Trading the GBP/USD over the past week has been difficult for breakout traders. On Thursday, Chart of the Day March 7th , we set an entry looking for the creation of a new high over 1.5840. Since this time price has moved lower and is yet to breakout to higher highs. That’s ok, because trading using entry orders kept us out of a potential losing position. As the short term trend changes directions, it is time to delete our previous order at 1.5840 and look for new entry levels on the chart.

Moving in on current prices , we can better see the decline from the resistance point mentioned above. Price has moved over 330 pips lower to today’s low currently residing at 1.5601. After deleting our previous entry to buy, we can effectively change our market opinion as well with this recent downward price action.

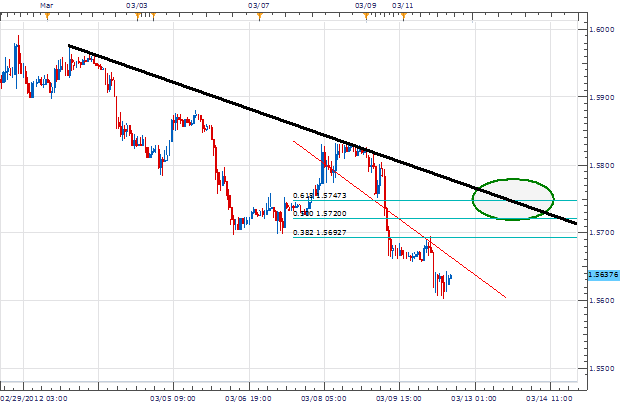

One method that can be useful is a combination of a trend line and our Fibonacci retracement tool. A trendline can be drawn by connecting our two previous highs on March 1st and March 7th. This creates a new band of resistance for us to establish sell positions. Next, a Fibonacci retracement can be drawn from the previous high to the current low to establish entry positions. The key is to find an area where our Fibonacci lines meet up with our trend line. Below, we can see our 61.8% retracement meets our trendline near 1.5750.

My preference is to create a new entry order to sell the GBP / USD near 1.5750. Stops should be set over resistance near 1.5800. First limit orders should look for a target of 100 pips at 1.5650 for a clear 1:2 Risk/Reward ratio.

Alternative scenarios include price breaking above resistance to form new highs.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.