Talking Points:

- EUR/GBP Retraces to Resistance After 150 Pip Decline

- Intraday Support is Found at .8465

- EUR / GBP Bullish Reversals may be Considered Over .8590

The EUR/GBP is currently trading off of monthly lows, and has already declined as much as 561 pips for the month of November. This downtrend has recently developed, as the British Pound continues to recover against most major currencies. As the pair pauses for the session, technical traders should consider to monitor key values of daily support to determine if this developing downtrend is set to continue. Important values to monitor include the psychological .8500 level and the September swing low of 8333.

EUR/GBP Daily Chart with Pivots

(Created Using TradingView Charts)

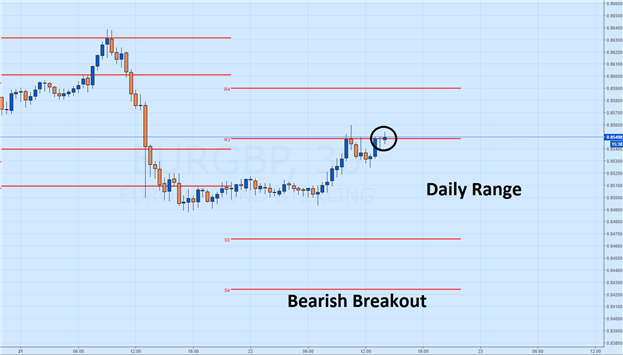

In the short term, the EUR/GBP is trading back near intraday resistance after declining as much as 150 pips in yesterday's trading. Resistance is displayed below at today’s R3 Camarilla pivot, which is found at a price of .8549. The EUR/GBP is trading above this point now, but if the pair returns back inside of the displayed pivot range it may suggest that trading may push price back to support. Values of support include pivot support at .8465 and the final support pivot (S4) at .8423.

If prices decline below .8423, this would denote a resumption of the EUR/GBP’s prevailing downtrend. Traders may extrapolate targets for a bearish breakout by using a 1X extension of today’s 74 pip range. This places initial targets near .8349. It should be noted that in the event of a bullish reversal, traders may look for the EUR/GBP to approach the R4 point of resistance at .8590. In this alternative scenario, traders may select to set intial bullish breakout targets near .8664.

EUR/GBP 30M Chart with Pivots

(Created Using TradingView Charts)

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.