Talking Points

- Rising Forex trend channels show clear entry and exits

- In a rising trend channel, a buy signal happens when price rebounds at or near support

- The current AUD / CAD daily chart illustrates a rising trend channel buy setup

Forex currency traders like trading horizontal ranges because they are easy to trade. One only needs to buy at support and sell at resistance. If the range is long enough, several repeatable trades can be made. However, when price breaks out of these ranges, traders can be disoriented as price makes a new high and breaks out. In some cases, range traders can be caught on the wrong side of the trade.

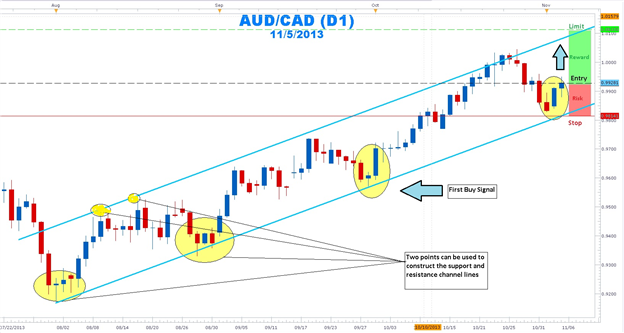

However, this initial spiking phase starts to mellow with time and the angle of assent eases. Price action settles into a different kind of upwardly sloping range called a rising trend channel. By connecting two consecutive rising swing lows, the support or base of the channel can be constructed. Similarly, by connecting to consecutive higher swing highs with a trend line, the resistance or top of the channel is created.

Learn Forex: AUD/CAD Long Entry Near Channel Support

(Chart Created using Marketscope 2.0 charts)

How to Trade

Projecting these lines into the future, traders will look for price to come down and test the support line and bounce higher. Waiting for the close of a bullish candle that is formed after the bounce would be the entry signal. Traders would then place a protective stop just below the last swing low and the trend line support. Next, they would place a take profit limit at or near the top of the channel.

AUD/CAD has been in an uptrend starting from the low at 0.9167 on 8/1/2013 peaking at 1.0046 on 10/28/2013. The pair has rebounded from near the bottom of the channel at 0.9828 on 10/31. As long as channel support holds near 0.9800, AUD/CAD should be able to reach the top of the channel at 1.0113. A possible entry is at 0.9928. However, a better on a pullback toward trendline support at 0.9814 would reduce the amount of risk on the trade. A daily candle close below the 0.9800 figure would invalidate this trade setup because the channel would have been broken.

In sum, channels do not need fancy indicators, just two parallel trend lines. The top of the channel is formed by connecting two consecutive higher highs to form the top of the channel. The bottom is formed by connecting two consecutive higher lows. Projecting these lines into the future can identify a trade setup with a predefined risk and profit target. So exchange your TV channel surfing habit for a Forex channel; you’ll be glad you did!

Knowing how to read candlestick patterns can help you become a better Forex Channel Surfer! Watch a free 15-minute course on the topic of Price Action Candlesticks . You'll first be asked to sign the guestbook, which is completely free;and then you will be me with the video-based lesson via Brainshark

To contact Gregory McLeod, email [email protected]

To be added to Greg’s e-mail distribution list, please click here.

Follow me on https://twitter.com/gregmcleodtradr .