Talking Points

- GBP/USD Breaks Lower as BOE Cuts Key Rates by 25 Basis Points

- GBP / USD Retracements May Begin Over 1.3148

- What’s next for the GBP/USD and US Dollar Pairs? Learn more with our Trading Guide

The British Pound has declined significantly this morning as the Bank of England has elected to cut key interest rates to 0.25% Bank of England Governor Carney has also not discounted further easing measures, and stated “We took these steps because the economic outlook changed markedly’.” This news coupled with a series of dovish statements has caused the GBP/USD to slide below the key 1.3200 support value. Prices are now trading at the lows of the day, leaving traders to consider if this downtrend may continue.

GBP/USD, 15 Minute Chart & breakout

(Created by Walker England)

In the 5-minute graph below, the GBP/USD can be seen trading off of the lows of the day at 1.310. Despite this small bounce in price, the Grid Sight Index (GSI) has highlighted a new short-term downtrend with a series of lower lows printed in the last hour. After reviewing 99,866,403 pricing points, GSI has indicated that price action has continued to decline by 12 pips or more in 55% of the 295 matching historical events. This places today’s first bearish distribution at a price of 1.3111.

Alternatively, GSI has indicated a 25-pip advance in just 8% of the 295 historical matches. Traders looking for a reversal of today’s breakout should watch for the GBP/USD to trade through 1.3148. A move through this value would show a significant change in the markets current downward momentum.

Want to learn more about GSI? Get started learning about the Index HERE.

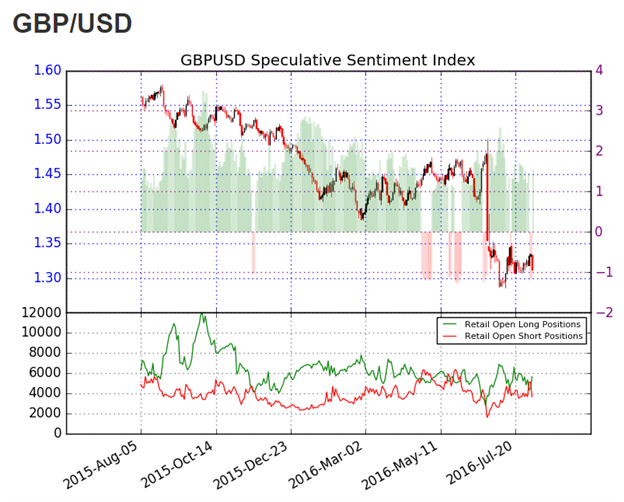

Sentiment for the GBP/USD stands short of extremes even after this morning’s decline. SSI ( speculative sentiment index ) is currently reading at +1.48. With 60 percent of positioning long, this may suggest that the GBP/USD may continue to trade lower. In the event that the GBP/USD breaks lower tomorrow, traders should look for SSI to read at a positive extreme of +2.00 or more. Alternatively, if a bullish reversal occurs, traders should look for SSI to move back from extremes towards a more neutral value.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Contact and Follow Walker on Twitter @WEnglandFX.