Silver continues to form lower lows from its April 2011 high of $49.78 ozt. During this descent, Silver has moved as much as 40 % lower throughout the year to $26.05. A price channel has emerged with a fresh test of resistance at $37.48 on February 29th. We can see price being contained by support and resistance as it continues its trajectory lower. As price trades under the main trend line we will keep a bearish trend bias on silver and look for selling opportunities.

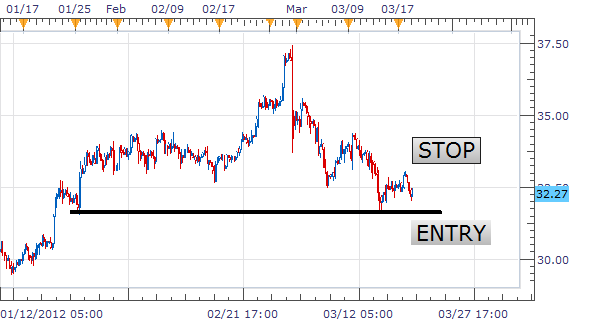

Moving into today’s 4Hr chart, we can begin to see price move back to short term support created on January 25th at $31.54. Trading breakouts can allow us to enter into the market with the creation of new lows back to longer term support. Once entered into the trade, stop orders can be left above the previous high. Using breakouts to enter trends can keep us out of unwanted trades as well. If price begins bouncing off support over $33.07 we can simply delete our sell entry.

My preference is to create an entry to sell silver under support. Orders should be placed under $31.40. Stops should be set above $33.06. Primary limits should look for a minimum of $1.65 profit at $29.75 for a 1:2 Risk/Reward ratio. Secondary targets can look for the channel low near $22.15.

Alternative scenarios include price breaking over short term resistance testing new highs.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.