For the week of October 14, 2012, here is the breakdown of our Slow Stochastic trading signals.

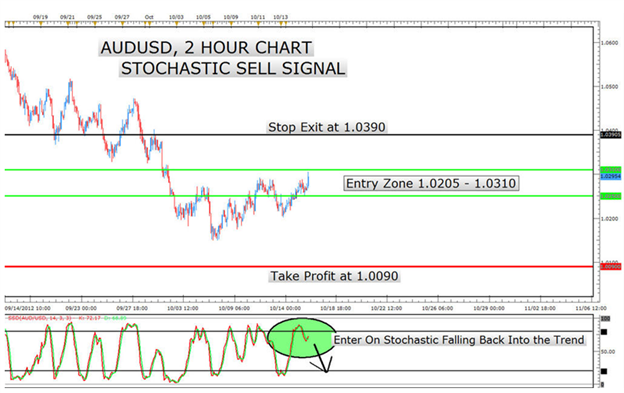

Tuesday’s Signal: AUDUSD overbought stochastic sell signal chart.

Result: Stopped out at 1.0390

Original Chart:

Current Chart as of Friday 10/19/12

Lesson:

This trade didn’t work out which is OK. It’s OK to have a signal not work out as it will correct our attitude about the risk of taking a trade.

The first key of every trade is to understand and accept the risk inherent on every trade. Yes, the rewards of trading well are great. However, the reality of trading well is being able to take a loss where a small part of your equity is risked and them moving on to the next high probability signal.

Because there is no guaranteed outcome we recommend risking 2% or less of your account equity per trade.

When you accept the limited risk of a trade, taking a trade that meets your requirements should be simple, easy and stress free. If the trade closes out for a loss, that’s OK and that’s the cost of doing business. A book store owner wouldn’t get upset when the time comes for him to buy books to put on the selves. To him, it’s a cost of doing business that will bring him closer to revenue. A trader would do well to see a losing trade in the same light.

An article was put together on how professionals approach accepting a loss and how an amateur who is not successful approaches the loss here .

The Bottom Line: The trade didn’t work out so we must move on to the next signal that meets our requirements.

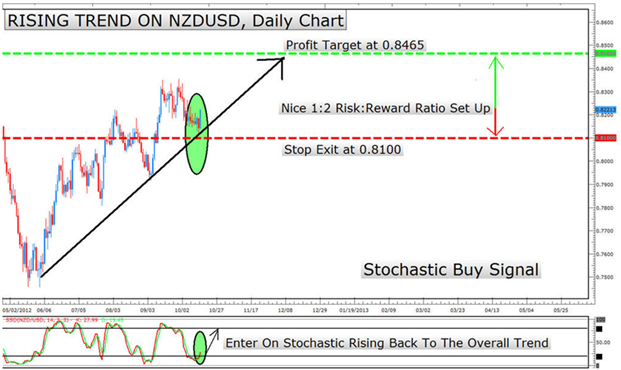

Wednesday’s signal – NZD USD oversold stochastic buy signal on the daily chart.

Result: Staying in the trade as the signal is still engaged and we haven’t hit our profit or loss target

Original Chart:

Current Chart as of Friday 10/19/12

Lesson: We are still in the trade as our profit target or stop exit has not yet triggered.

An article was written about this trade here if you want to see what other components encouraged us to enter a long trade.

Join us next week as we introduce the Moving Average Convergence Divergence (MACD) and provide two trading signals from the indicator from our @edu handle.

---Written by Tyler Yell, Trading Instructor

To be added to Tyler’s e-mail distribution list, please click here.

New to the FX market ? Save hours in figuring out what FOREX trading is all about.

Take this free 20 minute “New to FX” course presented by Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!