Talking Points:

- Traders can look for high-probability setups by matching a strong currency with a weak one

- Strong/Weak analysis can be performed manually, or with the StrongWeak App from FXCM

- This article outlines how scalpers can use StrongWeak analysis

Since FXCM rolled out the StrongWeak app on the FXCM App Store, thousands of traders have downloaded and integrated Strong-Weak analysis into their trading.

We’ve seen rampant demand for education around this style of analysis, and as we explained in Trading the Strong and the Weak – this makes sense. Because in the FX market, every trade is performed in a pair; and each position is trading two economies.

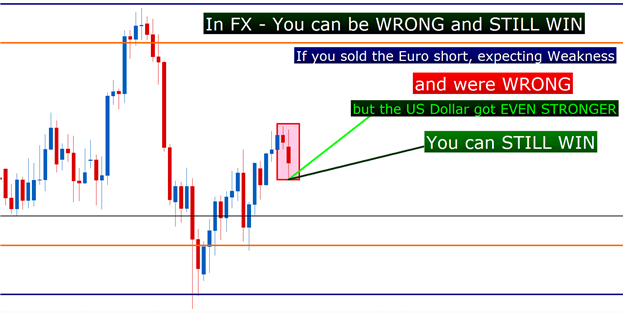

So, you can be wrong and STILL win.

The Value of a Two-Sided Pair: You can be wrong and still win in the trade

The flip-side of this, and perhaps more important to the new trader is that you can be right, and still lose. If you expect the Euro to weaken, and you sell the Euro against the US Dollar ; but we end up seeing more US Dollar weakness than Euro weakness: Well, you were right in expecting and getting Euro weakness – but you would still lose in the trade since the US Dollar got even weaker.

What is Strong-Weak Analysis?

Because every currency pair is a two-sided trade, traders are well advised to analyze both currencies in each of the pairings that they’re trading. Because, after all – if we can’t win when we are right, the prospect of profitability can seem distant.

Strong-Weak analysis analyzes each of the major currencies so that we can make an apples-to-apples comparison to find which currencies have been strongest, and which have been weakest over a relevant period of time.

We can do this manually simply by observing the chart and doing a little math. We outlined the manual process for performing Strong-Weak analysis in the article, How to Separate the Strong from the Weak .

An easier way to perform this analysis is with the StrongWeak App from the FXCM App Store. We walked through the app in this video, available on Youtube.

The StrongWeak App from the FXCM App Store ( Currently Free with this promotion )

Currency Strength/Weakness shown for 8 major currencies over 4 time frames

How to Scalp with Strong-Weak Analysis

One of the best parts of this analysis is that it will show us what may be the most opportune markets to look for fast movements.

Traders can look to the strongest currency in the analysis to go long, and the weakest currency in the analysis to go short.

So, using the above example, scalpers can refer to the one-hour time frame to find the largest deviation. As you can see in the box for ‘H1,’ EUR is the strongest currency analyzed, and NZD is the weakest.

Traders can then investigate long EUR/NZD positions.

At this point, traders need to decide how they want to trigger the position; and there are two ways to do this.

Traders can look to trade breakouts in the direction of the trend. In this case, they can investigate top-side breakouts in EURNZD.

Alternatively, traders can look to trade the EURNZD move by waiting for prices to pull back so that they can buy the up-trend cheaply. In this case, an indicator such as RSI or a moving average can be used on a lower time frame like the 5 or 15 minute chart; and traders can wait for a bullish trigger to enter the long position.

After locating trends via Strong-Weak Analysis, scalpers can look to indicators to trigger entries

So, if looking to buy EURNZD, traders can simply wait on the 5m chart for prices to pull back below the moving average of their preference, and when prices crosses back over that moving average in the direction of the trend, they can look to trigger the position in anticipation of the trend continuing.

James is available on Twitter @JStanleyFX

To join James Stanley’s distribution list, please click here .

Are you looking for Forex Education ? University is HERE!

Would you like to get better with Price Action? Please feel free to take our 15 minute course on the topic. You’ll first be asked to sign the guestbook, which is completely free; and then you’ll be met with the video-based lesson via Brainshark:

Price Action Presentation via Brainshark

We’ve recently begun to record a series of Forex Videos on a variety of topics. We’d greatly appreciate any feedback or input you might be able to offer on these Forex Videos: