SSI (Speculative Sentiment Index) is a proprietary tool offered to FXCM clients that can act like a compass used to navigate the foreign exchange market. Once mastered, traders will have the ability to add SSI as a component to any working strategy. So let’s take a moment to get familiar with this resource.

- What is SSI

- How to Read SSI

- Trading with SSI

SSI is a calculated ratio that gives us a snapshot of trader positioning while giving hints on market direction. SSI reveals trader positioning by determining if they are net long or short a currency pair, and if so by how much. Let’s take a look at this hand

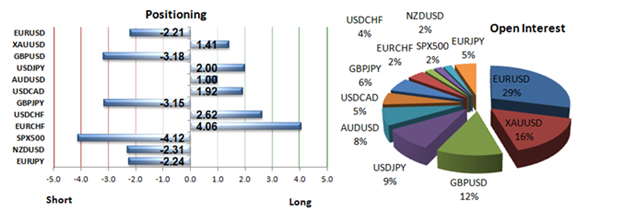

Below we can see the current SSI ratios posted on .com. If clients are net short a currency pair SSI will be negative, and if clients are net long the number will be positive. As of this morning, we can see that SSI for the GBPUSD is currently set at -3.16. This ratio means that trader positioning is net short at a rate over 3 to 1 when compared to all open buying interest.

So now that we know how to read SSI, let’s discuss how these numbers can be used in our trading.

Trading SSI

SSI is an exceptional trading tool based around the psychology of traders. Traditionally most Forex traders adhere to the old “buy low, sell high” adage. However, when most traders look to pinpoint a market top or bottom they end up fading some of the markets biggest trends! Because of this, SSI is often considered a contrarian indicator. Savvy traders that review SSI can then proceed to look for busy signals when SSI is net long or buy when SSI net short for a specific currency pair. Let’s take a look at an example of SSI at work.

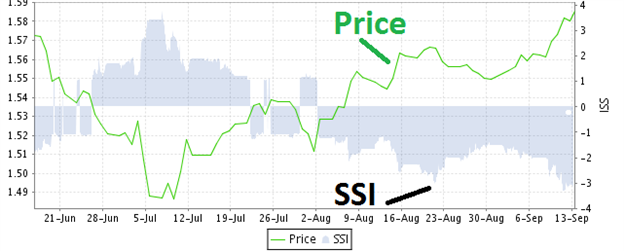

Below we can see a prime example of SSI at work again on the GBPUSD. Going back to the start of July, we can see that positioning on the GBPUSD has moved from an extreme net long to most positions being short. However when compared to the price graph, we can see that as traders began selling the pair has advanced over 1000 pips for the same time period! The current reading of SSI stands at -3.18. As more traders continue to sell into this market advance, SSI data suggests that the GBPUSD uptrend may continue to surge towards higher highs!

Learn Forex – Current GBPUSD SSI

Automated SSI Trading

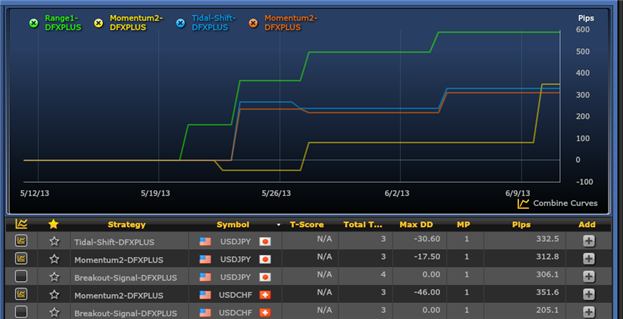

For those traders looking to use SSI but do not have an existing strategy, FXCM offers a variety of automated trading applications and solutions. Whether you trade trends, breakouts or momentum there is a system available for all market conditions. The easiest way to get started trading a SSI system is through our Mirror Trader Platform (Free with an FXCM Account).

Using the Mirror Traders software, Traders can select from a variety of automated strategies. This includes SSI strategies provided by which includes the Momentum 2 and Breakout 2, and Tidal Wave strategies. These strategies can be applied at any time, while allowing traders the ability to customize position size and currency pair selection.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information

New to the FX market ? Save hours in figuring out what FOREX trading is all about.

Take this free 20 minute “New to FX” course presented by Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!