Talking Points:

- EUR/USD Retraces From Weekly Lows

- Bearish Breakouts Begin Beneath 1.0316

- Looking for additional trade ideas for the Euro and US Dollar ? Read Our Market Forecast Here

EUR/ USD 1 Hour Chart & Pivots

(Created Using TradingView Charts)

After a series of large daily breakouts, the EUR/USD is starting Friday’s trading range inside of a 98 pip range. Price are now trading off of intraday resistance found at 1.0462 tobegin the US session trading. If the EUR/USD remains below resistancethe pair may continue to declinefrom this point towards values of daily support. The first point of intraday support is found at the S3 pivot at a price of 1.0364 completing today’s range. Reversal traders, looking to take advantage of the range, will look for price to bounce in this area.

In the event that price begins to gain momentum, traders may elect to begin looking for breakout opportunities A price break above 1.0508 at the R4 pivot would signal a bullish reversal, as the EUR/USD would be attempting to trade towards a short term high . Likewise a reversal in price, under the S4 support pivot at 1.0316 would signal a resumption in momentum back in the direction of the pair’s daily trend. It should be noted that if the EUR/USD does breakout lower, it would represent the third consecutive bearish breakout for this week’s trading.

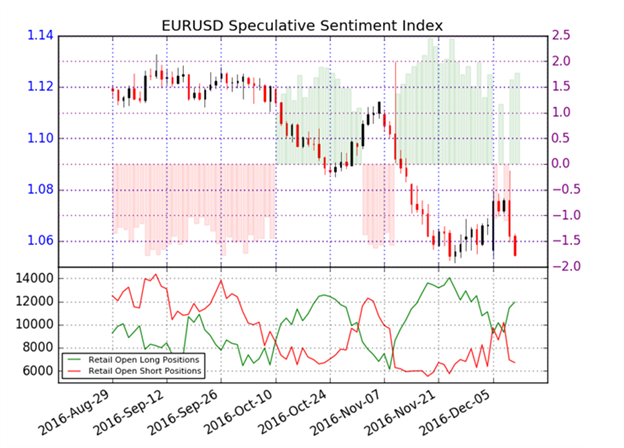

Traders tracking sentiment should also note that SSI ( Speculative Sentiment Index ) totals for the EUR/USD currently stand at +1.33. With 57% of positioning long, this typically suggests that the EUR/USD may be prepared to decline further. If prices do trade lower, it would be reasonably expected to see SSI totals move to a positive extreme of +2.00 or greater. Alternatively, if prices rebound traders should expect SSI figures to rebound back towards more neutral readings.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.