendar for a comprehensive schedule of release dates

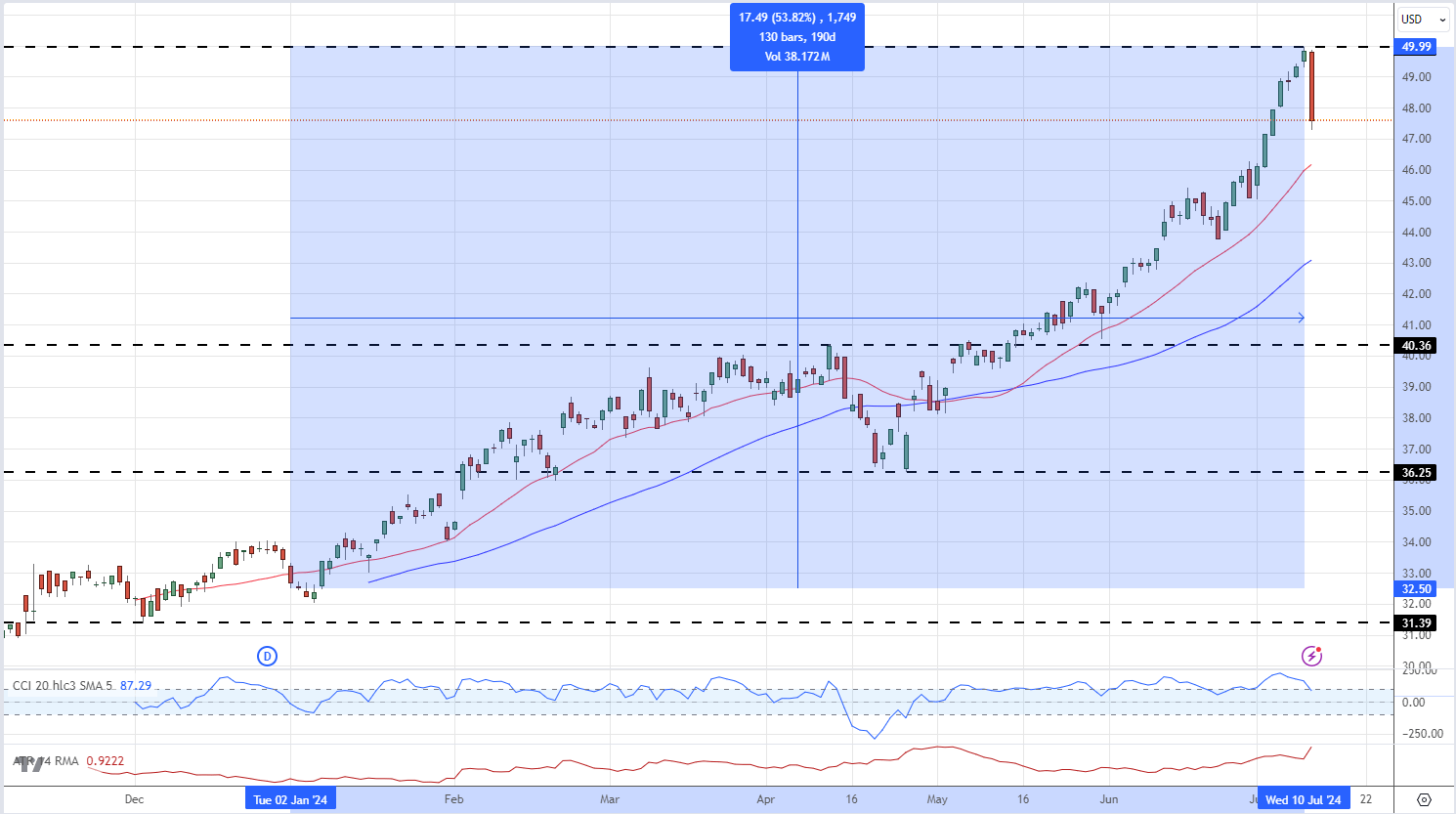

Away from the economic data and events calendar, the Nasdaq 100, and to a lesser extent the S&P 500 , will come under scrutiny after the sharp correction seen on Thursday. While Thursday’s sell-off may be seen as a correction within a longer-term trend higher, the dependence on just a small percentage of stocks to drive the index higher may become a problem.

Roundhill Magnificent Seven ETF Daily Chart

All Charts using TradingView