Talking Points:

-Directional trends in EURAUD , EURJPY , and GBPJPY perk up

-Be mindful of news announcements Wednesday for ECB and BOC

- GBPUSD SSI continues to favor breakouts lower though divergence is appearing in RSI

The Plus Breakout2 strategy is one of the more widely followed by traders. This piece aims to identify those markets where breakout conditions are prevalent, and therefore a follow through of the breakout is more likely.

Generally speaking, the market conditions for the Breakout2 strategy continue to be less than stellar. Directional trends are perking up on some new pairs like the EURAUD, EURJPY, and GBPJPY. However, with broad based volatility expansion absent across many pairs, we will implement a wait and see approach this week.

Also, this week, we have important rate announcements coming from European Central Bank and Bank of Canada rate that could expand volatility in the markets.

If these trends stay in place throughout this week, then we may consider upgrading them on the next report.

Plus Breakout2 Conviction Chart for April 13, 2015

| ADX | ROC | Volatility Expansion? | Sentiment Signal | Conviction | |

|---|---|---|---|---|---|

| EURUSD | Trend | Bearish | Yes | Bullish | 1 |

| AUDUSD | Range | Neutral | Yes | Neutral | 1 |

| GBPUSD | Trend | Bearish | Yes | Bearish | 2 |

| NZDUSD | Range | Bullish | No | Bearish | 1 |

| USDCHF | Trend | Bullish | No | Bearish | 1 |

| USDCAD | Range | Neutral | No | Neutral | 1 |

| USDJPY | Range | Neutral | No | Bearish | 1 |

| EURJPY | Trend | Bearish | No | Bearish | 1 |

| GBPJPY | Trend | Bearish | No | Bearish | 1 |

| CHFJPY | Trend | Bearish | No | Neutral | 1 |

| AUDJPY | Trend | Neutral | No | Bullish | 1 |

| EURAUD | Trend | Bearish | No | Bearish | 1 |

As you can see above, all ratings have stayed the same with the GBPUSD listed as the only pair rated higher than ‘1’.

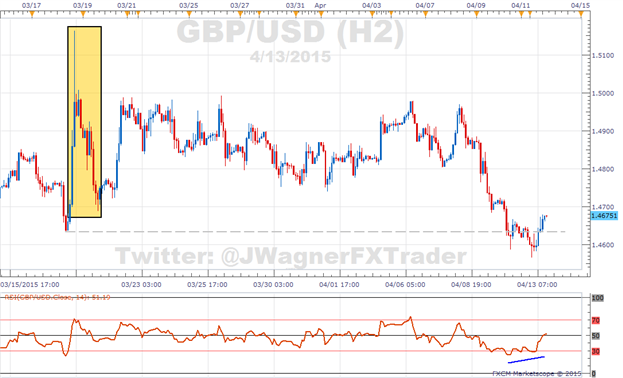

Last Week’s Conviction Chart – GBPUSD Sentiment Continues to Shed Some Pounds

The GBPUSD is currently sitting near 5 year lows. A successful break lower would align the breakout with the SSI signal. With twice as many retail traders positioned to the long side in anticipation of a bottom, a successful break lower will cause pain on these long traders and may force them to sell to close the position.

( Created using FXCM’s Marketscope charts)

A large obstacle in the way to a full conviction of ‘3’ rating is the chart pattern. When analyzing the chart of the GBPUSD, the move from the March 18 high to the March 19 low appears to be a corrective move and will likely be fully retraced higher.

Focusing in on the RSI (red line at the bottom of the chart), there appears to be some divergence showing up. This suggests the move lower is having a hard time punching through with vigor.

Longer term, we’re still looking for this pair to grind higher towards 1.5250. If the path is a slow chop, then the breakout strategy will underperform.

Time will tell what the path the prices would take, but a corrective move higher doesn’t bode well for the Breakout2 strategy when the SSI is giving an extreme bearish signal at near +2.

To receive future articles emailed to you regarding the conviction ratings for the Plus Breakout2 signals or trading an automated portfolio, sign up for the distribu t ion list here.

---Written by Jeremy Wagner, Head Trading Instructor, Education

The Plus Breakout2 strategy can be automated. If you wish for the trades to trigger automatically into your account, register for a Mirror account which provides you access to dozens of other strategies as well.

Follow me on Twitter at @JWagnerFXTrader.

See Jeremy’s recent articles at his Forex Educators Bio Page.

Feedback? Email Jeremy at [email protected]