South African Rand (USD/ZAR, GBP/ZAR) Analysis

- The ruling ANC relies on other parties for parliamentary majority

- USD/ZAR surges towards the 2020 high despite a generally weaker dollar

- GBP /ZAR experiences sharp rise but momentum indicator nears oversold levels

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Liberation Government (ANC) Relies on Others for Parliamentary Majority

The African National Congress (ANC) saw its share of the national vote drop to 40.18% according to the Independent Electoral Commission (IEC), marking its worst showing at the polls since rising to power in 1994.

Typically, the ANC has achieved the large share of the national vote anywhere around the 60% mark. The large drop-off is mainly attributed to ousted ANC stalwart and former President Jacob Zuma and his new ‘MK’ party which took a large portion of ANC voters.

For the first time since Nelson Mandela led the organization, the party will have to enlist the help of other parties to govern. The problem is there is no clear candidate for the ANC. The white-led, business friendly Democratic Alliance (DA) received 21.81% of the vote but it is clear that there are dissenting voices within the ANC as anti-DA protests got underway outside the venue where the ANC’s National Executive Committee (NEC) was meeting to discuss possible options.

Other options include the populist uMkhonto we Sizwe (MK) led by Zuma (14.58% of the vote) or the hard-left Economic Freedom Fighters (EFF) with 9.52% of the vote. MK refuses to join forces with the ANC as long as the current President Cyril Ramaphosa remains in office. Just to make things more complicated, the DA will not work with the ANC if it brings MK and the EFF into its coalition government.

According to the constitution, a new parliament has to convene within two weeks of the declared results, which highlights the 16th of June. Markets therefore, may have to endure an extended period of uncertainty.

Are you new to FX trading? The team at DailyFX has curated a collection of guides to help you understand the key fundamentals of the FX market to accelerate your learning

The rand has depreciated against the US dollar this year by around 3.4% and has experienced a sharper decline in the runup to the election and in the days that followed.

Selected Currencies and Their Performance Against the US Dollar in 2024

Source: Reuters, prepared by Richard Snow

USD/ZAR Surges Towards the 2020 High Despite a Generally Weaker Dollar

The rand has lost a lot of ground to the dollar since the swing low at 18.044. USD /ZAR has since headed higher, rising above both the 50 and 200-day simple moving averages where the pair remains currently.

The effect may have been worse had the US not been on the receiving end of weaker data that has trickled in over recent weeks as inflation appears to be heading lower again and economic growth is looking vulnerable. US real GDP growth for the first quarter (annualized) was revised lower, to 1.5% in the second estimate of the data. Estimates from the initial (advance) figure were originally as high as 2.5%.

South African GDP also missed estimates on Monday, aiding the decline. The 19.35 marker represents the nearest level of resistance in the event the rand continues to depreciate, while the 200 SMA and the swing low of 18.044 present the relevant levels of support should markets regain confidence in the political stability of the Southern African nation.

USD/ZAR Daily Chart

Source: TradingView, prepared by Richard Snow

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, "Traits of Successful Traders," and gain valuable insights to steer clear of common pitfalls

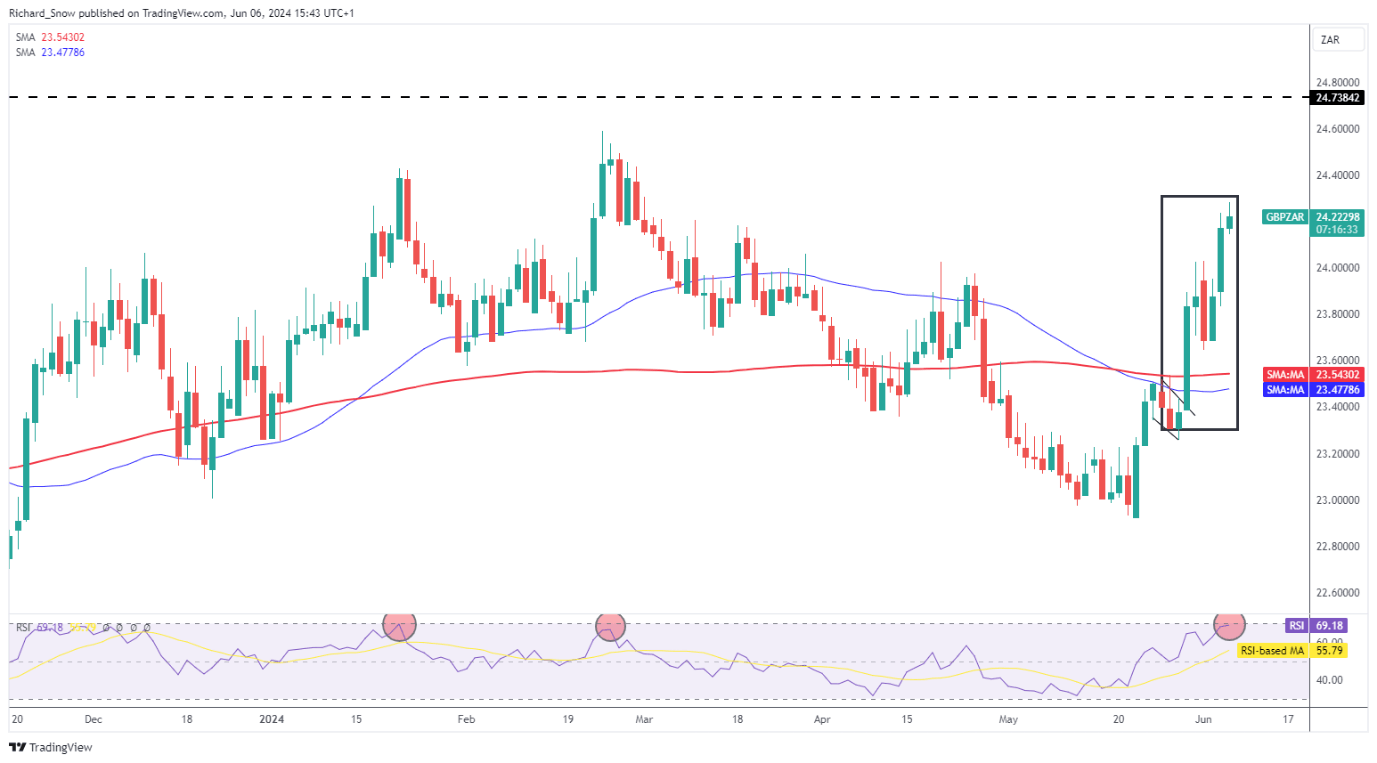

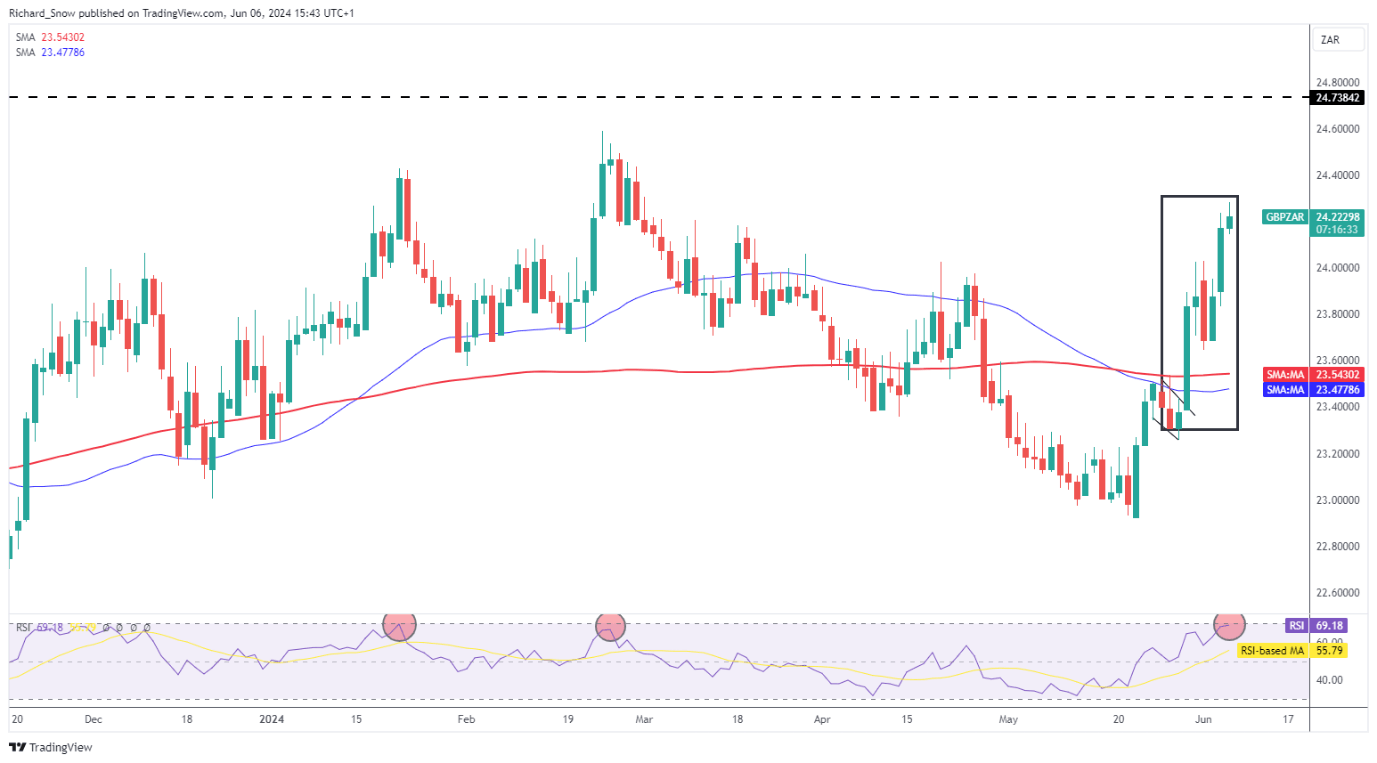

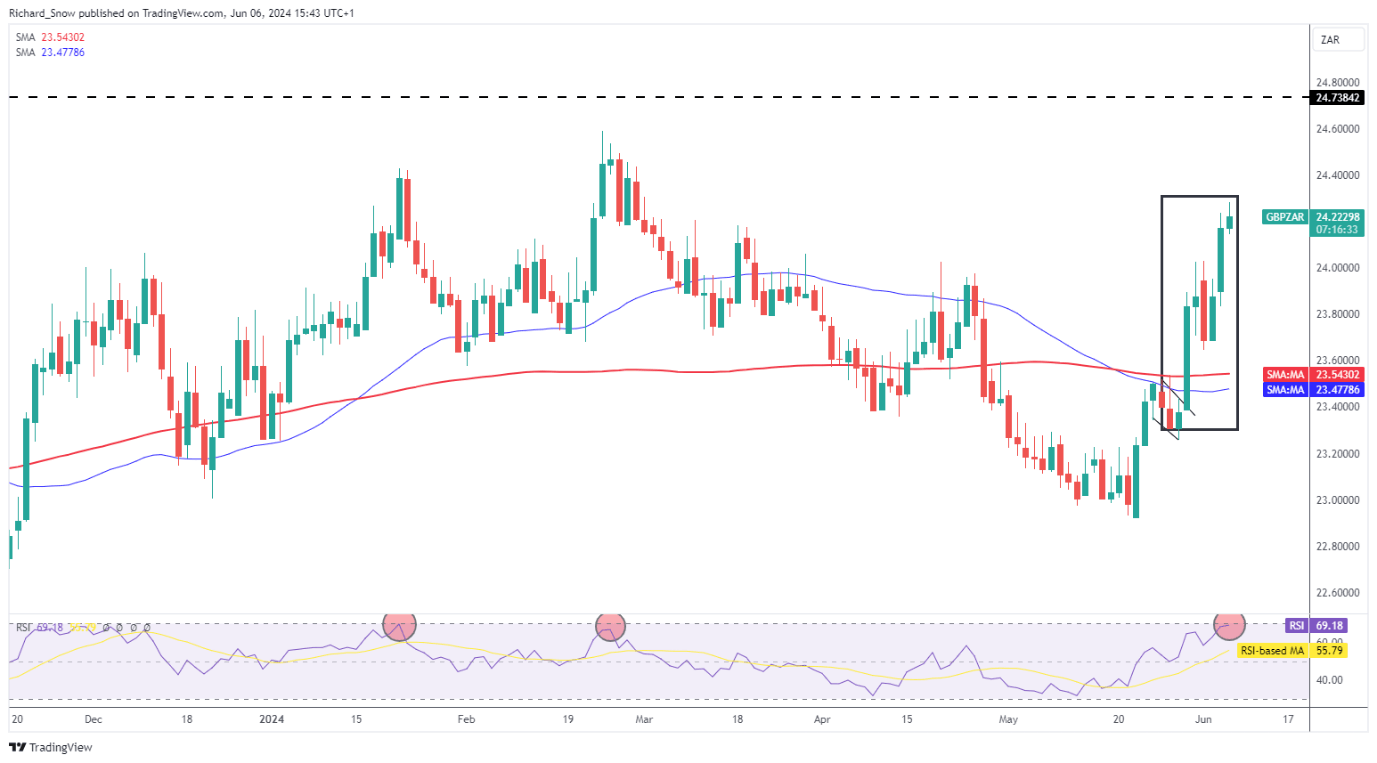

GBP/ZAR Experiences Sharp Rise but Momentum Indicator Nears Oversold Levels

The British Pound advances against the rand and trades above the familiar 24.00 mark once more. Much like USD/ZAR, the pair trades above the 200 SMA and approaches the swing high of 24.59 back in Feb.

However, when looking at the RSI indicator, the recent move higher could come under pressure as the pair pulled back at the prior two instances the indicator neared oversold territory. It may be prudent to weigh up the technical signals with the unfolding coalition talks as a ‘bad’ outcome could see the rand depreciate further from here.

Resistance appears at the swing high of 24.59 with support at the 200 SMA around 23.54.

GBP/ZAR Daily Chart

Source: TradingView, prepared by Richard Snow