Talking Points:

- SSI tells us the ratio of long retail traders to short retail traders for major pairs.

- Some cross currency pairs, like the NZDJPY , are left out of our SSI database.

- We can combine major SSI values together to create synthetic SSI for these pairs.

The Speculative Sentiment Index is by far my favorite Forex trading tool. One problem however, is that this data is not published for many cross currencies that traders trade, like the EURAUD , NZDJPY, CHFJPY , etc. In this article, I explain how synthetic SSI values can be generated for these types of pairs.

Summary of SSI

SSI gives us a comparison between how many retail Forex traders are currently long and short on each major pair. We want to trade opposite of the retail trading crowd meaning it’s a “contrarian” index. The idea is that most retail traders lose money, so there could be an inherit edge in fading them or placing the opposite trade.

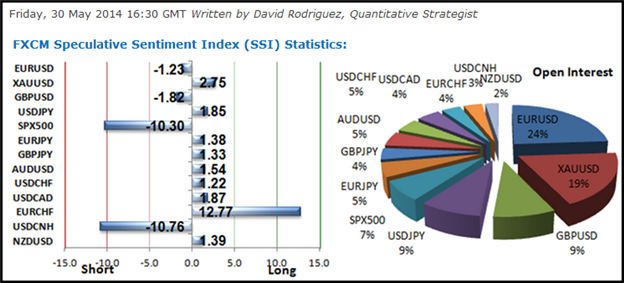

We can see in the image below a snapshot of what the SSI looks like, updated twice a day for free to members of Plus . All of the major pairs are represented as well as a few CFD products for traders outside the United States.

Learn Forex: Plus’ Speculative Sentiment Index (SSI)

(Source: 's S SI )

But what about some of the other currency pairs that are not listed? How do we know what the sentiment is on those pairs? This is where SSI becomes “synthetic.”

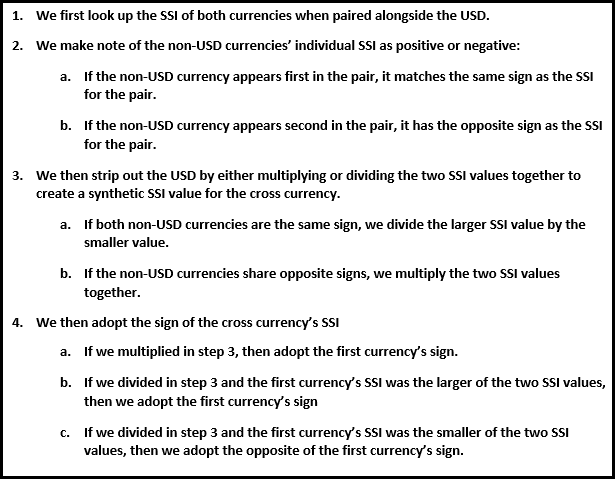

Steps to Creating Synthetic SSI

This sounds complicated the first time around, but makes sense over time. I am going to start with an explanation of how this works with the following formula. I will then go through 3 examples to put it into practice.

Did you get that? Probably not, which is ok. It took me awhile before I could wrap my head around it. Let’s take a look at 3 examples using the formula above.

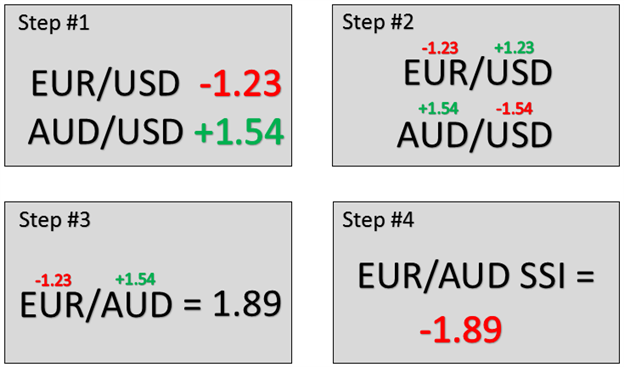

Example #1 - EURAUD

This is the simplest example of the group. Both currencies are the first currency in their USD pairs, so each adopt their SSI signs. Because the signs are opposite of each other, we multiply the two SSI’s together. The SSI for EURAUD is negative because the EUR has a negative SSI and it leads the pair.

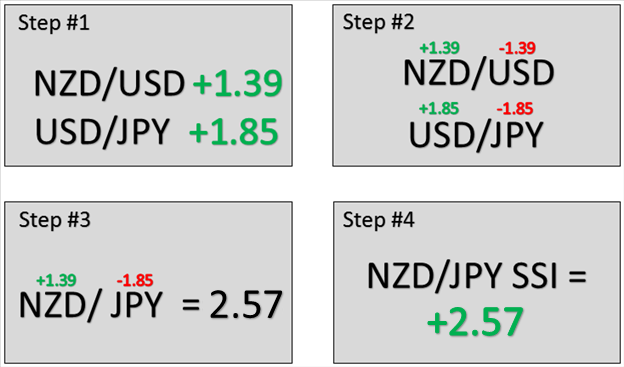

Example #2 - NZDJPY

This example is a little trickier. The NZD is first in its pair so it adopts its positive SSI, but because the JPY is the 2nd currency in its pair with the USD, it adopts the opposite SSI sign, negative. The NZD and JPY SSI have opposite signs so we multiply them together. The SSI for the NZD/JPY is positive because the NZD has a positive SSI and it leads the pair.

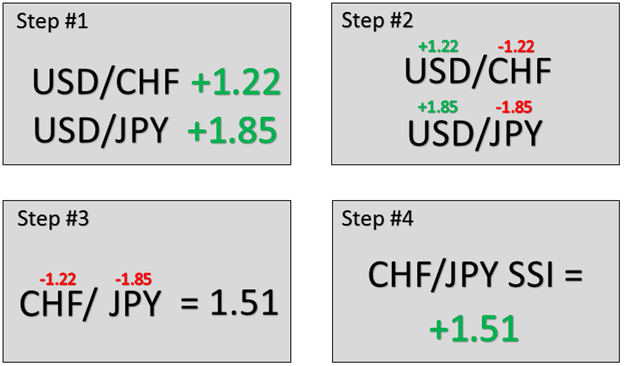

Example #3 - CHFJPY

This example is the most difficult. Both the CHF and the JPY are the 2nd currency when paired up with the USD, this means they each adopt the opposite sign. Because both the CHF and JPY are the same sign, we must divide the larger SSI (1.85) by the smaller SSI (1.22). The SSI for CHF/JPY is positive because the CHF had the smaller SSI of the two currencies so we must adopt the opposite sign.

Synthetic Sentiment Opening the Door

This advanced technique opens the door to sentiment trading on a large amount of pairs not otherwise available and can take your trading to next level. Rather than looking at only trading currencies against the USD, we can now pair together strong and weak sentiment currencies with each other for a sentiment trade stronger than their USD-pair counterparts. To test out your SSI based trades, be sure to sign up for Free Forex Demo account.

Good trading!

---Written by Rob Pasche

New to Forex ? Watch this introduction video .

Take this free 20 minute “New to FX” course presented by Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!