Talking Points

- USD/CAD remains locked in a 57 pip range

- US Dollar pairs wait for FOMC

- SSI remains extreme at -3.760

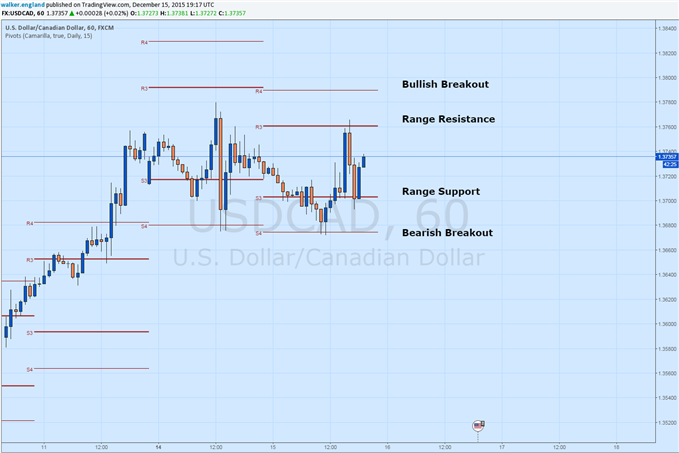

(Created using TradingView Charts)

Losing Money Trading Forex? This Might Be Why.

The USD/CAD continues to range late into afternoon trading as markets await tomorrow's FOMC rate decision . Expectations are set for the Fed to raise key rates to .50%. However, if the Fed again leans towards inaction, it could cause increased volatility for US Dollar based pairs. As such, traders may continue to monitor values of support and resistance for market direction up until tomorrows even at 13:00 GMT. Currently, the USD/CAD is trading at today’s central pivot at 1.3732 after bouncing from support, which is found at 1.3703. Prices have already traded through today’s 57 pip range twice, with resistance found at the R3 camarilla pivot at a price of 1.3760.

Traders looking for a late day breakout for the USD/CAD, should continue to monitor the S4 and R4 pivots. A move above the R4 pivot point at 1.3789, would be seen as a bullish continuation after last weeks 397 pip advance. Conversely, a move below the S4 pivot at 1.3674 would be significant, as it would signal a potential change in the markets trend. Traders watching for a breakout should also monitor sentiment values for the pair. Currently, SSI ( Speculative Sentiment Index ) for the USD/CAD reads at -3.68. This number is extremely negative and trend based traders may take that as confirmation for a continued bias towards higher highs.

See Walker’s most recent articles at his Bio Page .

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)