Talking Points:

- USD/CAD Turns Ahead of Employment Data

- Expectations for today’s Canadian unemployment rate (Jan) is set at 6.9%.

- Looking for additional trade ideas for US Dollar markets? Read Our 2017 Market Forecast

The USD / CAD is turning off of its weekly highs this morning ahead of important Canadian employment data. Expectations for today’s Canadian unemployment rate (Jan) is set at 6.9%. While net changes in Canadian employment for (Jan) are expected in at -5.0k. Both of these releases are scheduled for 1:30 GMT, and marked as high importance events on the economic calendar.

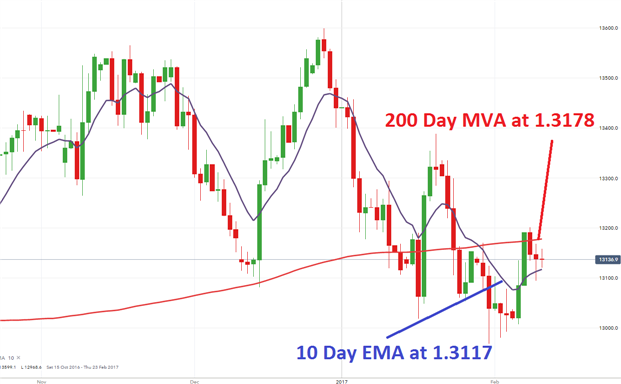

Technically, the USD/CAD is trading directly below a critical point of daily resistance. As seen below the pair has tested and failed to breakout above its 200 day MVA (Simple Moving Average), which is found at 1.3178. If the pair remains below this average, the current USD/CAD may be labeled as trending lower in the long term. However if prices rebound on this morning’s unemployment data, the USD/CAD’s daily trend could once again be pointed higher.

USD/CAD Daily Chart & Averages

(Created Using IG Charts)

At this point in the trading day, the USD/CAD remains relatively flat for Friday’s trading session. Currently the pair is residing right above today’s central pivot found at 1.3133. If prices remain above this point, traders may look for intraday values of resistance near 1.3172 and 1.3210. It should be noted that 1.3210 is denoted graphically as today’s R2 pivot. If the USD/CAD trades to this point the pair would once again be trading above the previously identified 200 day MVA.

Alternatively in the event that prices fall after today’s news, intraday support may be found at the displayed S1 and S2 pivots. These lines are found at 1.3098 and 1.3024. While the USD/CAD would not be reaching new weekly lows at either of these points, the pair would be trading back below the daily 10 day EMA (Exponential Moving Average) depicted above. This shift in price typically suggests a resumption of a short term downtrend.

USD/CAD 30 Minute Chart with Pivots

(Created Using IG Charts)

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.