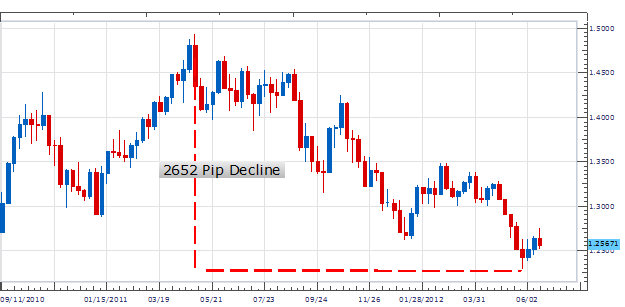

The EURUSD has been on a steady decline over the previous fourteen months. Since its high formed in April of 2011 at 1.4938, the pair has declined as much as 2652 pips. As the pair continues to move lower, traders can begin looking for fresh breakouts in the direction of the trend during active market hours . In order to take advantage of these moves it is essential to understand different market session characteristics and have a plan to take advantage to trade fresh breakouts.

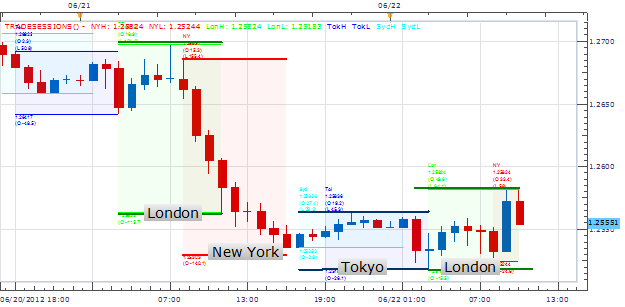

Below we can see a 1 Hour graph of the EURUSD using the trade sessions indicator. This indicator will will help us understand exactly when breakouts with the trend are likely to occur. Our largest market moves generally occur during either the London or New York market sessions. During yesterdays market activity the EURUSD moved as much as 167 pips. This is compared with the following Tokyo market session that moved as little as 45 pips. With this information in hand, we now know if we are looking to enter a trade using a breakout strategy, we should primarily focus our analysis on markets between London and New York trading hours.

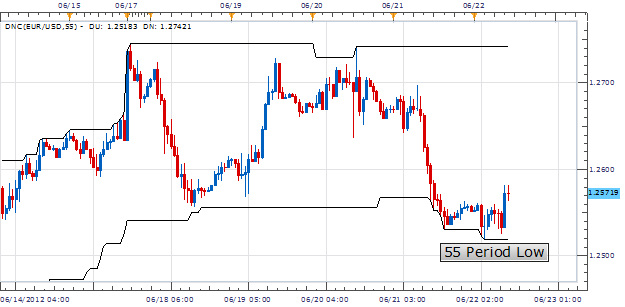

As volatility increases during the London and New York trading session, traders can begin to look for breakout trading opportunities using a variety of methods.One of the easiest ways to spot a potential breakout is by using a pricing channel indicator on your graph. Below we have a 55 period pricing channel placed on the EURUSD 30 minute chart. Traders will watch for the current 55 period low at 1.2518 to be broken during the London or New York session to plan their entries during the increased volatility.

My preference is to trade the EURUSD on a breakout on the establishment on a new 55 period low. Stops can be placed above the previous high above 1.2585. Minimum limits may be placed 140 pips away for a clear 1:2 Risk Reward ratio.

Price Channels are a custom indicator and must be loaded into Marketscope 2.0. For a full description on how to add DNC Price Channels to your graph please see our download instructions.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected] .

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.