Talking Points

- EUR/USD Trends Lower on US Consumer Confidence Data

- Bullish EUR / USD Reversals May Begin Above Resistance Near 1.1170

- What’s next for the EUR/USD and US Dollar Pairs? Learn more with our Trading Guide

The EUR/USD is trading to new weekly lows this morning, after US Consumer Confidence figures were released better than expected. Expectations were set for today’s event at 97; however, they were significantly beat with a reported reading of 101.1. This has caused the EUR/USD to sell off in a defined descending price channel, which is depicted below. This channel is marked by resistance, which currently stands under the most recent EUR/USD swing high at 1.1176. Short-term support may be found at the daily low, which currently stands at 1.1134. Traders looking for short-term trading opportunities should continue to reference these values to determine if the denoted technical price channel remains valid.

EUR/USD, 30 Minute Chart & Channel

Chart prepared by Walker England

In the 5minute graph below, the EUR/USD can be seen trading just off the current daily low at 1.1134. The Grid Sight Index (GSI) is currently viewing this move as a short-term downtrend, with the EUR/USD putting in a series of lower lows in the last four hours of trading. After reviewing 22,313,237 pricing points, GSI has indicated that price action has declined by 15 pips or more in 39% of the 18 matching historical events. It should be moated that a decline through today’s first bearish historical distribution at 1.1128 would be significant. This would place the EUR/USD at daily lows and near the bottom support line of the previously mentioned price channel.

Alternatively, GSI has indicated that prices have advanced by 31 pips or more in just 22% of the 18 historical matches. Today’s first bullish historical distribution is found at 1.1174. A move through this value would open the EUR/USD to trade back towards channel resistance near 1.1170. In this scenario, traders may reevaluate the market to determine if a broader reversal is in play, or if channel resistance will hold through the conclusion of today’s trading.

Want to learn more about GSI? Get started learning about the Index HERE.

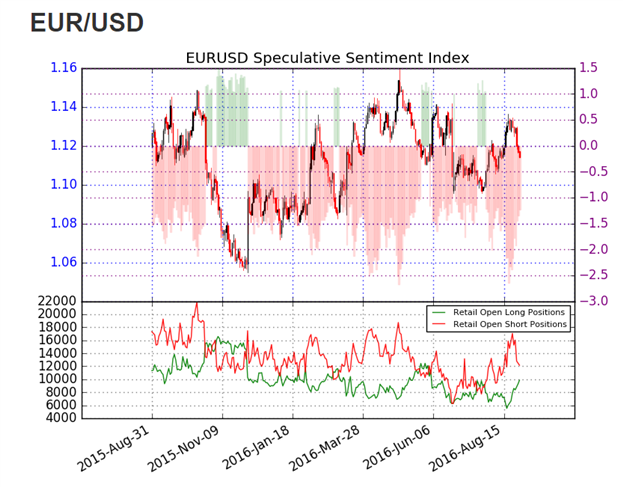

Sentiment for the EUR/USD has continued to neutralize as prices have declined. SSI ( speculative sentiment index ) for the pair is currently reading at -1.26, compared to yesterday’s reading of -1.26. Even though SSI has declined from its weekly peak, this value is still at a positive extreme. Typically, a positive extreme suggests that there may be further declines in price. If the price of the EUR/USD falls further, it would be expected to see SSI flip to a positive value. Alternatively, if the pair reverses higher, and breaks from its descending price channel, SSI would be expected to remain negative for the time being.

Are traders long or short the market Find out here !

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.