Talking Points

- AUDNZD Opens in a 35 pip range

- Range Support Sits at 1.1226

- Bullish Reversals Signaled Over 112.78

AUDNZD 30Minute Chart

(Created using FXCM’s Marketscope 2.0 charts)

Looking for more FX Reversals? S ign up for my email list here: SIGN UP HERE

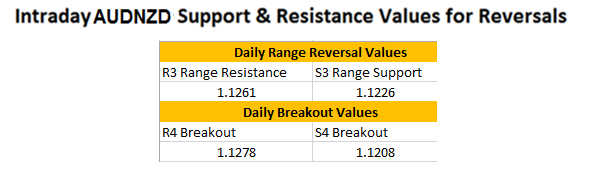

The AUDNZD has opened the US trading session this morning moving inside of a 35 pip range. Volatility has remained low due to the RBA rate decision being released in line with expectations at 2.50%. Price has moved across the range twice so far, and the pair is currently sitting near range support found at the S3 pivot at 1.1226. In the event that price remains supported, reversal traders can again begin to target lines of resistance. Today’s R3 pivot completes the range identified above, and can be found at a price of 1.1261.

There is more news on the horizon, with the release of the NZD employment data at 21:45 GMT. If volatility increases, traders can prepare for a breakout. A price break above 1.1278 would be a bullish move above the R4 pivot, signaling a return to the pairs standing trend. Likewise a reversal in price, under the S4 support pivot at 1.1208, would show a reversal towards continued bearish momentum. In either breakout scenario, the range would be considered concluded and traders can begin to identify positioning based off of the markets given direction.

Are you new to trading with pivot points? To become more familiar with Camarill Pivots and how to use them for day trading FX Reversals, check out the suggested reading links below. This way you can continue your trading education, while working towards actively incorporating pivot points into your selected day trading strategy.

Suggested Reading:

Trading Intraday Market Reversals

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

To contact Walker, email [email protected] .

Contact and Follow Walker on Twitter @WEnglandFX.