“Happy Days Are Here Again,” is a song that would go on to become a timeless anthem of optimism. Milton Ager (music) and Jack Yellen (lyrics) wrote the tune. This iconic melody was composed in 1929, just as the United States was entering the Great Depression. Its creation was a response to the dire economic situation of the time, with the intent of providing a ray of hope to a nation grappling with the devastating effects of the stock market crash that had occurred earlier that year.

The song’s purpose was clear: to uplift the spirits of the American people during a period of immense economic hardship. As the country faced unemployment, poverty, and despair, “Happy Days Are Here Again” aimed to inject a sense of optimism and faith into better times ahead. Its catchy melody and lyrics conveyed a message of resilience and a belief that the dark days would eventually give way to brighter ones.

For the next 13 years, the U.S. economy continued to grapple with the effects of the Great Depression. It wasn’t until Franklin D. Roosevelt’s presidential campaign in 1932 that the song truly became the anthem of the Democratic party. FDR adopted it as his campaign song, and its infectious optimism resonated with voters. While it wasn’t commissioned by the government after the stock market crash, its association with FDR’s campaign and subsequent presidency solidified its place in American political and cultural history. To this day, “Happy Days Are Here Again” remains a symbol of hope and resilience in the face of adversity.

The reason this song is relevant to economic news of today is that there are some very gloomy economic realities that contrast very strikingly against the economic reports we receive from the government. As I sit down to draft this article the GDP report showed that the U.S. economy grew at a 3.3% pace in the 4 th quarter, which is much better than expected. The media pundits and talking heads are tripping over themselves with optimism and enthusiasm over this incredible feat.

The problem that I have with almost all economic reporting is that it does not differentiate effectively between the public and private sectors. I have a major issue with this conglomeration of facts and figures because the private sector lives in a completely different economic reality than the public sector.

Public sector finance and private sector finance differ significantly in their goals, constraints, and consequences. One key distinction lies in how deficits are perceived and managed. In the private sector, a prolonged deficit can indeed lead to bankruptcy, as it indicates that a company is consistently spending more than it is earning, jeopardizing its financial stability and survival. In contrast, the public sector often operates under a different paradigm, where the prevailing belief is that deficits don’t matter, or at least not in the same way as in the private sector.

In the private sector, businesses are profit-driven entities, and their survival hinges on their ability to generate sustainable profits. If a company consistently runs a deficit, it signals financial mismanagement or unsustainable operations, prompting creditors to lose confidence and potentially forcing the company into bankruptcy. Private sector entities must adhere to strict financial discipline to ensure their long-term viability.

Conversely, the public sector, which includes government entities, operates with a broader mandate that extends beyond profitability. Governments can run deficits for extended periods, financing public services, infrastructure projects, and social programs. The prevailing belief is that deficits can be managed through various mechanisms, such as taxation and borrowing, without necessarily leading to bankruptcy. However, this does not mean that deficits in the public sector are without consequences; they do lead to inflation, increased debt burdens, currency debasement and reduced investor confidence if not managed prudently. Ultimately, the difference in how deficits are perceived and managed between the public and private sectors reflects their distinct objectives and responsibilities.

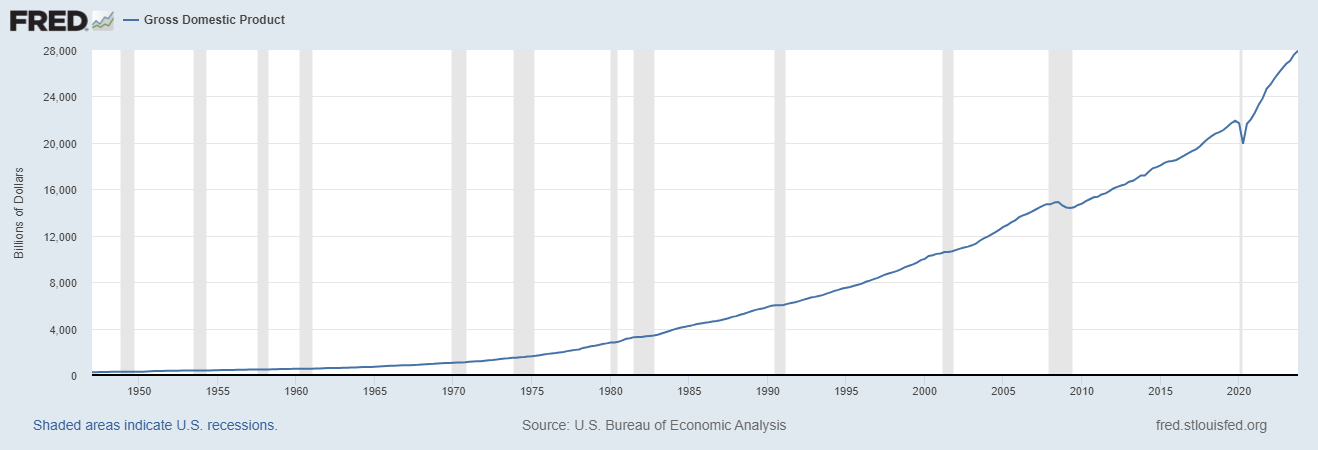

Here is the most current chart of United States GDP.

How could anyone criticize a chart that continues to rise so gracefully?

Here’s my point. The biggest component of GDP is government spending. If you want that chart to communicate anything of value, we need to break it out to see the GDP of the private sector and then of the public sector. Why?

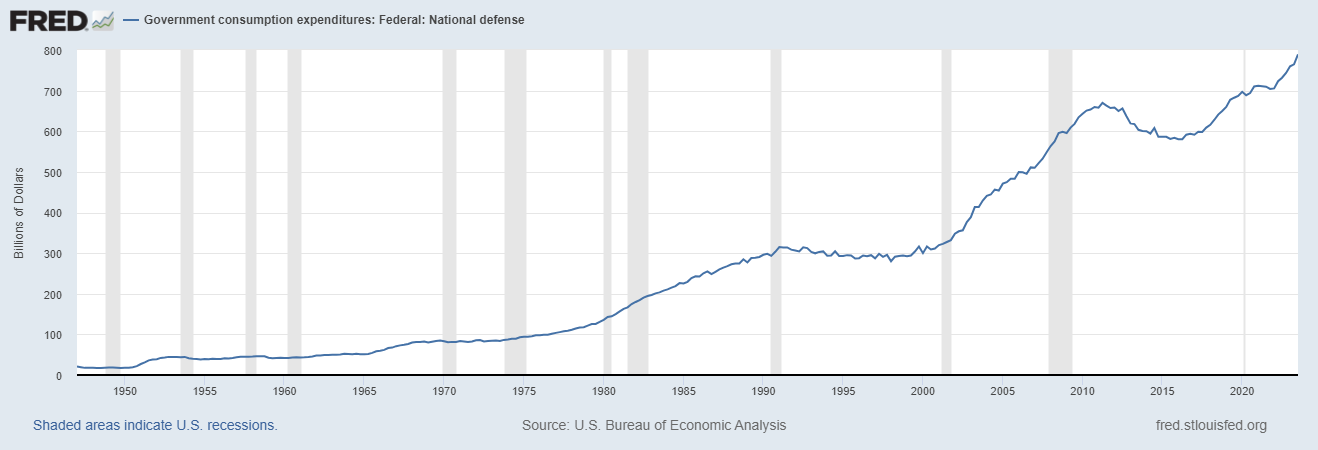

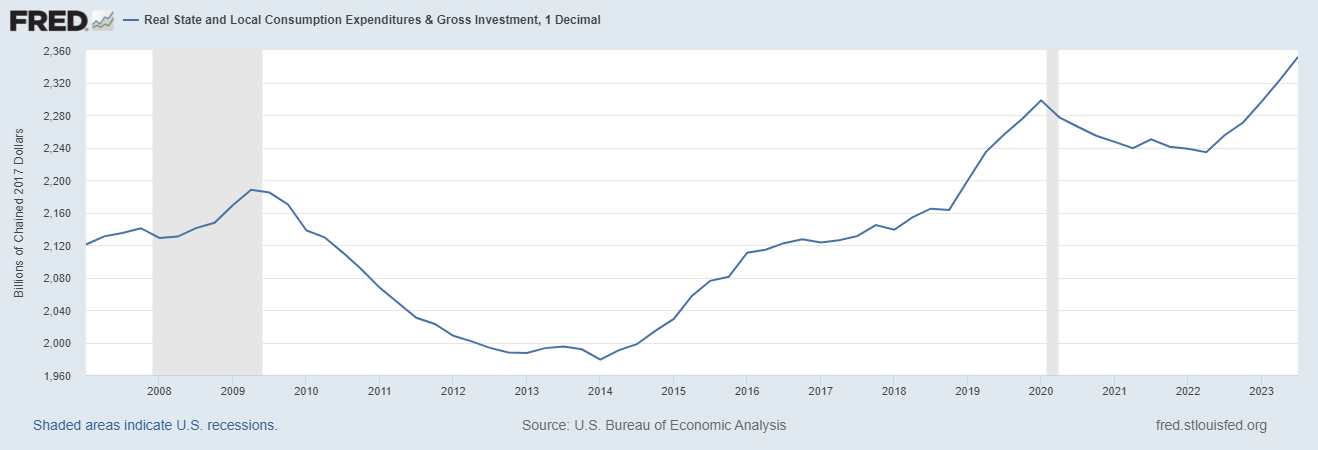

As hard as it may be to believe the government spent more in 2023 than they did during COVID. Here are two charts that communicate that reality very clearly.

The first chart is spending on military and national defense.

Yes, military spending is typically considered part of a country’s Gross Domestic Product (GDP). Stated concisely, the more government spends on supporting military conflicts around the world the stronger our nation’s GDP will be. When the government allocates funds for its military, these expenditures are included in the government spending component of the GDP calculation. “Happy Days Are Here Again!”

Next, look at the chart of gross consumption, expenditures, and investment by the government during 2023. New all-time highs!

My point is that the only thing that today’s GDP report effectively communicated is that spending is alive and well in Washington DC. That should not be a surprise to anyone.

GDP, folks, it’s been touted as the holy grail of measuring an economy’s health, but let me tell you, it’s far from perfect. One major problem is that it doesn’t consider the distribution of wealth . So, you can have a soaring GDP, but if all that wealth is concentrated in the hands of a few, it’s not benefiting the average American. Another issue is that GDP doesn’t consider the environmental or societal costs of economic growth or supporting war. It doesn’t care if we’re polluting our air and water, killing our neighbors, or depleting our natural resources at an unsustainable rate. And let’s not forget, GDP can go up when we spend more on things like healthcare or cleaning up after disasters, but that’s not a sign of a healthy economy, that’s a sign of problems we need to address. So, folks, while GDP can give us some insights, we’ve got to look beyond it to truly gauge the well-being of our economy and our people. We also need to recognize that this is an election year, and it is essential to be supremely skeptical of ALL DATA that is presented by incumbents or their challengers.

If the GDP report and numbers are ever to be meaningful it must be segregated down to show the private sector and public sector separately. Otherwise, it lends itself to massive unnecessary distortions and complexities.

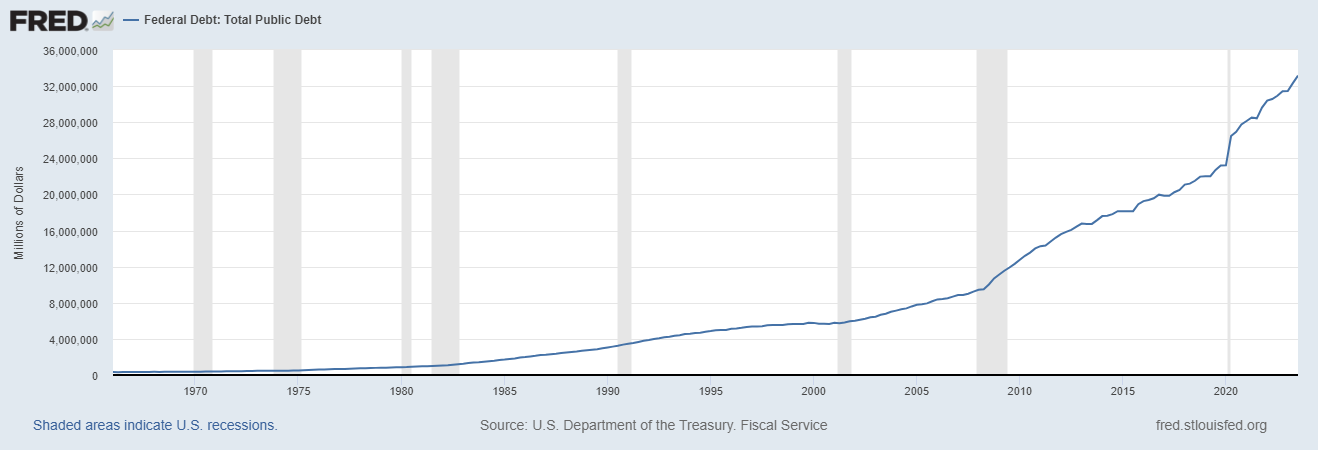

To give you an idea of how addicted our economy has become to government spending consider the following. The United States surpassed its first trillion dollars of national debt on October 22, 1981. This significant milestone occurred during Ronald Reagan’s presidency. At the time, the crossing of the trillion-dollar threshold was a notable event, marking a substantial increase in the national debt compared to previous levels. Today we are adding $1 trillion to the national debt every 72 days! Stop and think about that. It took 205 years for our country to reach its first trillion in debt. Today we are accomplishing that feat in 10 weeks! At our current pace we will add an additional $5 trillion to the national debt this year!

Want to understand the magnitude of $1 trillion? If you spend one million dollars an hour it would take you 114 years to reach $1 trillion.

Why am I concerned?

Ah, the delightful art of currency debasement! Let’s whip up a recipe for this time-honored tradition, beloved by empires of old and modern governments alike. Here’s how to cook up your very own currency debasement dish:

**Ingredients:**

1. A robust national currency (preferably one with global trust and value).

2. A central bank with a penchant for printing money.

3. A dash of economic challenges (optional, but it adds to the flavor).

4. A generous serving of government debt.

5. A sprinkle of short-term solutions.

6. A complete disregard for long-term economic health.

**Instructions:**

1. Start by slowly heating up your economy. It’s best if it’s already experiencing some challenges – a crisis works wonders for this recipe.

2. Next, take your central bank and have it print copious amounts of money. The more, the merrier! This will be the base of your dish.

3. Gradually mix in a heaping pile of government debt. Don’t worry about the size – the bigger, the better.

4. For that extra zing, throw in a sprinkle of short-term solutions. This will make your dish appealing in the now, and let’s be honest, who cares about the future?

5. Stir continuously, making sure to ignore any warnings from economic advisors about inflation or loss of currency value. They’re just party poopers.

6. Simmer and watch as the value of your currency slowly but surely erodes. This may take some time, so be patient.

7. Finally, garnish with a collapse in public confidence. Serve hot and watch as the economic chaos unfolds. Bon appétit!

**Pairing:**

This dish is best served with a side of public unrest and a tall glass of international skepticism or distorted markets.

Remember, this is a dish best enjoyed rarely and in small quantities, as the aftereffects can be rather hard to stomach!

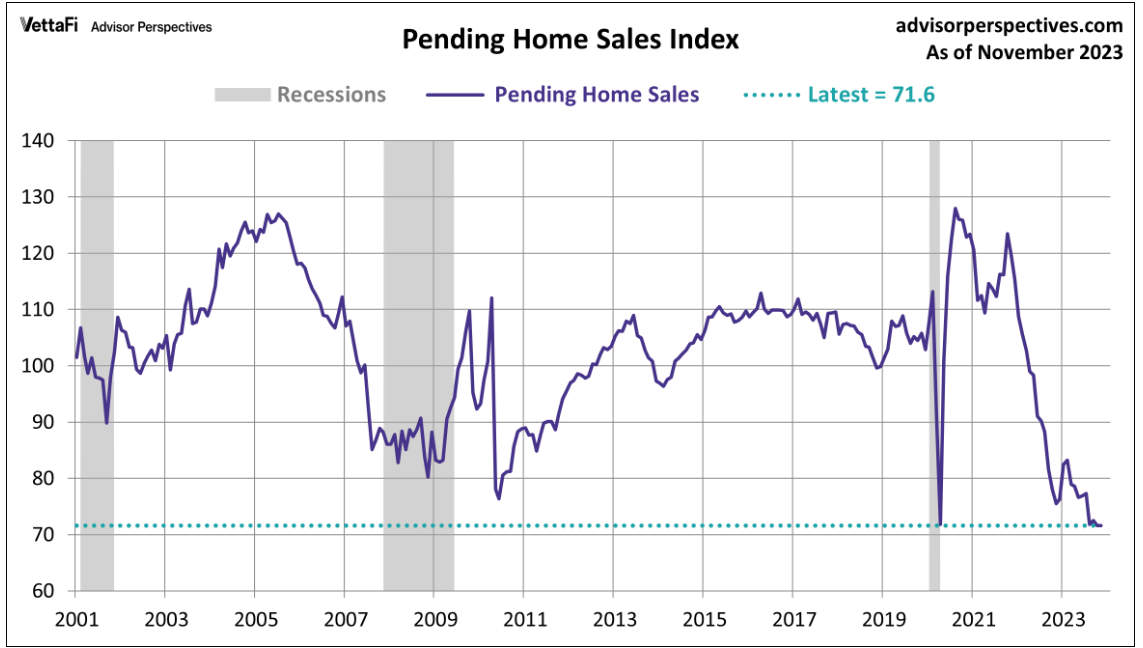

Simply contrast today’s glowing GDP report with the following chart of PENDING Home sales, which is at its lowest level.

Here’s a very simple thought exercise. How can you have a healthy, strong, and resilient economy when the real estate sector has massively contracted? The real estate sector plays an unequivocal role in determining the overall health of an economy. It’s not just about bricks and mortar; it’s about the ripple effect that spending on homes, and everything associated with them has on economic vitality. The state of the real estate market serves as a barometer for the well-being of an economy. When the real estate market is thriving, it signifies robust consumer confidence, investment, and economic stability.

A healthy real estate market stimulates economic growth on multiple fronts. Firstly, it drives construction and housing-related industries, creating jobs and income for countless individuals. The demand for materials, labor, and services such as architecture, interior design, and landscaping all surge in tandem with a buoyant housing market. This, in turn, bolsters consumer spending, as homeowners tend to invest further in their properties, fueling retail and home improvement sectors. Additionally, a thriving real estate market often translates into rising property values, fostering a sense of wealth and encouraging homeowners to spend more, further propelling the economy.

Conversely, an unhealthy real estate market can be indicative of broader economic woes. A downturn in the housing sector often points to diminished consumer confidence, decreased construction activity, and sluggish economic growth. Falling home prices can erode household wealth, leading to reduced spending and a slowdown in related industries. Moreover, a troubled real estate market can trigger a cascade of negative effects, from a decline in property tax revenue for local governments to an increase in mortgage delinquencies and foreclosures, which can have destabilizing consequences for financial institutions. A robust real estate sector isn’t merely a contributor to economic health—it is, indeed, a vital sign that reflects the overall well-being of an economy.

It is these types of stark contrasts that we must engage in regularly to protect ourselves from financial propaganda and determine the best move forward.

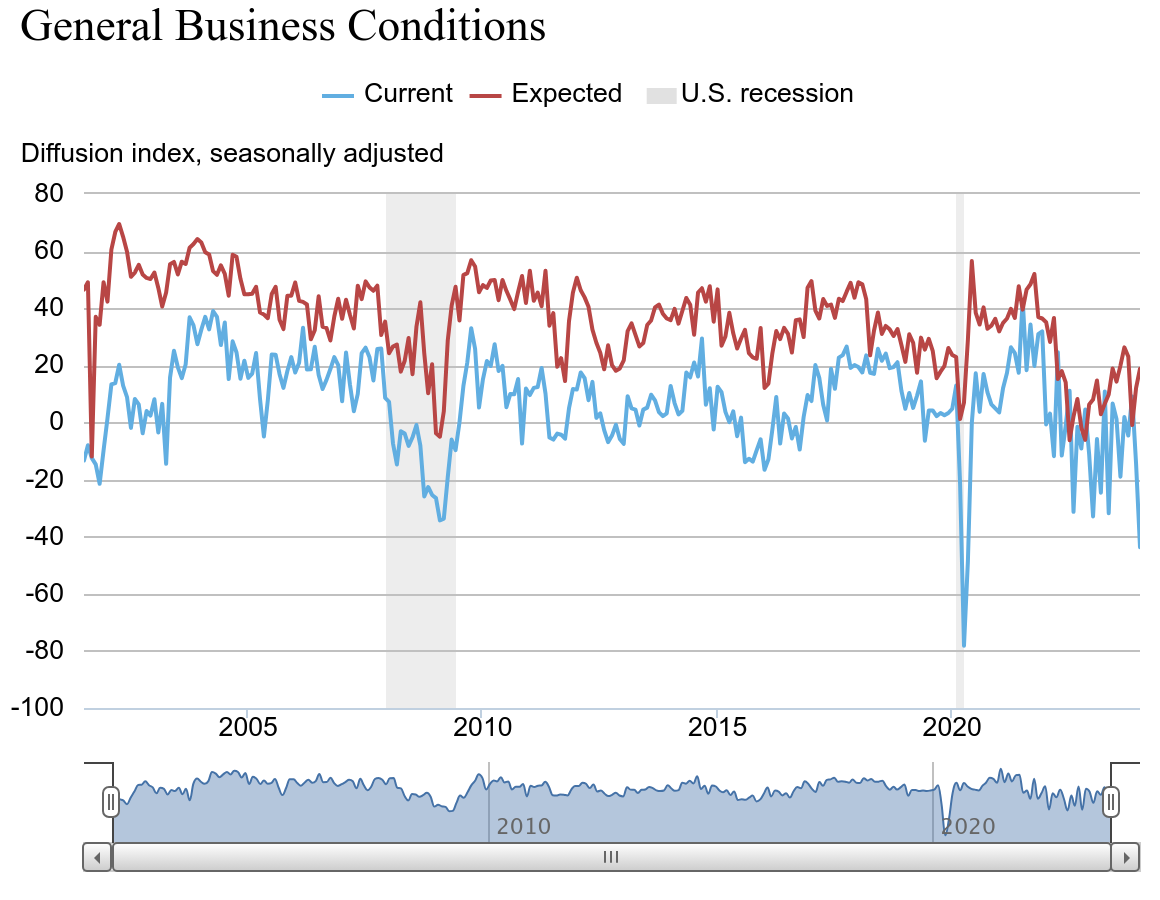

Or consider the following chart from the New York Fed showing you the health of the New York State manufacturing sector which posted its second lowest reading in its history.

New York State has 19.8 million people. How can you have a strong and resilient economy when one of our countries industrial powerhouses is reporting its second worst contraction in its history?

Do you remember this headline from 2023?

The reason I share this with you now is to simply remind you that there is no budget and 2024 is an election year. This was agreed to by both sides of the aisle. The idea that government cuts spending in an election year is a total joke. When a government lacks budgetary constraints and spends without limits, it exposes its economy to a myriad of dangers, primarily currency debasement standing out as its gravest threat. Furthermore, it erodes trust in the government’s fiscal responsibility, undermining confidence in the currency. This poses a serious risk to its economic stability and the well-being of its people.

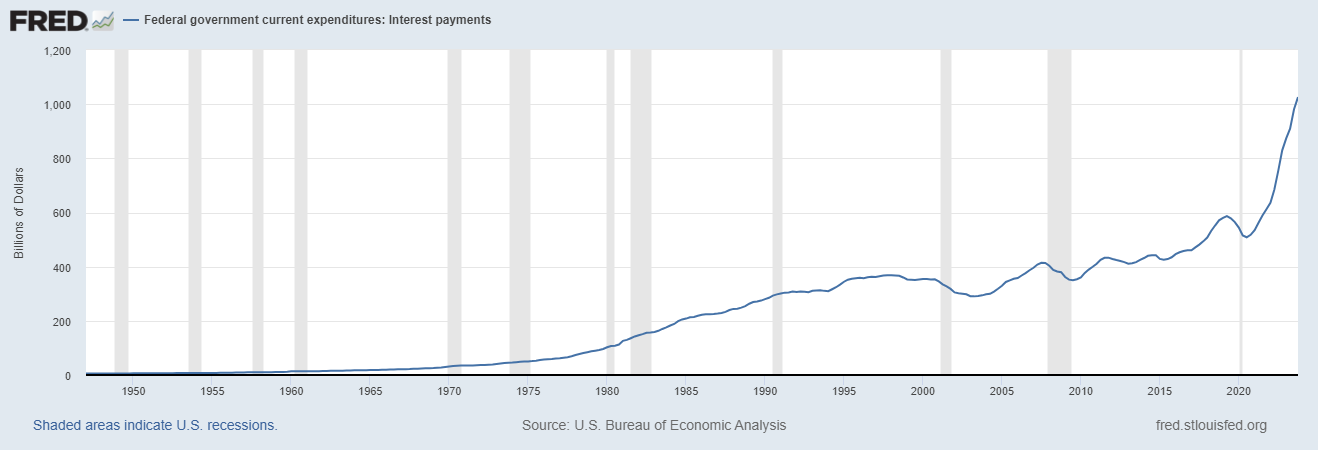

Let me lay it out for you: we’re in the midst of what we can call a “sovereign debt crisis,” and the main culprit behind this mess is none other than the ever-expanding U.S. Federal Debt burden. You see, up until the Fed’s recent interest rate hike spree, those zero interest rate policies and low rates sort of masked the underlying problem. But now, with rates going up to tackle inflation head-on, we’ve got the impending insolvency of the U.S. Federal Government laid out for all to see. Take a look at these charts; they show the relentless growth of our debt and the sudden surge in Federal interest carrying costs.

The Federal government needs to refinance $10 trillion of the Federal Debt in the next 2 years. My question is very simple, who buys it?

Last time I looked at the government auctions buyers were stopping at 3 years on the yield curve. In other words, savers will loan the government their funds but only for very short durations. So now the flavor of the day is loaning the government your savings for shorter and shorter time frames. This is a recipe for unprecedented financial distortions and volatility.

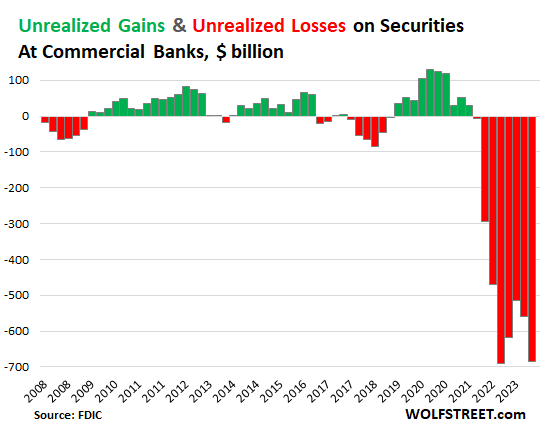

What is creating this problem? Lack of trust. Look at the following chart originally published by the FDIC. It shows the number of losses that commercial banks are holding by carrying U.S. Treasuries. It’s been 11 months, and that situation has not improved one iota. Commercial banks are sitting on $685 billion of unrealized losses from loaning Uncle Sam their excess funds.

In the challenging landscape of 2024, with volatility as the constant companion, the key lies in proactivity rather than reactivity. As we navigate these turbulent waters, being prepared and making informed decisions today can be the compass guiding us toward a more secure tomorrow.

The alternative is literally singing “Happy Days are Here Again” and hoping for the best. As I have tried to illustrate in this article, we are facing unparalleled risks and distortions due to exponential debt growth.

The challenges we face in making effective decisions in today’s distorted and dynamic financial markets cannot be underestimated. Logic alone will not lead us to profitable outcomes, and hoping for success is not a sound strategy. These are indeed unprecedented times, and to thrive, we must harness the power of artificial intelligence, which is purpose-built to keep us on the right side of the market at the right time.

Artificial intelligence , combined with neural networks, utilizes vast data and historical insights to determine the best course of action. The crucial question here is, how are you leveraging this knowledge? What’s your track record in the markets, and how consistently have you managed risk? Do you possess the tools and skills to identify the strongest trends amidst the economic disruptions caused by the printing press?

Artificial intelligence has proven its dominance in various fields, from Poker to Chess, and trading is no different. It offers invaluable insights and a systematic approach to managing risk, providing a way to safeguard your purchasing power in these uncertain times.

To explore the transformative potential of AI in trading, I invite you to join us for a FREE Live Training session.

Discover how AI can help you minimize risk, maximize rewards, and provide peace of mind in your trading journey. Don’t miss this opportunity to equip yourself with the knowledge and tools that can make all the difference.

It’s not magic.

It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.