Talking Points

- GBP/USD Trades to Daily Lows on BOE Rate Decision

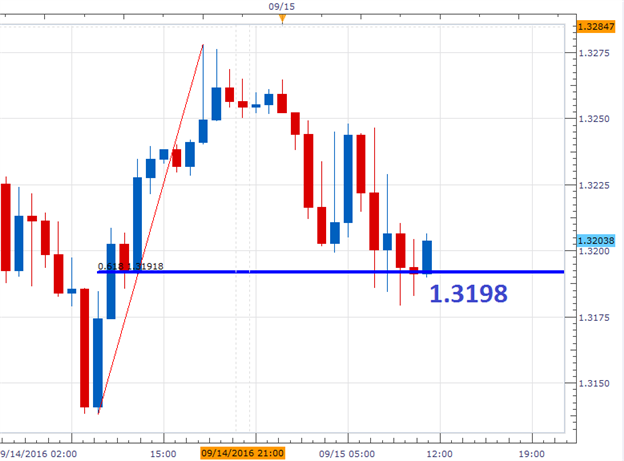

- Current GBP / USD Support is Found Near 1.3198

- What’s next for the GBP/USD and US Dollar Pairs? Learn more with our Trading Guide

The GBP/USD is trading near daily lows after the BOE (Bank of England) kept key interest rates flat at 0.25%. While it was expected that rates would be kept flat, the Pound is still losing ground to the majors as traders are speculating that rates may be cut in the future. Technically the GBP/USD is currently finding support at a short-term retracement value near 1.3193. This area is represented in the graph below as a 61.8% retracement from yesterday’s low of 1.3138 to the high of 1.3278. Now traders will wait to see if prices recover here, or if the Cable is set to decline further in the short term.

GBP/USD, 30 Minute Chart with Breakout

(Created using Marketscope 2.0 Charts)

In the 10-minute graph below, the GBP/USD can be seen bouncing from this morning’s low of 1.3179. The Grid Sight Index (GSI) has interpreted this move as a developing short-term uptrend by identifying a series of higher highs in the last 2 hours of trading. After reviewing 43,384,969 pricing points, GSI has indicated that price action has continued to advance by 20 pips or more in 66% of the reported 41 historical matching events. This places the first current historical price distribution point at 1.3224. A move through this point would indicate that the GBP/USD is at least temporarily supported, allowing traders to target new values of resistance.

Alternatively, GSI has indicated that prices have declined by 42 pips or more in 15% of the 41 historical matches. Today’s first bearish historical distribution for the Cable is found at 1.3162. A move through this would place the GBP/USD at new daily lows, and invalidate the previously mentioned point of support. In this scenario, traders may look for the pair to continue its decline towards weekly lows at 1.31.38.

Want to learn more about GSI? Get started learning about the Index HERE.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.