Talking Points:

- Gold Prices Trend Lower Ahead of FOMC

- US Dollar Bullish Breakouts Begin Above 102.05

- What’s next for commodities market? Read Our Oil and Gold Market Forecast HERE

Gold prices have found short term support and are rebounding off of monthly lows at $1,151.07.This rebound has come ahead of this week’s FOMC rate decision which is expected to directly influence the price of Gold and the US Dollar.

Going into Wednesday’s event, technically Gold prices remain in a short term downtrend, as prices remain beneath the displayed 10 period EMA (exponential moving average) at $1,173.54. In the event that the US Dollar strengthens, traders may look for Gold to continue in the direction of the trend. However, if the US Dollar weakens, traders may look for Gold to move back towards its 200 day SMA (simple moving average) near $1,276.31.

Gold Price Daily Chart and Trend

(Created Using TradingView Charts)

What’s next for the US Dollar? Read Our Dollar Market Forecast HERE

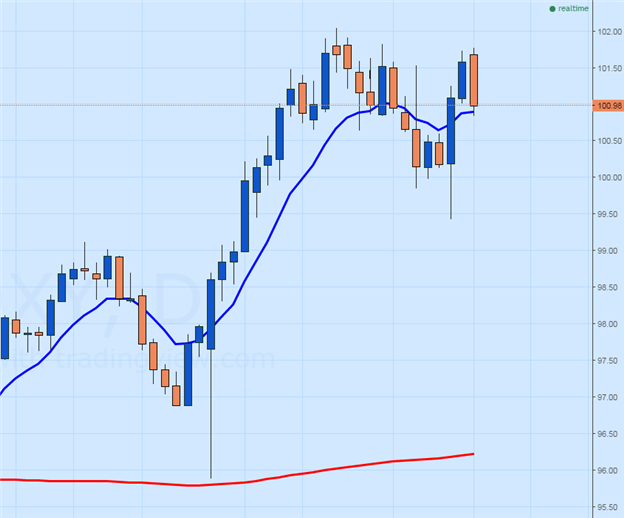

Technically, the US Dollar Index (Symbol DXY) is trading lower for the session, after initially attempting to breakout higher. In the short term it should be noted that the US Dollar remains supported above today’s 10 period EMA at 100.88. If the US Dollar remains above this value, it may suggest that the Index may attempt to breakout to new yearly highs above 102.05. However, if the US Dollar is rejected later in the week, the Index may retrace its previous yearly gains and trade back towards its 200 day SMA at 96.22.

US Dollar Daily Chart and Trend

(Created Using TradingView Charts)

Looking for additional trade ideas for Gold and commodities markets? Read Our Gold Market Forecast

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.