Talking Points:

- EUR / USD Sentiment Flips to Negative

- Long-Term Channel Support Near $1.25

- Potential Exits: Stop at 1.2480 & Limit at 1.2950

The Euro has taken a turn this week after its relentless free-fall the past few months. After falling to $1.25 last week, it has now risen as high as 1.2675. I am predominantly a trend trader and look to trade in the path of least resistance (in this case, selling the EUR/USD as its fallen), but there are a couple compelling reasons to consider buying the EUR/USD at this price.

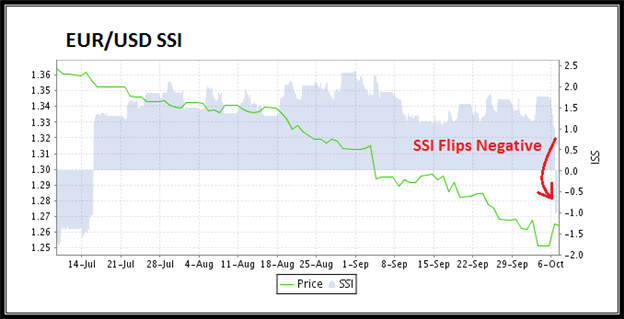

EUR/USD SSI Flips to Negative - Bullish

First, we want to look at the recent shift in sentiment. The EUR/USD has had more retail buyers than sellers for almost three months; this has coincided with a drop in price for the pairwhic is often the case. We focused on this downtrend back in August when 66% of EURUSD Retail Traders were buying , and readers following SSI are now consequently sitting on a hefty profit.

But today, the SSI has actually flipped negative. This means there are more retail traders selling the EUR/USD than buying, a bullish signal. The chart below shows historical SSI alongside price and the most recent change in SSI’s direction.

Learn Forex: EUR/USD Historical SSI & Price

(Created using On-Demand Live SSI )

The Speculative Sentiment Index is not a guaranteed signal. It does not mean that the EUR/USD is guaranteed to begin moving higher. But it certainly has piqued my interest in a potential long Euro trade, opposite of the retail trading crowd.

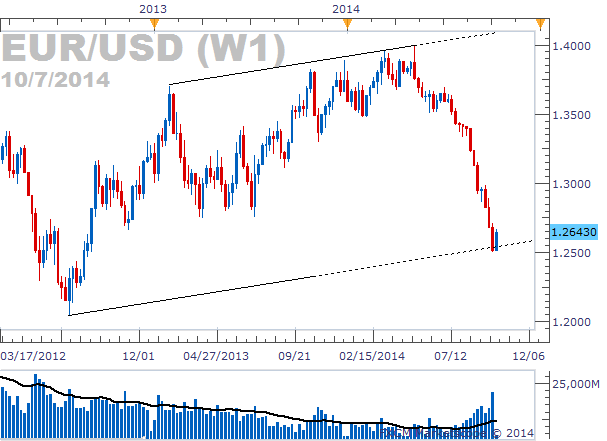

Weekly Chart Channel Support at $1.25 - Bullish

Moving on to technical analysis, the Euro has bounced at not only the psychological level of 1.2500, but a very significant supporting trend line. While trend lines typically require more than two points to become valid, we were able to project this trend line into the future by drawing a line parallel to the trend line created at the top of the chart pictured below. This method is further explained here .

Learn Forex: EURUSD Weekly Chart – Bullish Channel

(Created using FXCM’s Marketscope 2.0 Charting Package )

This weekly chart shows how strong the EURUSD bounce has been off of this key level. We are banking on this support level to continue holding to give us a successful buy trade.

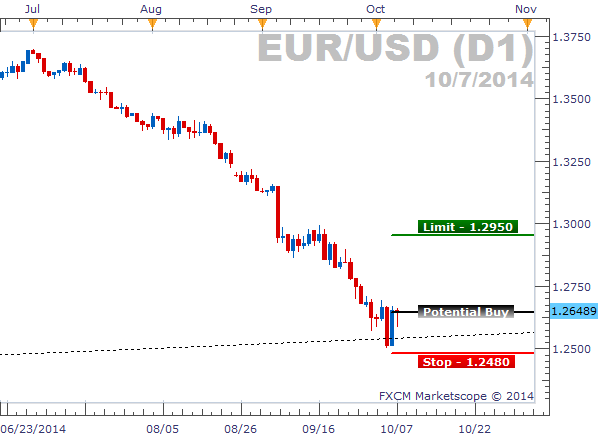

Potential Exit Strategy for Euro Bulls

No trade setup is complete without an exit strategy. Looking at this setup in particular, it is clear that we want to set our stop loss below the most recent swing low. Traders can set their stop losses at 1.2480 to give our long position room to breathe as well as allow the trade to be closed out at a loss if a new low is created.

Learn Forex: EUR/USD - Buy Trade Exit Strategy

Using a 1:2 risk:reward ratio (see Forex Fast-Track II ), we can set our profit target around 1.2950. This will place the limit before price would hit the psychologically important $1.30 level and will put our exit right in the middle of a consolidation area we saw 3 weeks ago. We hope this will get us out of our winning trade before these potential resistance levels have an effect on price action.

The Euro’s Fork in the Road

No one knows with certainty if the EUR/USD will bounce higher or not. We can only look at similar situations in the past to create an educated guess on what may happen in the future. With the EUR/USD turning around at such a key level and SSI flipping negative, an argument can be made that the Euro could rally higher against the US Dollar . To trade the EUR/USD risk-free, download a Free Forex Demo account with real time charts.

Good trading!

---Written by Rob Pasche

Start your Forex trading on the right foot with the Forex Fast-Track Webinar Series . This 4-part, live webinar course is the disciplined Traders’ Fast-Track to the Forex Market. Topics include:

- Using FXCM’s award-winning trading platform

- Calculating Leverage and reducing risk

- Trading with a simple (yet effective) trading strategy

- Maintaining for Forex account and enrolling in on-going education

This course is completely free, so sign up or watch on-demand today.