Talking Points:

- CCI is a momentum oscillator used for Overbought / Oversold values

- CCI can be used in conjunction with a MVA to determine trading signals

- Scalpers can time entries when momentum returns with the trend

Timing entries is one of the most difficult parts of trading retracements in the trend. This is especially true for scalpers looking to take advantage of quick changes in price and momentum in the market. Normally an oscillator can be used to simplify this process and give traders a clear execution signal. Today we will review using the CCI (Commodity Channel Index) oscillator for scalping trends. Let’s get started!

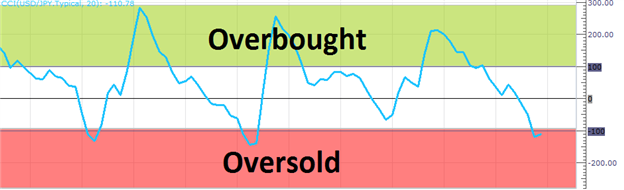

CCI and Overbought / Oversold Levels

If you are already familiar with RSI , Rate of Change, or other oscillators you are one step closer to trading with CCI. Like many oscillators, CCI uses a mathematical equation to depict overbought and oversold levels for traders. Pictured below is CCI, which uses a +100 reading to indicator overbought conditions, while a reading below -100 represents an oversold level.

Normally 70-80% of the values tend to fall between these points, which can be interpreted as buy or sell signals. As with other overbought/oversold indicators, this means that there is a large probability that the price will correct to more representative levels. Knowing this, trend traders will wait for the indicator to move outside of one of these points before reverting back in the direction of the primary trend. Let’s look at an example using the strong trend on the GBPCAD .

Learn Forex –CCI Overbought / Oversold

(Created using FXCM’s Marketscope 2.0 charts)

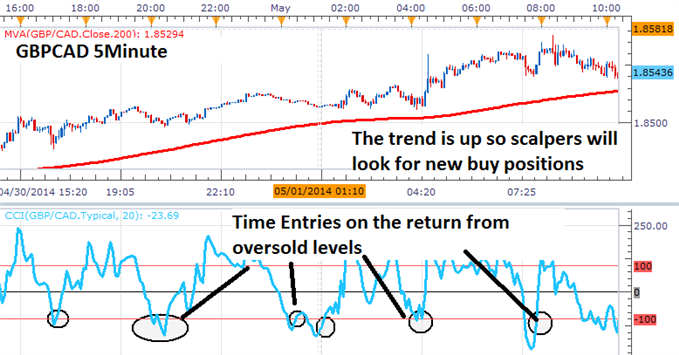

Timing a CCI Entry

Below we can see an example using a 5minute GBPCAD chart. The currency pair is in an established uptrend with price remaining above a 200 period moving average. Knowing this, trend traders should look to initiate new buy positions. The primary way of timing entries with CCI in an uptrend is to wait for the indicator to move below -100 (oversold), and enter into the trade when CCI moves back above -100. This creates an opportunity to buy the currency as momentum is returning back in the direction of the trend. In the event you are trading a downtrend, the process can be reversed. Trades to sell can be timed as momentum pulls the indicator back beneath an overbought value.

Learn Forex –GBPCAD Oversold Entries

(Created using FXCM’s Marketscope 2.0 charts)

Continue your Training

As you can see, CCI is a useful tool for timing market entries that can easily be worked into a scalping strategy! To learn more about CCI, as well as gain access to a complete scalping strategy sign up for the CCI training course linked below. Registration is free, and the course will include videos, checkpoint questions, and rules for the Lon-NY day scalping strategy. Get started using the link below!

(Valid name, email, phone number, and country are needed)

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information