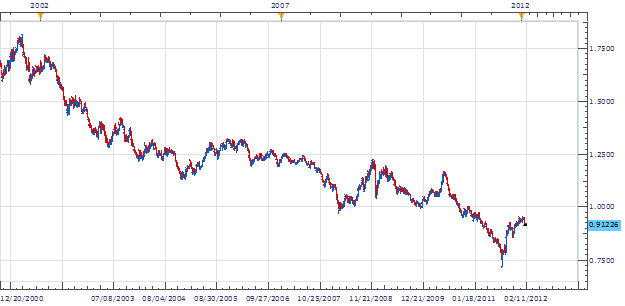

The USD/CHF pair has been on trend trader’s radar since its 2002 high at 1.7227. Price has steadily continued to the downside culminating in a 10,000 pip drop to 2011s low at .7066. Picking entrys with the trend has not always been easy though. Markets by nature will retrace against their trends, as we have seen with the USD / CHF from August 2011 – January 2012. One way we can optimize new movement within the trend, is to look for breakouts to create new lows.

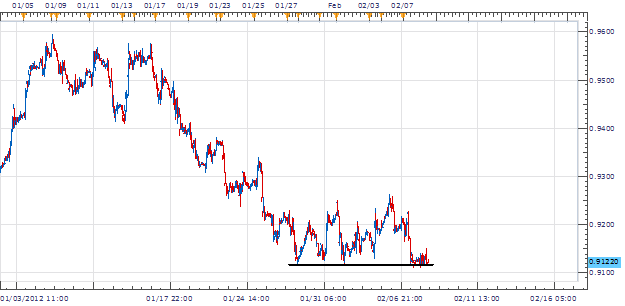

Moving the USD/CHF to a 1Hour chart, we can begin to see price decline 488 pips over the last month’s price action. The USD/CHF peaked on January 9th at.9594 and is now pausing at today’s low at .9106. As price begins to consolidate near support at current levels, traders may begin to look out for breakout opportunities. Entry’s to sell with the trend should be placed under support, by drawing a line connecting the January 27th and February 1st low with today’s price action.

My preference is to place entries under .9085 to trade a breakout on the USD/CHF. Stops will be placed over .9150. First profit targets should be at .8955 for a clear 1:2 Risk/Reward Ratio.

Alternative scenarios include prices bouncing to form a higher high over .9300.

---Written by Walker England, Trading Instructor

To contact Walker, email [email protected] . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to [email protected].

provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.