Talking Points

- USDOLLAR moves to support at 11,845

- S4 reversals begin at 11,828

- Range resistance sits at 11,878

USDollar 30Minute Chart

(Created using Trading View Charts: Click on the chart below to zoom in; after zooming in, press the play button towards the right to set the market in motion)

Looking for more FX Reversals? S ign up for my email list here: SIGN UP HERE

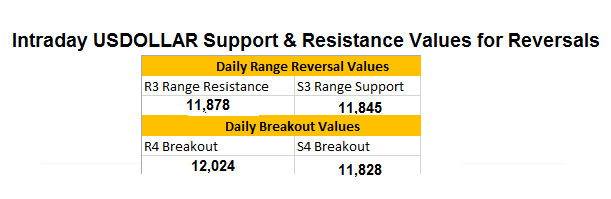

The Dow Jones FXCM USDollar Index (USDOLLAR) has advanced in four of the previous five trading sessions. However, in this morning’s trading, prices have retraced to key values of support. Currently prices reside at today’s S3 Camarilla pivot found at 11,845. In the event that prices begin to bounce, traders will begin looking for the index to head back towards values of resistance including the R3 pivot found at 11,878.

Alternatively, in the event of a further decline, traders would begin looking for a reversal of the Index on a breakout beneath the S4 pivot found at 11,828. This reverals in price would signal a shift in momentum for the USDOLLAR on the week. In this scenario, traders could begin looking to trade pairs such as the EURUSD , GPBUSD or USDJPY to take advantage of a weakening USDollar.

Using Camarilla pivots is just one way to approach day trading. To help you get started in your trading pursuit, hosts a variety of day trading webinars. To learn more and register for future events, see the webinar calendar listed HERE .

Previous Market Setups

GBPUSD Reaches Range Resistance

USDollar Attempts Breakout on News

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email [email protected] .

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)