Talking Points

- EUR/USD Tests Trendline Resistance Near 1.1307

- Daily Support for the EUR /SUD is Found at 1.1270

- What’s next for the EUR/ USD and US Dollar Pairs? Learn more with our Trading Guide

The EUR/USD has rebounded this morning, after initially gapping lower to open this week’s trading. Now the pair is testing critical trendline resistance near 1.3007. This point of resistance has been identified by connecting a series of lower swing highs, which begins with the August 18th high at 1.1366. If the EUR/USD breaks above resistance, it opens up the possibility that the pair will trade to new monthly highs above this value. However if prices are rejected here, traders may look for the EUR/USD to return toward session lows at 1.1270.

EUR/USD, 4Hour Chart & Trendline

Chart prepared by Walker England

In the 10 minute graph below, the EUR/USD can be seen bouncing from this morning’s low. The Grid Sight Index (GSI) is currently highlighting a short term uptrend, with the EUR/USD putting in place a series of higher highs. After reviewing 31,097,753 pricing points, GSI has indicated that price action has advanced 20 pips or more in 42% of the 67 matching historical events. This places today’s first bullish price distribution at 1.1316. A move through this value would be significant, as the EUR/USD would then be trading through the previously mentioned value of trendline resistance.

Alternatively, GSI has indicated that prices have declined by 41 pips or more in just 21% of the identified historical matches. Today’s first bearish distribution is found at 1.1255. A move through this value would place the EUR/USD at new session lows. This would suggest that a longer tern retracement may be in play, despite the pairs longer tern uptrend. In this bearish scenario, traders should continue to watch the final bearish distribution at 1.1195. Prices declined 101 pips in only 1% of historical matches, and a move to this point would help validate a bearish turn in the market.

Want to learn more about GSI? Get started learning about the Index HERE.

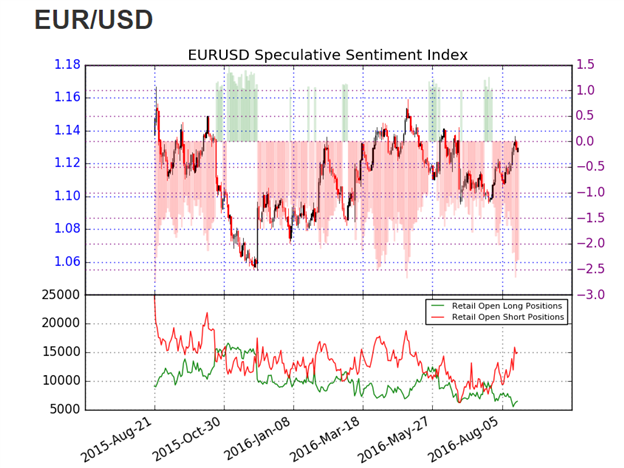

Sentiment for the EUR/USD remains extreme, with SSI ( speculative sentiment index ) reading at -2.30. With 70% of positioning short, this value suggests that the EUR/SUD may continue to trade higher. If the EUR/USD trades higher after breaking resistance, it would be expected to see SSI remain at positive extremes. Alternatively in the event of a bearish reversal, it would be expected to see SSI move off of positive extreme back towards more neutral values.

Are traders long or short the market Find out here !

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.