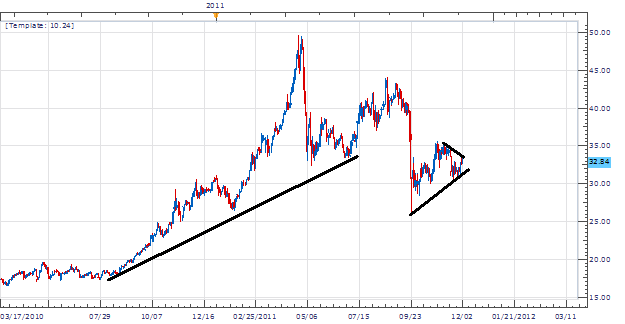

Silver (XAU/ USD ) has been a difficult metal to read during the 2011 trading year. First, the metal surged up to $49.78 an ounce on May 25th. After testing and failing to break the standing all time high of $50 an oz, silver reversed 52% printing a new low at $26.05 on September 26th. Currently price has been seen consolidating in a wedge formation, as price has yet to form a new high or low over the last three months.

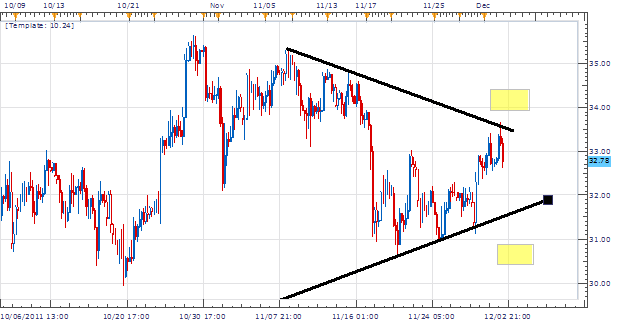

Taking Price in to a 4Hour chart we can see silver holding in a consolidation pattern. Support is created by joining the November 8th, 15th and December 2nd highs. Support is found likewise by connection he November 21st, 25th and 30th lows. One plan of action is to place entry orders outside of support and resistance levels, in preparation of a breakout. Taking this action will effectively bracket the market, so traders are prepared to enter in either direction regardless of direction.

My preference is to place entry orders to sell bracket XAU/USD. Entrys over support should reside near $34, while orders to sell sit under $31. Stops should be centered between support and resistance at $32.50. Limits should look for a minimum of $3.00 profit per oz for a clear 1:2 Risk/ Reward scenario.

Alternative scenarios include price continuing its consolidation pattern.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.