Talking Points

- Gold Prices Consolidate With an Inside Bar

- Traders May Plan for a Breakout During Tomorrows FOMC Event

- If you are looking for trading ideas for Gold and other commodities, check out our Trading Guides .

Gold prices (CFD: XAU/ USD ), are consolidating after failing to breakout above yesterday’s high of $1,318.31. With price action failing to move on new highs, this technically suggests that Gold prices may close the session by forming an inside bar. It should be noted that, Monday’s low is found at 1,309.36. Knowing this, traders should continue to monitor these values as support or resistance going in to tomorrows FOMC rate decision .

With the price of Gold consolidating, traders may plan to trade either one of two scenarios. First, traders may elect to trade further consolidation in Gold prices. This strategy may be considered valid until price action breaks out either above $1,318.31 or below $1,309.36. With the second opportunity, Gold traders may look for a breakout around tomorrows FOMC event. Expectations are set to leave rates unchanged at 0.25%, however any deviation in this expectation may cause Gold and other commodity markets to react violently. In this scenario, traders may elect to extrapolate a 1X extension of the $8.95 range to find preliminary breakout targets. This places primary bullish breakout targets near $1,327.36, and bearish targets near $1300.41.

Gold, Daily Chart & Inside Bar

(Created by Walker England)

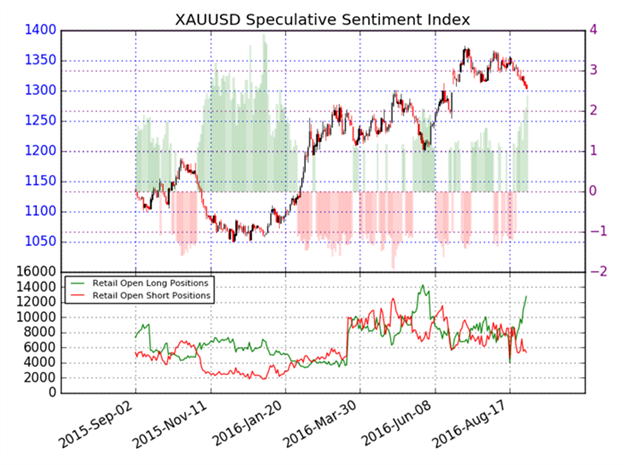

The ratio of long to short positions for Gold (CFD: XAU/USD) stands at +2.11. This SSI (speculative sentiment index) reading shows that 68% of positioning is currently long Gold. Typically when SSI reads at a positive extreme, this suggests that Gold prices may begin to decline. In the event of a bearish breakout, traders should look for SSI to remain at negative extremes. Alternatively if prices breakout higher, SSI may move back towards more neutral values.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.