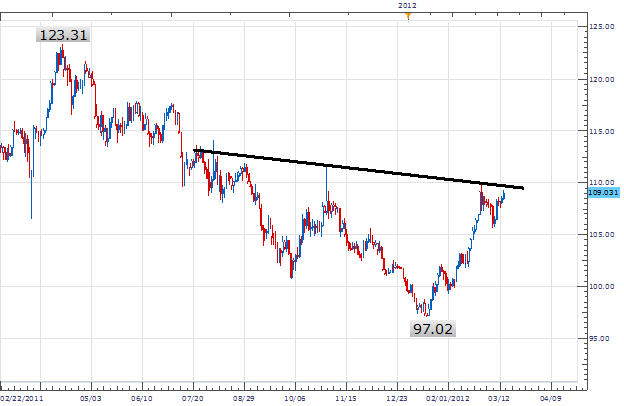

The EUR/JPY has spent much of 2012 making higher highs, inside of a much broader downtrend. Since its April 2011 high at 123.31 the pair has moved 2629 pips lower , to the current 2012 low at 97.02. Price has rallied through the month of March, particularly since traders have begun accumulating risk by selling the Yen . Better than expected news, such as NFP on March 9th, has also been a market driver. As prices continue to climb, savvy trend traders are looking at the daily trend looking for a chance for fresh sell entry’s.

Moving in to a 4Hour time frame, we can see the development of a rising wedge. A rising wedge is often considered a corrective pattern, occurring at the end of a retracement. The pattern itself is created by extrapolating a trend line using both highs and lows on the graph. As support and resistance merge together, while trading ranges decrease, traders begin to look for breakout entry’s.

Price targets can also be extrapolated when trading wedge patterns. The key is to measure the distance of the base in pips. Once this amount is found, we can extrapolate this from our breakout point to find our primary limit entry. It is also important to note, that since the wedge is a reversal pattern, we can look for larger profit targets depending on our time and risk/reward preferences.

My preference is to create a new entry order to sell the EUR /JPY under 108.35. Stops should be set over resistance at 109.35. Using our extension as a price target, primary limits will be set at 106.35 for a 1:2 Risk/Reward ratio.

Alternative scenarios include price breaking over daily resistance to new highs over 109.94

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.