Article Summary: Trading is exciting. Because of that, many new traders rush out of the gates without some key aspects of successful trading ironed out. It’s a mistake to think if you know when to enter a trade you’re ready to trade. Instead it’s best to think about the full picture of trading well and what you will do in all aspects of trading.

“Everyone has a plan until they get punched in the face”

-Mike Tyson

Traders who are prepared for the unexpected have an edge. Their edge is derived from the fact that when things go sour according to expectations, they’ve made a decision in advance on how to act so as to not be dissuading by irrational emotion. The reason for this foreknowledge is due to preparation ahead of time.

Trading Is About More Than a Good Entry

Many new traders that we speak with spend a considerable percentage of their time finding the system with the best entry. Unfortunately, this journey is often based on back testing and optimizing against past price which will never perfectly repeat in the future. This forces traders to have too much faith in a trade (as opposed to a system) so that they are reluctant to close out a losing trade which often backfires as the trend continues to move against them.

Beyond the entry, there are a handful of things that deserve every trader’s attention as they’re starting out in the market or developing a new strategy to take advantage of a changing market environment. The overall focus should be one of consistency. This way you have a fixed approach to attack any specific weakness you identify or fundamental adjustment to your trading methodology while keeping the other aspects of your trading performing at a high level.

Focal Points on Strategy Development

While consistency is the overall aim, there are three things outside of your entry that every trader should focus on. Regarding the trade, you should nail down your exit criteria, trade size, and when you should ignore the current chart because it doesn’t align with a strategy you can effectively trade. Lastly, you should focus on when you should take a break from trading all together and what fundamental factors would encourage you to consider adding a new market to your trading plan.

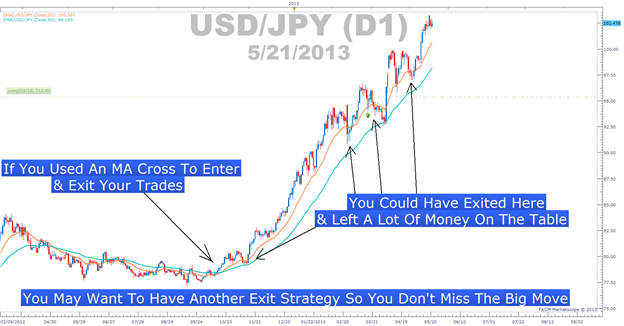

Learn Forex: What Gets You into a Trade Shouldn’t Necessarily Take You Out

Exit Criteria Can Be More Important Than Entry over the Long Run

New traders often believe the criteria that encouraged them to enter a trade should be the same criteria to exit a trade. If you’re following a strong trend, that belief could have you leaving many pips on the table. Trends never move in a straight line up or down so it’s often helpful to have a looser filter to keep you in a trade so that you squeeze the trend for all its worth until it has clearly reversed.

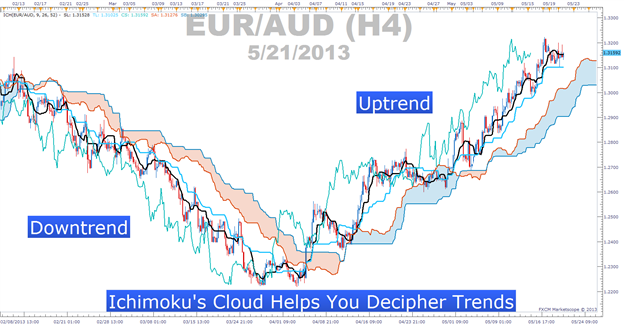

There are multiple methods for specific exits that are looser than the entrance. One popular method is using a slower reading on your entry tool like a MACD to make sure you stay in the trade until the move has likely played out. Another time tested method is the Ichimoku cloud which uses multiple measurements of price to clearly display the overall trend over the last 52 periods of your chart.

Learn Forex: Ichimoku’s Cloud Can Help You Stay in a Trend as It Plays Out

Trade Size Is a Strong Determinant of Long Term Success

Your decision of how large of a trade to place is extremely important. In short, the trade size you decide one will determine how much risk you’re taking on or how much profit you’ll take if you’re trade is correct. Many traders with a good system have been done in prematurely from not knowing what trade size was best for their account.

The good news is that there is little mystical about choosing the correct trade size for your account. The main things you need to understand about yourself when covering trade size is what drawdown you’re willing to accept and what you want to reasonably earn should your trade idea work in your favor. In summary, your trade size should be to the point that your profits are worth it to you but your losses will still keep you in the game.

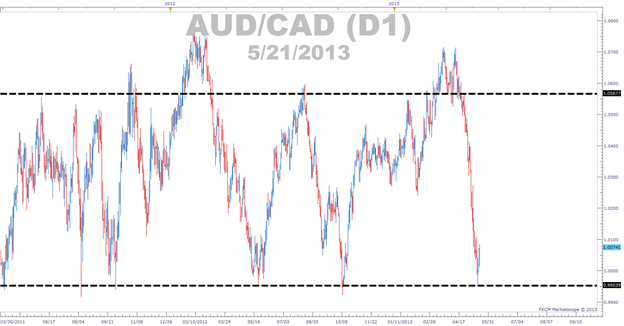

Knowing When a Currency Should Be Off Your Trading Radar

One thing that traders can quickly do to increase their efficiency is to come up with rules or non-negotiables as to when a currency pair or chart isn’t showing an edge for the trader to work with. A quick way to create this short list is to figure out what the perfect trade set-up would look like and then visualize it’s exact opposite. This will keep you away from the charts that drain the accounts of other traders who are trying to force a trade which rarely if ever works.

Learn Forex: Long Term Trend Traders Would Be Hard Pressed To Trade AUDCAD Well

Closing Thoughts

Any trader looking to build a well-rounded system should not stop after they’ve found an enticing entry strategy. Traders should look to exit strategies, trade size, and knowing when to not even consider a currency pair for their strategy so they have a well-rounded personalized trading system. The extra discipline needed to hammer out the aforementioned details should help put discretionary traders ahead of the pack.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

To be added to Tyler’se-mail distribution list, please click here .

Would you like dozens of trade ideas every day with updated charts to identify major levels of support and resistance on the currency pair you’re trading?

If so, register for a free trial of our Technical Analyzer here and you’ll be provided with a free temporary login on the last page of the walk-through.