Talking Points

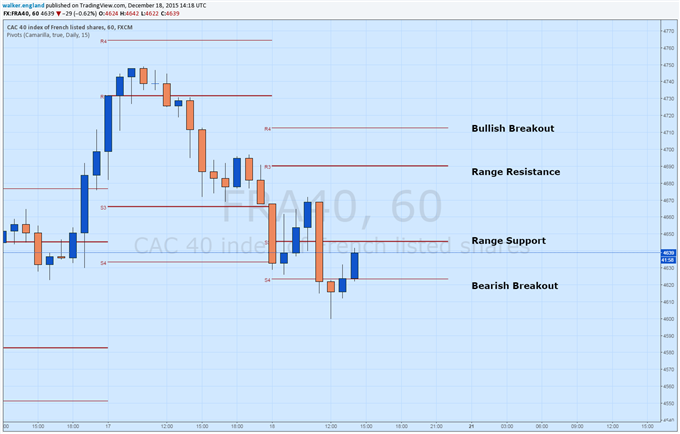

- The CAC40 attempts to breakout under 4,623

- Today’s Daily Pivot Range Measures 45 Points

- A Move Over 4,645 May Signal a Bullish Reversal

CAC40 30minute Chart

(Created using TradingView Charts)

The CAC40 is attempting to breakout lower this morning, and is currently trading down -.96% on the day. Price is currently testing support which is found at the S4 Camarilla pivot at a price of 4,623. If prices continue to break lower, it would be significant as it would be the first bearish breakout for the CAC40 this week. Traders looking for bearish targets may extrapolate today’s 45-point range from the previously mentioned value of support. This places initial targets for a bearish decline near 4,578.

If prices begin to reverse off of today’s current low at 4,599, traders may look for prices to trade towards the S3 pivot point depicted above at 4,645. A move to this point on the chart would invalidate the current move downward, as well as potentially signal a return toward the CAC40’s uptrend. First bullish targets include the R3 range resistance pivot point at 4,690. A price move through this point would open up the Index for a bullish breakout above today’s R4 pivot at 4,712. In this bullish scenario, traders may again choose to extrapolate today’s 45-point range to target a move in price towards 4,757.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page .

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)