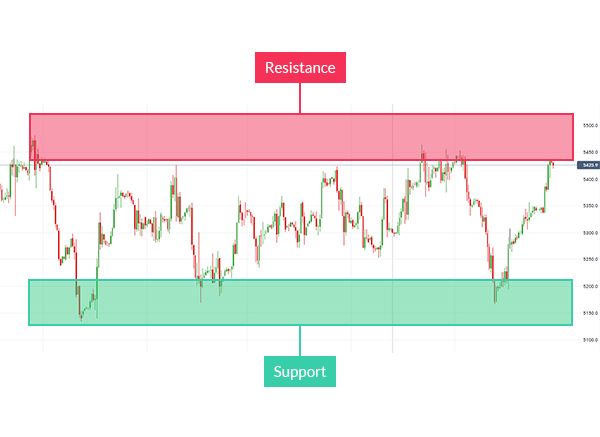

In between times of market volatility, traders may find extended periods where markets are trading sideways. These periods are defined as a ranging market, and develop graphically when prices trade between established levels of support and resistance. Below we can see an example of anongoing range for US Crude Oil . Our pertinent price points include resistance at current highs near $54.50 and support at a price level near $51.50. With these areas defined we can then proceed with a trading plan to trade these pricing levels. For this we will once again turn to the RSI oscillator.

(Created with IG Charts)

Yesterday we discussed using RSI in trending conditions . But the truth is, that RSI can be used just as well in a range. In a ranging market we want to time our entries when support / resistance points line up with RSI and overbought / oversold conditions. Timing is key, and we can see on the graph below that the previous trading signal allowed us to sell resistance as RSI moved from overbought levels. As price declines traders can look for a fresh signal to buy the US Crude Oil at support if RSI becomes oversold.

The great thing about ranging markets is that you do not have to have a specific market or trend bias. Traders have the ability to trade the range until price breaks out from support and resistance levels. Due to the possibility of a breakout , range traders can use half the distance of the current range to ass potential stop levels. In this example traders may elect to keep a minimum stop of $1.50 from their point of entry.

(Created with IG Charts)

By using a stop that equals half the distance of the range, traders may then extrapolate a 1:2 or better Risk/Reward ratio for their trade. This step is important, because in the event of a market breakout traders should elect to close out any existing range based positioning.

Next: Trading Tokyo Ranges with Price Action (32 of 50)

Previous: Trading Commodity Correlations

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.