The AUD/JPY has steadily been progressing to lower lows from its April 2011 high at 90.02. From this point the pair has moved down as much as 19% lower to its October 4th low of 72.69. Currently the pair has surged higher six out of the last eight days to test resistance near 79.25. As prices approach this point trend traders can look to enter in with the broader daily move.

Fundamentally, the Aussie still is the currency of choice when the global economic outlook improves. As a “ Risk on ” currency, the Aussie Dollar is a preferred investment with traders looking to take advantage of its associated 4.75% Central Banking Rate. Likewise, it is the first to tumble as the economic climate turns worse and traders move to safe haven currencies such as the Yen . For the latest on economic news turn to our Calendar linked here.

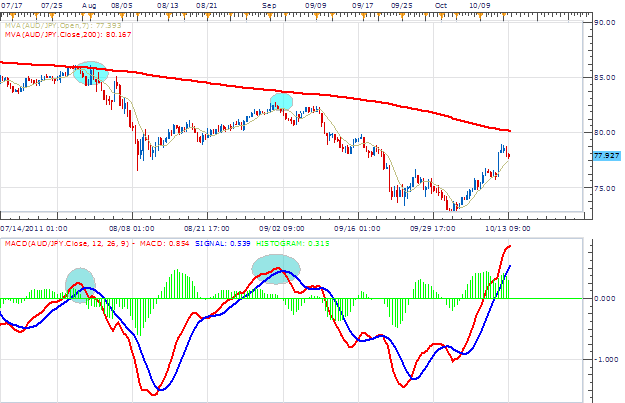

Taking Price in to an 8Hour chart we can see resistance above 80.16 on the AUD /JPY by utilizing a 200 MVA . Price has continued to trade under this line of resistance dating back to July of 2011. Moving into its fourth month of a downtrend, we will begin looking to trade the AUD/JPY short with the trend by utilizing the MACD indicator. Potential signals for entry will include the MACD and Signal line crossing above the zero line.

My preference is to sell the AUD/JPY on a crossover of the MACD & Signal line. Orders should be placed to sell the AUD/JPY as near resistance as possible at 80.00. Stops should be placed over resistance near 82.00. Limits should be placed at 76.00 for a clear 1:2 risk reward ratio. A second long term target may be placed at 70.175 on a breakout to new lows.

Alternative scenarios include price breaking through resistance and price challenging Sept 2011 highs.

Additional Resources

To contact Walker , please email [email protected] . You can follow on Walker onTwitter @WEnglandFX . To be added to Walkers’ distribution list, please send an email with the subject line “Notification,” to WEngland@fxcm .