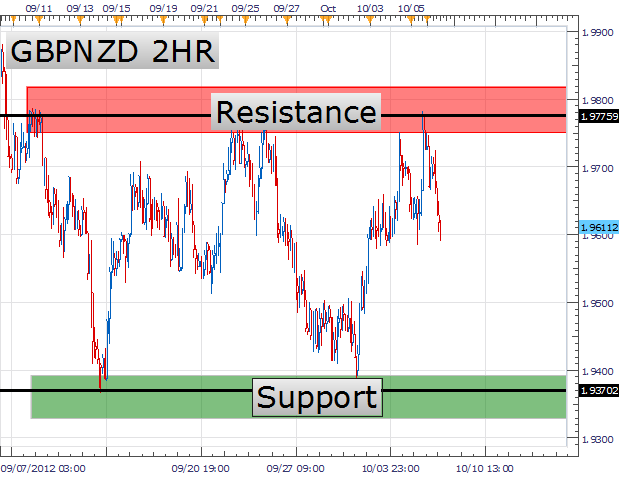

Ranges develop as market volatility decreases on a currency pair. These periods can bring great trading opportunities as price travels between support and resistance levels prior to a breakout. Below we can see the GBPNZD currency pair trading in a 422 pip range. The range is developed by identifying resistance at current highs near 1.9790 and support at a price level near 1.9368. With these areas defined we can then proceed with a trading plan to trade these pricing levels. For this we will once again turn to interpreting the RSI oscillator.

(Created using FXCM’s Marketscope 2.0 charts)

When it comes to trading ranges, most traders choose to employ an oscillator to find overbought and oversold conditions. RSI excells in this roll as traders will look for price to move lower from resistance and sell when RSI crosses below 70. RSI can also be used in conjuncture with a center line crossover. Below we can see that RSI has already turned from overbought values and a trader waiting for further confirmation can enter when RSI dcips below 50. As momentum builds to the downside traders can continue to sell the GBPNZD as price breaks short term lows to support found near 1.9370.

One of the direct benefits of a ranging market is the built in pricing targets and entries. Traders selling resistance can look to take profit near support levels pictured in the above graph. As price reaches support traders can again look to establish new positions to buy the GBPNZD. This process can again be used by finding oversold levels or simply placing entries at support. As long as support holds, and price does not break to lower lows, traders can then trade price back up to resistance.

(Created using FXCM’s Marketscope 2.0 charts)

Using the RSI with the chart mentioned above, my preference is to sell the GBPNZD trading range down towards support. New orders can target range support at .9715 with stops over the swing high outside of resistance using previous highs. Entries can be set as well to buy the GBPNZD at support in the event that ranging markets continue.

Alternatives include using entry orders to trade a breakout of the existing range.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected] .

Want to learn more about trading RSI? Take our free RSI training course and learn new ways to trade with this versatile oscillator. Register HERE to start learning your next RSI strategy!

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.