XAU/ USD ( Gold ) has continued to hold the attention of trend traders since posting an all time high of $1,920 an OZT on September 6th of this year. As of November 8th, gold posted a lower high at $1,802. If price stalls under this lower high, it could potentially mean a halt in our longer term uptrend. Traders will look for either fresh highs to be created in relation to the longer term trend, or a move back to support near $1600.

Fundamentally, gold continues to be seen as a store of wealth during economic turmoil. As many investors lose faith in paper assets, gold traditionally will surge in price as people look to hold tangible assets. Currently, we are seeing mixed signals in regards to whether the European debt crisis is getting worse or improving. Based on this knowledge we will keep an eye on the economic calendar for more information on our fundamental outlook.

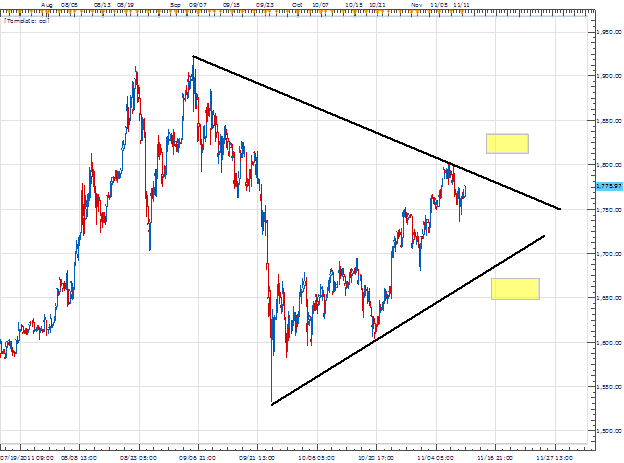

Taking Price in to a 4Hour chart we can see a symmetrical triangle begin to form on Gold. Resistance has been established near $1800 by matching the September and November 2011 highs. Support is found near $1678, and is created by connecting the September 26th and October 20th lows. With a triangle pattern being spotted, we can place entry orders to wait for a break of either of the above levels.

My preference is to place entry orders in anticipation of a breakout on gold. Entry orders should be placed near $1820 to buy and $1680 to sell. Stops should look to risk no more than $100 an OZT. Limits should look for a minimum of $200 profit per oz traded for a clear 1:2 Risk/ Reward scenario.

Alternative scenarios include price trading within the triangle pattern prior to a break.

Additional Resources

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.