Talking Points:

- AUD/USD Prepares for a Daily Breakout

- AUD / USD Sentiment Totals are Negative; SSI at -1.35

- Looking for additional trade ideas for trading US Dollar currency pairs? Read Our Market Forecast

The AUD/USD is trading up modestly higher for Wednesday, after dropping as much as 76 in yesterday’s session. Technically, the pair is now consolidating inside of yesterday’s price action, which suggests that the market is preparing to breakout. Using yesterday’s high as a reference, bullish breakouts may be signaled above the high at .7681. Alternatively, bearish breakouts may be considered under Tuesday’s low at .7605.

Traders should note that a bullish breakout would have the AUD/USD trading back in the direction of its primary 2017 trend. In this scenario, traders will next look for the pair to challenge the existing 2017 high found at .7698. A bearish breakout below .7605 should be seen as a counter trend breakout. In this scenario, traders may begin looking for the pair to next challenge the January 11th swing low at .7511.

AUD/USD Daily Consolidation

(Created Using IG Charts)

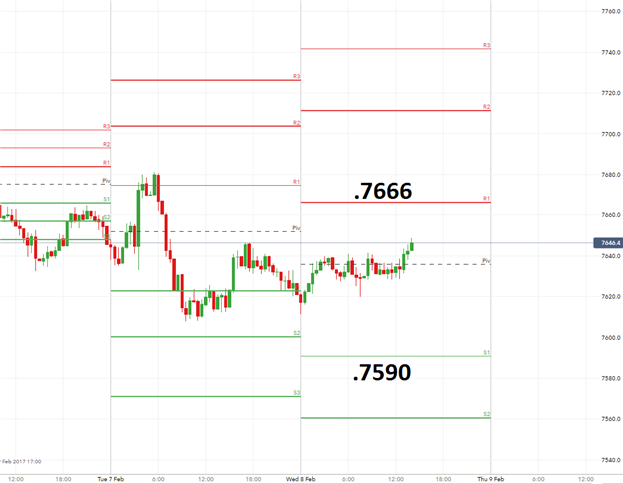

Intraday market analysis has the AUD/USD is trading above today’s central pivot at .7635. If this short term bullish rally continues, the next values of resistance may be found at the R1 (.7666) and R2 (.7711) pivot displayed below. Traders should note that if prices reach .7711, the AUD/USD would then be trading above the previously mentioned high at .7681.

If prices remain below resistance, traders may see the AUD/USD trade back towards key values of support. Today that includes the S1 pivot at .7590 and the S2 pivot at .7560. Both of these points are below yesterday’s low, and a move here would suggest further bearish momentum for the AUD/USD.

AUD/USD 30 Minute Chart with Pivots

(Created Using IG Charts)

Current sentiment totals have AUD/USD SSI at -1.35 . With 58% of positioning short the AUD/USD this signal has a moderately bullish bias. In the event that the AUD/USD breaks higher, and continues its ongoing uptrend, traders should look for SSI totals to move to -2.0 or more. In the event of a bearish reversal, it is likely that sentiment totals will reverse and move back towards more neutral values.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.