Price & Time covers key technical themes daily and can be delivered to your inbox each morning by joining the distribution list : Price & Time

Talking Points

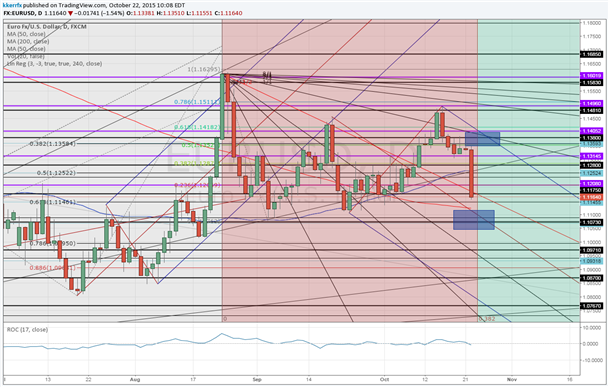

- EUR/USD turns down from key Fibonacci timing relationship

- 1.1070 key support pivot

Unfamiliar with Fibonacci Relationships? Learn more about them HERE

The timing seems right for a move in the markets. This past week I have highlighted timing relationships coming up in GBP/USD , USD/JPY , the S&P 500 and USD/CAD . We can throw EUR/USD into the mix as well as the latter half of this week is the 38% retracement of the amount of time between the March low and the August high. I usually like to give these timing relationship windows a day or so on either side so the breakdown in the euro this morning fits well with my notion for an inflection point here.

My big question here is obviously what does it all mean? There are basically two ways to look at it. The first is that we have been consolidating for the past several weeks and this move down in spot during the timing window is the start of a new trend down for the euro. The other option is that this move down is false and we are going to get a reversal before the end of the window over the next couple of trading days. Given the importance of the timing at the turn in August, the contraction in volatility and the buildup of energy over the past few weeks I favor the former, but I will need to see support around 1.1070 give way soon to get excited about a more important decline taking hold. There have been several false starts lower in EUR/USD over the past few months so the burden of proof remains on the bears. Failure to break the aforementioned support by the middle of next week followed by strength back through today’s high around 1.1350 would signal this has probably been another false foray lower.

--- Written by Kristian Kerr, Senior Currency Strategist for .com

To contact Kristian, e-mail [email protected] . Follow me on Twitter @KKerrFX