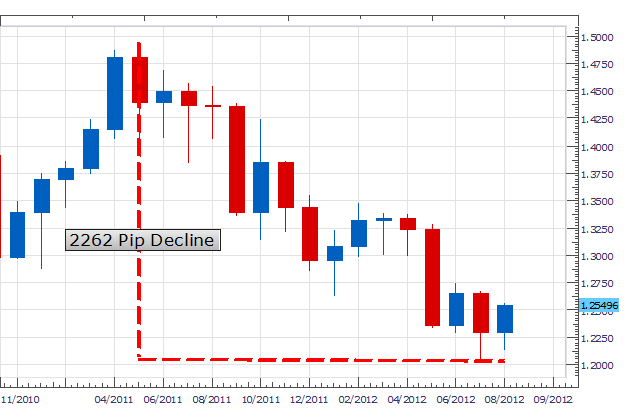

Trading with the long term trend can be useful for traders with a longer term time horizon. However, when looking at a trend it can be hard to pinpoint where to enter into the market. One example of this is the EURUSD . Below we can see the EURUSD which has been trending lower for the last 15 months. It’s clear to see looking back that a trend based strategy, looking to sell into an existing downtrend, could be profitable as the pair declined over 2262 pips. So how can we pinpoint a price entry in an existing trend? Today we will focus on entering the trend using a price retracement.

(Created using FXCM’s Marketscope 2.0 charts)

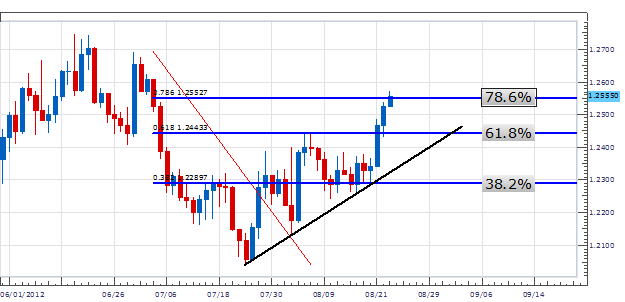

Fibonacci retracements are an excellent way to gauge how far a currency pair may pull backs against the trend. These pricing levels are gauged in percentage terms by measuring the difference between the previous high and low in a downtrend. Below we can see the retracement levels for the EURUSD by measuring the distance between the June 29th high at 1.2692 and July 24th low at 1.2041. Often traders will wait for price to move to a 38.2%, 61.8% or 78.6% price retracement before entering into fresh positions.

The 78.6% percent retracement level is often referred to as the “Fib level of last resort”. If price breaks through this line of resistance, traders may assume price will continue to test the previous high at 1.2692. For this reason traders will watch to see if today’s daily candle closes under the 78.6% Fibonacci retracement. If prices hold, fresh sells may be considered with the upside risk limited with a stop order above today’s high.

(Created using FXCM’s Marketscope 2.0 charts)

My preference is to sell the EURUSD near our 78.6% Fibonacci level at 1.2550 upon the daily candle close. Stop orders can be set above resistance set by the current daily high, which currently stands at 1.2571. Profit targets should look for a minimum 1:2 Risk/Reward ratio, but aggressive traders may look to trade new to new low under 1.2041.

Alternative scenarios include price breaking higher, continuing the ongoing price retracement.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.