Talking Points

- Gold Prices Remain Bearish; Decline For 6th Session

- Intraday Support for Gold Found Near $1,308.91

- Looking for additional trade ideas for Gold? Check out our Gold Trading Guide

Gold prices are pushing towards support this morning, and have declined now for six consecutive trading sessions. Despite having little on the economic calendar today, the US Dollar remains strong ahead of this Friday’s NFP (Non-fam Payrolls) release. Expectations are set for the event at +170k, and any deviation from this figure may increase the short-term volatility in the Gold market.

Gold Prices 30 min Chart & Pivot

(Created using TradingView Charts)

Technically, Gold prices have reached intraday support near $1,307.51. If prices remain above this value, it may suggest that intraday bearish momentum has at least temporarily subsided. In this scenario, traders may look for the intraday price action of Gold to bounce back towards resistance. Resistance for the session is marked in the graph above at the R3 pivot at a price of $1,323.48. In the event of further price declines, traders may look for bearish breakouts below today’s S4 pivot at $1,299.65. A move through this value should be seen as significant, as it would place Gold prices at new monthly lows.

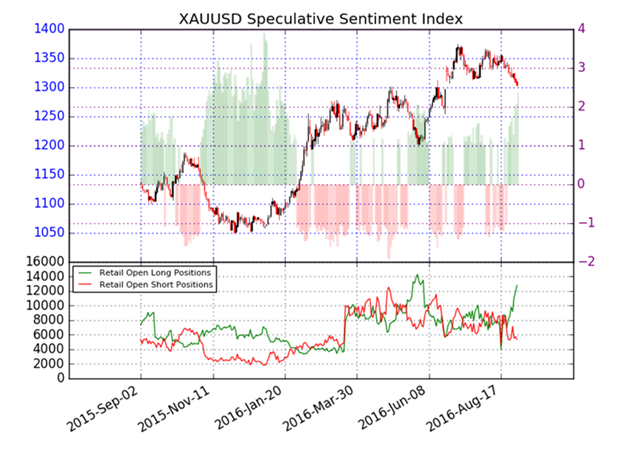

Sentiment for Gold is currently reading at +2.52. With 72% of positioning long, this typically suggests that Gold price may continue to decline. In the event of a bullish market reversal , traders may look for sentiment values to neutralize. Alternatively, if Gold prices breakout lower, traders may expected sentiment totals to remain at positive extremes.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.