Dow Jones 30, Nasdaq 100, Nikkei 225 Analysis and Charts

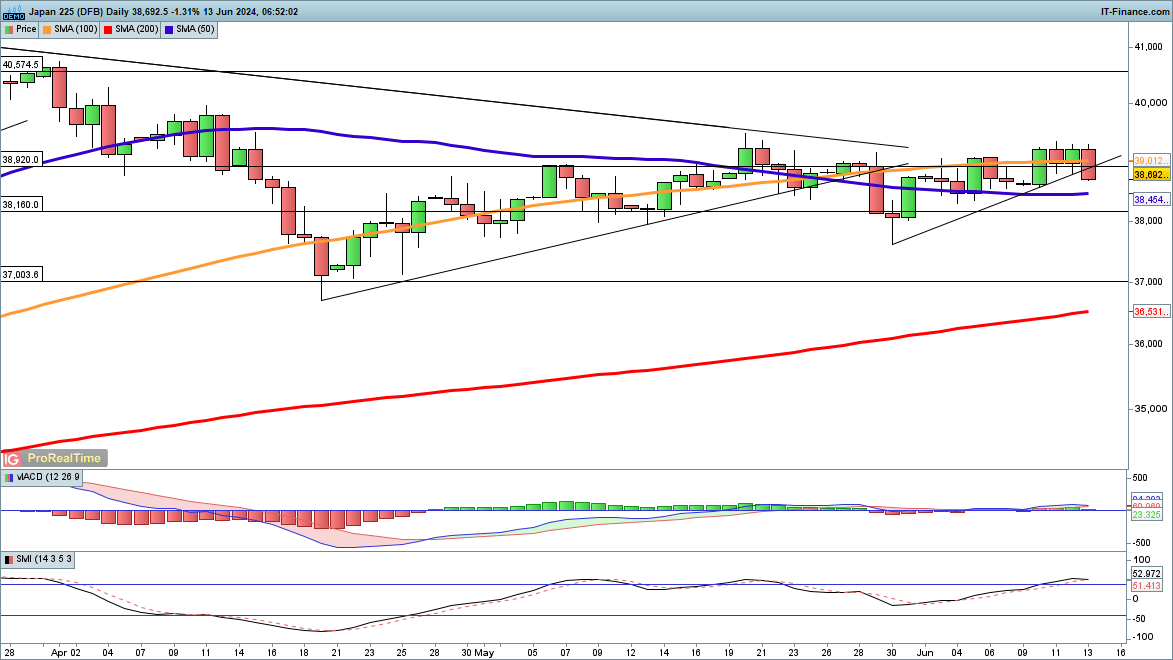

Post-CPI gains slip away for Dow

The index has slipped lower following the Fed meeting, having failed to hold on to the gains made in the wake of the US CPI reading yesterday. The reduced expectations around a 2024 rate cut (now one instead of two previously) have hit stocks, and a sense of disappointment lingers across markets. A fresh decline could take the price back to 38,000, or down to the April lows around 37,500.

Buyers will need a close back above 39,000 to provide hope that a fresh leg higher has begun.

Dow Jones Daily Chart

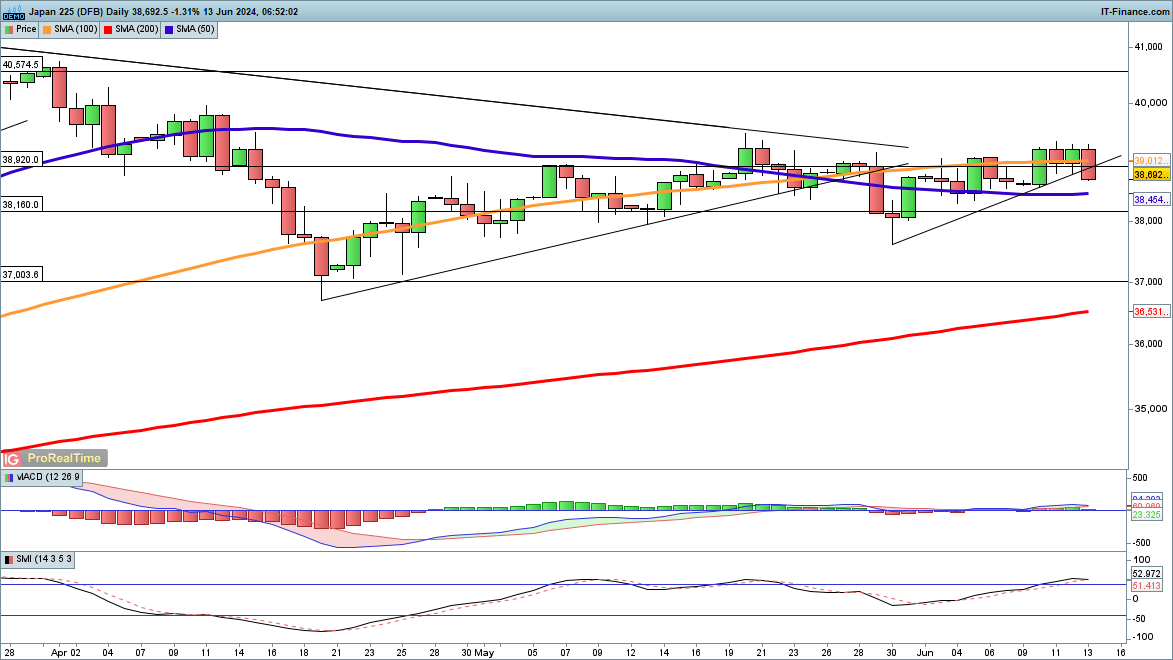

Nasdaq 100 surges to new record

While the Dow struggled, the Nasdaq 100 continued to make gains, leaping above 19,500 for the first time. Tech stocks continue to enjoy a bullish run, having begun a rally back at the end of May. Record highs have been made and then broken throughout the week, and now the 20,000 level seems to loom as the next big psychological level.

In the short term, a close back below 19,000 might indicate the rally has run its course for now.

Nasdaq 100 Daily Chart

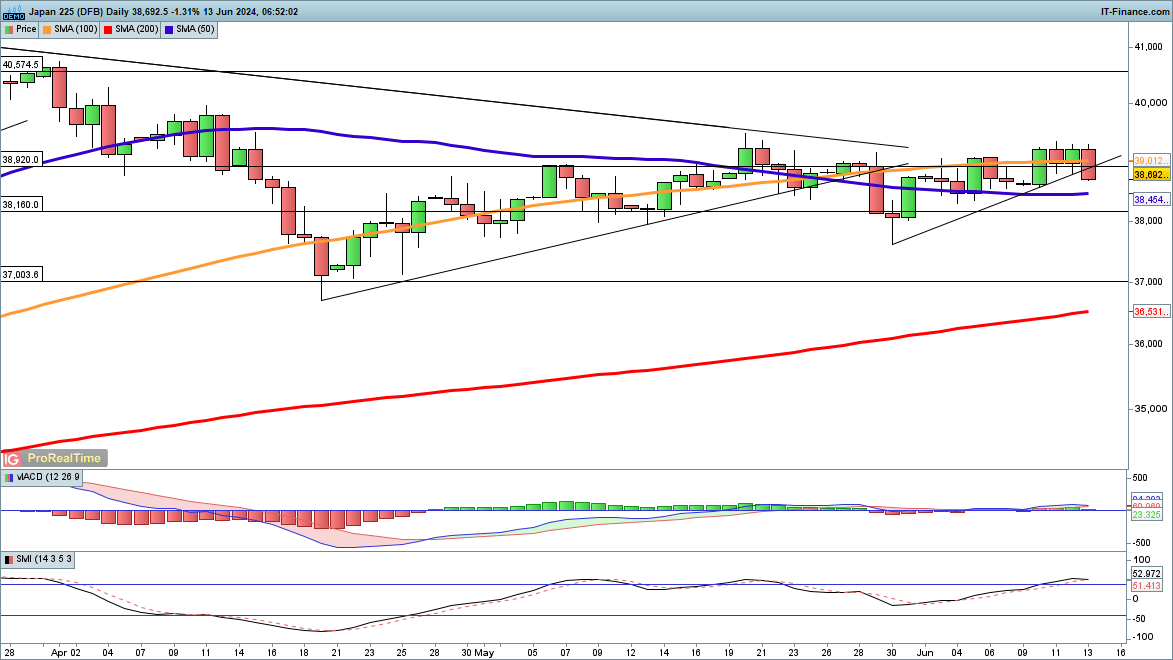

Nikkei 225 rally stumbles

The push higher from the beginning of the week has stalled, as concerns about the Bank of Japan’s policy outlook weighed on Japanese stocks.Gains this week have run out of steam around 39,340, a similar level to the mid-May highs. The price has broken below trendline support from the late May low, which could now open the way to the lows of May at 37,500.

A close above 39,000 would be needed to suggest that a new rally has begun.

Nikkei 225 Daily Chart