Talking Points

- EUR/USD Consolidates Ahead of Jackson Hole Policy Symposium

- Daily EUR / USD Support is Found at 1.1244

- What’s next for the EUR/USD and US Dollar Pairs? Learn more with our Trading Guide

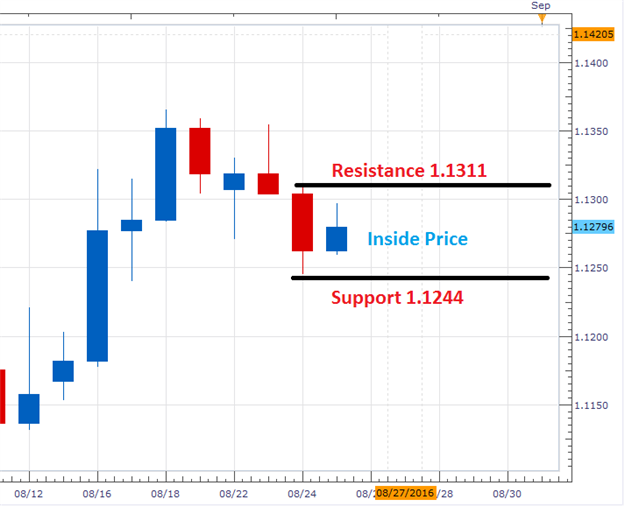

The EUR/USD is currently consolidating after declining as much as 66 pips in yesterday’s trading. Today’s consolidation is found in the form of an inside bar, which is found by using Wednesday’s daily candle as a reference. This places resistance at the daily high of 1.1310, and support at the low of 1.1244. Traders may continue to monitor these values, planning on a EUR/USD breakout, going into tomorrow’s Jackson Hole Policy Symposium.

EUR/USD, Daily Chart & Inside Bar

Chart prepared by Walker England

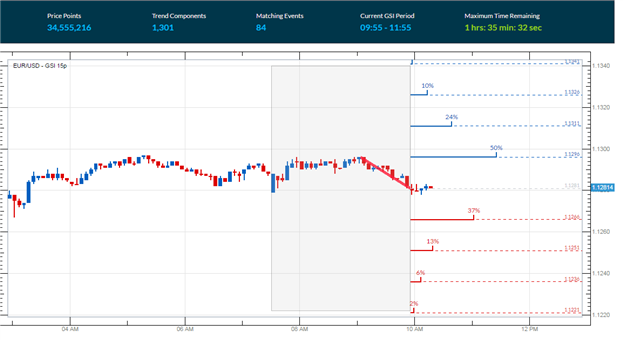

In the 5 minute graph below, the EUR/USD can be seen trading just above the current daily low at 1.1277. The Grid Sight Index (GSI) is currently highlighting a short term downtrend, with the pair creating a series of lower lows in the last hour of trading. After reviewing 34,555,216 pricing points, GSI has indicated that price action has advanced 15 pips or more in 50% of the 84 matching historical events. This places the first historical bullish price distribution point at 1.1296. A move through this point would, suggest a change in the current short term momentum for the pair. As well, a move to 1.1296 would open the EUR/USD up to testing the previously mentioned value of daily resistance at 1.1311.

Alternatively, GSI has indicated that prices have declined by 15 pips or more in just 37% of the 84historical matches. This places the current first bearish distribution at a price of 1.1266. A move through this value would not invalidate the current daily inside bar pattern. However, this would push the EUR/USD closer to daily support at 1.1244.

Want to learn more about GSI? Get started learning about the Index HERE.

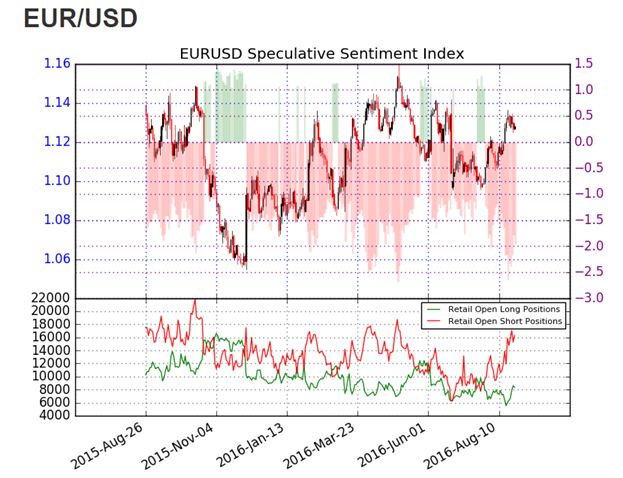

Sentiment for the EUR/USD continues to move closer to negative extremes, with SSI ( speculative sentiment index ) reading at -1.95. Typically with 66% of positioning short, this suggests that the EUR/USD may continue to trade higher. If the EUR/USD does breakout higher, SSI should shift to a negative extreme of -2.0 or more. Alternatively if the EUR/USD begins to breakout lower, it would be expected to see sentiment figures shift to a more neutral reading.

Are traders long or short the market Find out here !

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.